Digital manufacturing revolutions as political projects and hypes:

evidences from the auto sector

Abstract

The article analyses the evolution of automotive manufacturing technologies and organisations and assesses the impact of “fourth industrial revolution” concepts and policies (in Germany, US and China) in particular for employment and work. While it dismisses the idea that a fourth industrial revolution is under way and that a radical break will happen in the coming years, it shows that more subtle changes are taking place on the shop-floor of automotive factories that might result in deskilling and work intensification. The article advocates for a more active role of trade unions and social partners in challenging these narratives of disruptive change and building alternative human-centred visions of the future of work.

Introduction

The debate about the future of global manufacturing is all about revolutionary transformations. A world where smart factories would be connected between them and with consumers through digital technologies that would allow for the production of an almost infinite variety of customised products built to order by 3D printers and intelligent co-robots. In these smart factories production, maintenance and logistics would be managed by artificial intelligences, constantly improving efficiency and quality through machine learning using the big data generated by connected objects and sensors through all the value chain. These visions of a brave new world have been promoted by consortiums of technology providers in mechanical and electric engineering sectors and in the ITC sector, mainly in Germany, United States and China, where they have also informed a new set of industrial policies that are now spreading to other countries. Under the concepts of industry 4.0 and advanced or digital manufacturing these visions have been endorsed by the main global consulting companies and they have become mainstream in media and politics. A substantial scientific literature has also promoted the idea of an imminent digital revolution, or of a “second machine age”

According to this new vision the automotive industry is expected to be at the forefront of the “fourth industrial revolution”: first, because the automotive sector has been historically a pioneer in introducing new manufacturing technology from mass to lean production; second, because it is one of the largest and most capital-intensive industries, which concentrates alone around 40% of the world stock of operational robots but still employs a sizeable amount of unskilled and relatively well-paid workers

While these new technologies are deemed to be “disruptive”, their impact is generally presented as positive for almost all the existing players: they would allow fast and increasing productivity gains; cheaper and more advanced diversified products; the elimination of hard repetitive tasks; the reshoring of manufacturing in high wages countries since the cost of work will become less a factor for international competitiveness; but also the economic and functional upgrading of supply chains in emerging countries. Against this general positive outlook, the only problem seems to concern employment, as gloomy prophesies of machine-human substitution cast a long shadow on the future of human work in automotive manufacturing. According for instance to BCG, “fewer than 8% of tasks in the U.S. transportation-equipment industry are automated, compared with a potential of 53%”

These studies focus on Western developed countries, but forecasts concerning emerging countries are not much more encouraging. A recent ILO survey of South-East Asian countries estimates that the job losses linked to future automation will range between 45% for Thailand and 70% for Vietnam by 2030

Despite such alarming perspectives, these forecasts are not publicly contested and translate into different scenarios and policy recommendations. Governments and firms are encouraged to promote these technologies in order to benefit from stronger productivity growth and they are expected to anticipate the related massive jobs losses by introducing or reforming lifelong training schemes that will also provide the fewer but more skilled workers who will interact with co-robots and smart technologies. Some countries are also considering the possibility of subsidizing labour costs and taxing technologies and robots

As already mentioned before, during the last ten years this kind of forecasts, scenarios and policy recommendations have gained strong visibility and a diffused political consensus has been built around them. While there are softer and harder versions of this consensus depending on the timing (before or after 2030) and scope (the rate of jobs substituted by machines and AI) of the expected transformations, it is difficult to spot in political arenas many controversies and debates concerning the fundamental direction of change. As a result, even though it is not clear whether a digital revolution in manufacturing is really happening, empowered technological determinism of this kind can already produce important effects. On the one hand, it makes it difficult to contest, criticize or resist the diffusion of these new technologies, regardless of their political and social consequences or even of their effective impact on efficiency and quality. On the other hand, these visions can very well turn into self-fulfilling prophecies: as the belief in a digital revolution in manufacturing spreads, more resources are allocated to develop these technologies and more firms start to introduce them in their workplaces, reinforcing as the result the belief that a digital revolution is happening, leading to even more resources allocated and more firms implementing these technologies and substituting men with machines, and contributing as a result to decreasing the prices of new technologies through economies of scale.

In such a context to think about the future of work and employment is obviously a challenging task. As we will see more in detail below, so far the impacts of industry 4.0 and digital advanced manufacturing technologies in the automotive industry appear to be small, and there do not seem to be clear prospects for their future widespread implementation and diffusion, at least in mass production. Yet according to this powerful vision, the present state of manufacturing in the automotive sector should not matter because what we are dealing with are “disruptive” transformations that only visions of the future can make sense of

What we would like to do in this article is to reverse back this perspective and reconnect empirically grounded studies of the evolution of automotive manufacturing with the future of work, employment and manufacturing. We argue that such an approach is necessary not only to produce more realistic scenarios for stakeholders and policymakers, but even more important to bring back politics and work in the debate about the future of manufacturing.

To fulfil this agenda the article will be organised as follows. First, we will introduce the notion of “performativity” as an analytic tool to deconstruct the determinist premises of industry 4.0 and digital manufacturing revolutions concepts. This notion has been used in social sciences to analyse economic theories, managerial fashions and technology expectations from a critical perspective and will provide a theoretical framework to organise the other parts of the article. Second, we will focus on the most significant aspects of the recent history of automation in the automotive sector, starting from the 1980s and moving up to present time. We will analyse the significance but also the limits of the first wave of digitalization and automation of automotive manufacturing that has reached its peak in the 1990s. We will stress in particular the reasons why human labour and human agency still have a central place in highly standardized production environments. Third, we will analyse more in detail the three main concepts promoting the idea of a digital revolution in manufacturing: industry 4.0, advanced manufacturing and Made in China 2025. The objective is to show that these concepts are not “neutral” visions of technological progress but political projects promoted by different consortiums of technology providers supported by their respective governments in Germany, US and China. In this section we will also provide a preliminary overview of the recent transformations of automotive manufacturing by looking at the rate and degree of introduction of industry 4.0 and other related technologies in automotive factories in these countries. Finally, on the basis of the analysis developed in the previous sections of the forces at work, the dynamics in place, and the first outcomes in terms of diffusion and impact of these new technologies, we will discuss the place of politics and workers in the future of work.

Performativity and digital revolutions

What does confer to certain concepts, theory and future expectations the power of bringing into being new worlds as self-fulfilling prophecies? This question dates back at least to the seminal work of Karl Polanyi on the “Great transformation” of modern economies under the influence of liberal economic theories

The question has two main dimensions: first, to understand by which means theories and concepts can shape the world; second, to identify the conditions under which this power can act. The concept of “performativity” has been developed and used in social sciences to analyse and deconstruct this type of phenomena. It has been applied to economic theories

First, as any other technological expectations, these concepts and visions are not scientifically grounded forecasts of probable futures, but political projects that aim at shaping improbable futures. To analyse these political projects, it is therefore important to identify the consortium of actors who have built them, their objectives and strategies, as well as the role that interest groups and the state are playing in their development. This will allow not only to deconstruct the deterministic premises of these concepts, but also to understand what is really at stake behind the narrative of revolutionary change.

Second, while these concepts have certainly already gained strong visibility and political support, it is reasonable to assume that their visions of the future are “overly optimistic”. Indeed, most of the above literature agrees on the fact that technology expectations are becoming more unrealistic due both to the increasing complexity of the processes involved and the longer time horizon of the forecasts associated with them

Third, the performativity of technology expectations is limited for objective reasons that can be identified and which explain why the new technology could not live up to the “overly optimistic” expectations. In our case, this is of course difficult to do since the technologies involved have just started to be implemented and their diffusion in the automotive sector is still marginal. Yet, in the current debate about the digitalisation and automation of work, some of the assumptions on which the new “digital revolution” narrative has been built have started to be challenged and contested

The first argument is historical and consists in looking back at previous phases of “automation anxiety”. Autor focuses on the 1950s and 1960s “Automation jobless” threat in the US that pushed the Johnson administration to create an ad-hoc Commission in ways that are very similar to the present debates about massive technological unemployment (p. 3-4). Autor argues that previous phases of “automation anxiety” proved systematically wrong, and he suggests that this could be also the case in the current configuration.

The second argument is analytical and consists in understanding the reasons why these “doom” prophecies turn out to be wrong in the past. Autor highlights two main reasons. First, automation can only substitute for certain tasks (typically the most repetitive and standardised ones) while others are still required to complete the job. When the first are automated, the latter increase in importance and value. The overall effect of this dynamic is job creation: not only because the productivity gains should raise output and therefore employment, but also because new employment is created in the tasks that are complemented by automation.

The second reason highlighted by Autor is that even relatively routinized tasks in the so-called low-skilled jobs can prove very difficult or even impossible to automate due to the M. Polany’s paradox according to which “we know more than we can tell”

Autor argues that this paradox could also explain one of the major transformations of the employment structure in the US and other developed countries: the polarization of jobs at the high end and low end of the employment spectrum (p. 12). Increase in automation would therefore not reduce the quantity of jobs, but “it may greatly affect the quality of jobs available” (p. 9) because it leads to “the simultaneous growth of high-education, high-wage jobs at one end and low-education, low-wage jobs at the other end, both at the expense of middle-wage, middle education jobs” (p. 12). As we will see later on, there are evidences that this could be the case for some industry 4.0 technologies, in particular concerning predictive maintenance of machines and robots. However, as we will discuss in the next section on the previous wave of automation in the 1980s and 1990s, one could also argue that job polarization has been the outcome of managerial strategies aimed at re-establishing the “right to manage” in the context of struggles for the control of the shop floor rather than of technology per se.

Workplace automation in the automotive sector: historical patterns and current prospects

Since the introduction of mass production in the 1910s the stamping, welding and painting of the car have been progressively mechanized paving the way in the 1970s and 1980s to the automation of most of these assembly operations. By contrast final assembly where most of the variety and complexity of the assembly process converged was still manually intensive and concentrated over 60% of the total employment in the factories

According to Fujimoto, Japanese companies were pursuing a “low-cost automation” strategy: where the “high technology” strategy focused on “automation for the sake of automation regardless of its overall competitive performance”, the “low-cost automation” strategy focused on overall competitiveness “…with the simplest, most reliable, and least expensive automation equipment”

During the second half of the 1980s, following the successful “transplantation” of Toyota, Honda and the other Japanese carmakers in the US

More radical approaches to enhance human motivation in car assembly were carried out in northern Europe during the 1980s and aimed at decoupling assembly work from the assembly lines, enriching tasks and extending time cycles. Exemplified by the well-known and extreme case of the Volvo Uddevalla plant

The Uddevalla case raised many debates. Lean production supporters argued that Uddevalla required twice as much hours of work to assemble a car than the average lean factory

The second part of the 1990s saw the abandon by all the carmakers of both the “high technology” and the radical “human motivating” automation strategies and a general convergence towards the “low cost” and moderate “human fitting and motivating” automation strategies associated with lean production. As a result, at the end of the decade the rate of automation in assembly had not progressed significantly by comparison with the late 1980s, even though more flexible robots had been introduced in the body and paint shops

A first factor is the supply of labour. Following the collapse of Soviet Union, the entry of China in the WTO and the creation and extension of free trade zones in all the major economic regions, hundreds of millions of workers have been added to the world supply of workforce. As a result, the availability, cost and willingness to work of unskilled and skilled workers have ceased to be a problem for the automotive industry, at least for the time being. Rather than trying to pursue automation, carmakers have structured regional value chains and shifted production to low-wages countries in order to reduce their costs. The rapid growth of production for local markets in the BRICs as well as the need to upgrade factories in low-cost countries has had a mixed impact in terms of automation: on the one hand, the need to ramp-up production and improve quality has led to the creation of more capital intensive and automated factories than in the past

A second factor is related to one of the precondition identified by Shimokawa et al. (1997) for the further diffusion of automation: the reduction of product variations in order to improve the design for automation (p. 9). The 2000s and 2010s have rather seen a constant increase in product variations pushed by direct competition in all the main markets and the rapid introduction of new products and technologies

A third factor is more recent and is related to the greening and digitalization of the car. The on-going shift towards electro-mobility on the one hand, and the movement towards connected and autonomous cars on the other hand, are absorbing very substantial amount of capital investments by automotive firms, to which one should add the important cost of “cleaning” internal combustion engines after the “dieselgate” and the tightening up of the homologation rules

While factory 4.0 and other related concepts of advanced manufacturing are now clearly pushing for a revival of high-technology automation strategies, the two main drivers that have spurred previous automation waves in the automotive sector in the 1980s and 1990s appear to be absent: neither the productivity and quality problems that affected Western carmakers in the 1980s, nor the labour shortage and workers’ discontent that affected Japanese carmakers in the early 1990s are present today2. What is again present and diffused by the “industry 4.0” vision is the drive for automation for the sake of automation. As in the 1980s, “Technology- oriented notions, such as

Manufacturing revolution concepts as political projects

The years 2000s have been marked by declining contribution of manufacturing to GDP, historically low levels of investment in industrial equipment, and deterioration in the trade balance of manufacturing goods in almost all mature economies. These underlying negative trends have been exacerbated by the impact of the 2008-2009 crisis, triggering as a result the reactivation of voluntarist industrial policies at national and supranational level3. By contrast, in emerging countries, notably in the BRIC and in particular in China, the weight of manufacturing in GDP growth and the levels of industrial investments have significantly increased before the crisis and remained exceptionally high after it.

This is the context that sees the emergence of the industry 4.0 and advanced manufacturing platforms and projects in Germany and the US, followed by Made in China 2025. The section aims at characterizing these three initiatives with a special focus on their implications for the automotive sector.

Germany: Industrie 4.0

The German concept of Industrie 4.0 goes back to work in the context of the German government’s high-tech strategy. The German government passed its first high-tech strategy in 2006, which was further developed in subsequent years. The Ministry of Education and Research was commissioned with the supervision of this process and was advised by the specially-founded “Research Union Business and Science” between 2006 and 20134.

Within the Research Union, a group of scientists and business stakeholders were responsible for developing the “Industry 4.0” concept. Representatives of the IT industry (Henning Kagermann, President of the Acatech, and former CEO of SAP, Wolfgang Wahlster, President of the German Research Center for Artificial Intelligence, and Johannes Helbig, former board member of the Deutsche Post) played a central role. In 2013, this group issued the “Implementation Recommendations Industry 4.0”

From a policy perspective, Industry 4.0 is a campaign to mobilize significant public funding and private investment for technological modernization and innovation

While the overall vision of Industrie 4.0 is to develop the “Smart Factory” based on self-organized cyber-physical systems – a concept including a very high level of decentralized self regulation of the technology –, in practice Industrie 4.0 mainly describes a bundle of technologies with different potential consequences. The basic technology is the Internet of Things, which establishes a network of machines, materials, components, and also workers communicating with each other. In addition to this basic technology, Industrie 4.0 includes a number of further developments:

-

Efforts to integrate the often fragmented IT infrastructures in companies, to collect process-related data systematically and use new techniques to provide real-time data analysis for process control and process optimization;

-

Introduction of so-called assistance systems i.e., systems running on devices like tablets, data glasses, smart watches, smart gloves and other, providing information to workers, but also allowing for tighter control of work in manufacturing processes; and finally

-

New approaches to automation of manual operations.

Further technological developments such as 3D printing or the use of artificial intelligence have until now been of niche character in manufacturing and will not be analysed further here. Where 3D printing is introduced in the automotive industry, it is mainly used for the production of individual spare parts, and its deployment in mass production is in a very early stage and it is not clear if it will be possible in the middle term. Applications of artificial intelligence are so far highly specialized (e.g., image recognition systems used for quality control). More sophisticated applications of artificial intelligence, for instance, for the directing of automated guided vehicles in internal logistics are under development in laboratories but not yet deployed at a large scale in the factories.

One of the key promises of the Industrie 4.0 discussion is new possibilities for data-based optimization of production processes. By integrating all levels of IT systems from machine control to manufacturing execution systems (MES) and to enterprise resource planning (ERP), Industrie 4.0 aims at providing comprehensive process transparency to management. The study of Nyhuis et al.

In particular, the new approaches to order management and production control could have an impact on work areas traditionally dominated by skilled work. A prime example is maintenance work, a domain of skilled workers. For a long time now, companies have tried to structure and rationalize work processes in maintenance. In particular the introduction of Total Productive Maintenance (TPM) concepts as an element of lean production has provided a boost to change. A part of the TPM concepts is data-based planning of maintenance work in order to avoid machine downtime

Developments like the “Smart Maintenance” concepts are currently in their very beginning. They show, however, a possible future in which digitalization reduced the need for skilled production work and creates highly polarized employment structures in factories consisting of engineers and data analysts on the one and unskilled workers on the other hand.

The systematic introduction of digital assistance systems on the shopfloor is one of the core elements of Industrie 4.0. Assistance systems are using existing IT infrastructures and knowledge data bases in order to provide information to workers. Assistance systems can be run on a number of different devices. In assembly areas, assistance systems often run on computer screens; they visualize each step of the work processes, provide problem-solving help if needed, and can be also used to control the work process, for instance, by asking the workers to confirm each finished operation. In logistics, the newest generation of assistance systems is running on data glasses. There are also assistance systems using devices like “smart” gloves. These gloves are equipped with RFID chips, location and motion trackers, and light signals. They can be fed, for instance, with information about the right sequence of movements or parts to pick, and they show a warning light if the worker does not conduct the operation to standard.

Assistance systems are expected to help companies to quickly integrate new employees into the production process without disturbing the processes themselves. This is seen as an answer to problems related to integrating new groups (for instance, immigrants) and increasing staff turnover.

Automotive OEMs and suppliers are experimenting with a large number of projects introducing assistance systems, with intralogistics being a particularly frequent field of application. So-called pick-by-light and pick-by-voice assistance systems have been used here for a long time. These systems shown the workers the items to be picked by means of a light signal or a computer-generated voice. Now, companies have begun to test so-called pick-by-vision concepts that significantly increase the transparency of the picking process. In these approaches, the logistics workers carry data glasses, which are connected to the order management system. The order management system provides the information about which products are needed, where they are to be found in the warehouse, and in what order they need to be fetched. All information and instructions are displayed step by step on the data glasses. The built-in camera or body-worn RFID (Radio Frequency Identification) chips confirm that the right products have been picked up. In addition, a precise localization of the employees is possible.

The use of such assistance systems could certainly facilitate the execution of work. For semi-skilled workers, working under high time pressure and with high quality and safety requirements can mean considerable stress that can be absorbed by digital assistance systems

It has already become clear that automation in the classical sense is not at the core of Industrie 4.0 concepts. During the last years, at least in European high-wage locations of the automotive industry, there has not yet been a great boost in the field of automation. This is not least because the production at these locations is already characterized by a very high level of automation. In the case of car makers, possibilities to automate the body shop and the paint shop have been nearly exhausted; the only area strongly dominated by manual work remains the final assembly. In the German automotive supplier industry, about 54% of the companies report strongly or predominantly automated production; in 36% of the firms the production is characterized as mixed, i.e. it consists of automated and predominantly manual areas; only 10% of firms still have predominantly manual production

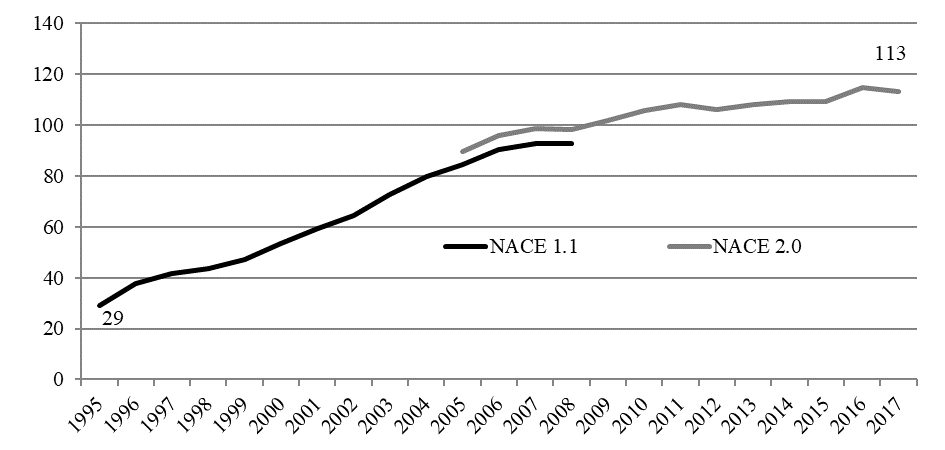

The following figure shows that the development of automation in the German automotive industry is a gradual, long-term process. This is illustrated here by the example of industrial robots – whereby it should be noted that robots are only one form of process automation. In recent years, the growth of robot intensity in the automotive industry has slowed down even - at least compared to the 1990s, where a much faster increase in automation was observed. This might be due to the fact that the focus of industrial robots is primarily in the body shop, where automation levels of over 90% already prevail.

Figure

Source: Eurostat sbs_na_2a_dfdn and sbs_na_ind_r2; International Federation of Robotics, World Robotics 1.1.14. NACE corresponds to the sector codes used by Eurostat that has changed the classification in 2008 from NACE 1.1 to NACE 2 (here it refers to the number of employees in the German automotive industry).

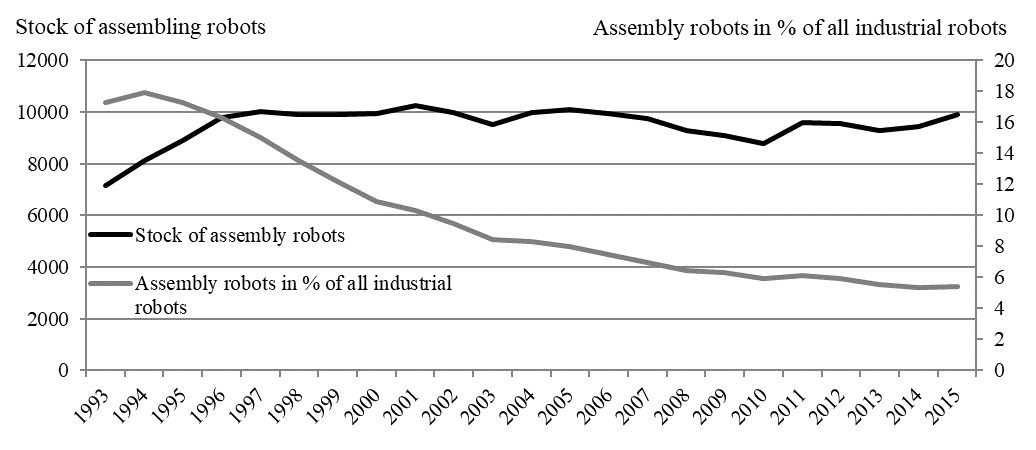

Today, manual work still prevails in assembly areas of OEM and supplier plants. An important innovation in the context of Industrie 4.0 aiming at automating assembly tasks are the so-called “collaborative” robots (cobots), which can be used flexibly and whose price has dropped dramatically in recent years. Although there are a number of pilot projects related to the introduction of cobots in the plants of German car manufacturers, these projects have hitherto focused on just a few areas of activity – a huge boost in assembly automation has not yet been recorded. In the current fields of application, cobots perform particularly repetitive or ergonomically unfavourable tasks and represent therefore rather an improvement of working conditions than a systematic threat to employment. In many assembly areas, however, the use of cobots is not possible due to the spatial conditions, the variety of parts and variants as well as the volatility of the manufacturing process. As the next figure shows, there has been no increase in the number of assembly robots in Germany since the 1990s, and the proportion of assembly robots in the total inventory of industrial robots is falling.

Figure 2: Assembly robots in Germany, 1993-2015

Source: International Federation of Robotics, World Robotics 1.1.14.

United States: Advanced manufacturing initiative

The concept of “advanced manufacturing” has been developed by the US Federal Government as a way to revitalize the manufacturing sector, and in particular the high-tech industries after the 2009 financial crisis. Its origin can be traced back to the US Department of Commerce’ report “Manufacturing in America” of 2004, which already highlighted the weakening of the manufacturing base for high-tech products, in particular computers and electronics, semiconductors, and electrical equipment (p. 20). The report was published in the aftermath of the 2001 recession triggered by the burst of the dot.com bubble and translated a declining confidence in the capacity of digital based services to replace manufacturing as the long-term growth engine of US economy. The report also stressed the importance of a strong manufacturing base in order to maintain US global leadership in new technologies, and as a key provider of good jobs

However, it was only after the 2009 “great recession” that the federal government really activated this industrial policy. A key move was the decision to rescue both GM and Chrysler from bankruptcy triggering the restructuring of the “Big Three” in order to restore their competitiveness by reducing capacity and labour costs. The two main arguments here were to protect well-paid jobs5 and an industry with strong back-links, which is also a main contributor to R&D spending. Yet the main focus of this new policy was not in manufacturing industries per se, but in the development of new key technologies. As highlighted by the President’s Council of Advisors on Science and Technology

The AMP appears from the start as a quite typical instrument of US industrial policy. On the one hand, it is supposed to address the risks of market failures in the development of new technologies justifying therefore the intervention of the State in terms that remain compatible with the laissez-faire principles historically endorsed by the US administrations. On the other hand, by putting national security at the forefront of the innovation agenda, it builds on the long-term commitment of the US administrations to the industrial-military complex and the nation innovation system built around it

The main initiative taken by the AMP has been the creation of a National Network for Manufacturing Innovation (NNMI), based on regional research institutes: the Innovative Manufacturing Institutes (IMI). An initial federal budget of $1 billion was given in 2012 to finance the first 15 IMI, and a further $1.9 billion has been released in 2016 to reach 45 IMI by 2025. These funds are managed by two government agencies directly linked to the scientific military complex: the DARPA (Defense Advanced Research Projects Agency) and the NIST (National Institute of Standards and Technology). Each IMI is specialized on some key technologies and operates as a public-private partnership. While the IMI take inspiration from the German Fraunhofer Institutes, the focus is different by comparison with the Industrie 4.0 platform. Of the first five institutes created between 2012 and 2014, three are dedicated to new materials and are placed directly under the control of the Department of Defense (DoD), and the other two work on new generations of power electronics and are managed by the Department of Energy (DoE). To date (August 2018), 15 IMI have been created and 8 of them focus on new materials (such as functional fabrics, biomaterials, 3D printing, composite materials and lightweight materials), while only two are specialized on robotics, artificial intelligence and digital manufacturing.

Overall, the DoD concentrates half of the total federal spending on R&D

While the long-term purpose of the AMP is to foster the “birth and growth of major new industries”, for the time being its impact on the shop-floor seems very limited, and concentrated in relative small scale aerospace production.

The US equivalent of the industry 4.0 platform is the Industrial Internet Consortium, which is a private driven initiative that aims at competing with industry 4.0 in defining the interoperability standards of IoT (references architectures). The IIC has been founded by General Electric and IMB in 2014 and its membership has now grown to over 300 firms.

The IIC has developed in cooperation with the IEEE standards association the Internet Reference Architecture (IIRA) that stands as the main alternative to the Reference Architectural Model Industrie 4.0 (RAMI 4.0). Both are general frameworks to build interoperability standards for IoT. Starting from 2015 the IIC and Industrie 4.0 platform have begun to cooperate and representatives of Bosh and SAP, two of the most active German players in the Industrie 4.0 platform, now sit in the IIC steering committee. While the effective creation of interoperability standards for IoT appears to be in its infancy

In the case of Germany, software (SAP), IT and dominant mechanical engineering firms (Bosch, Siemens, etc.) successfully lobbied the central Government and obtained funding and political support for the development of the Industry 4.0 platform, which explain why the smart factory is now centrally integrated in the German industrial policy and benefits from a generalized involvement of the nation innovation system. In the US, this is much less the case. As highlighted above, public funding for innovation policy is essentially managed by the DoD, captured by the aerospace industry and channelled towards the traditional industrial scientific complex where smart factories and related digital manufacturing technologies have so far attracted relatively little attention.

Different reasons can account for the marginal place of digital manufacturing in the advanced manufacturing framework. A major drawback for the experimentation and the diffusion of smart and cloud manufacturing in the Defense sector is the vulnerability of these technologies to cyber-security threats

The US automotive sector is not prominent in the Advanced Manufacturing Platform: initially only Ford was involved, joined later by GM, and the strong focus on new high-tech materials and additive manufacturing is a clear evidence of the little weight of auto producers in the platform, since these technologies have no realistic applications in mass production. The same can be said about the Internet Industrial Consortium, where just few automotive suppliers from the electric and electronic sectors are represented. As expected, the impact of both these initiatives on the shop-floor of automotive companies appears so far to be almost non-existent, with a couple of minor exceptions in recent transplants of some German premium carmakers where co-robots have been experimented on ad-hoc basis6.

The US automotive sector has been under restructuring since at least the years 2000, and this process has been dramatically amplified by the impact of the 2008 crisis and the bailout of GM and Chrysler. Following the closure of 13 factories and the loss of 128 000 jobs, the Big Three have drastically reduced their capacity and restored their cost competitiveness

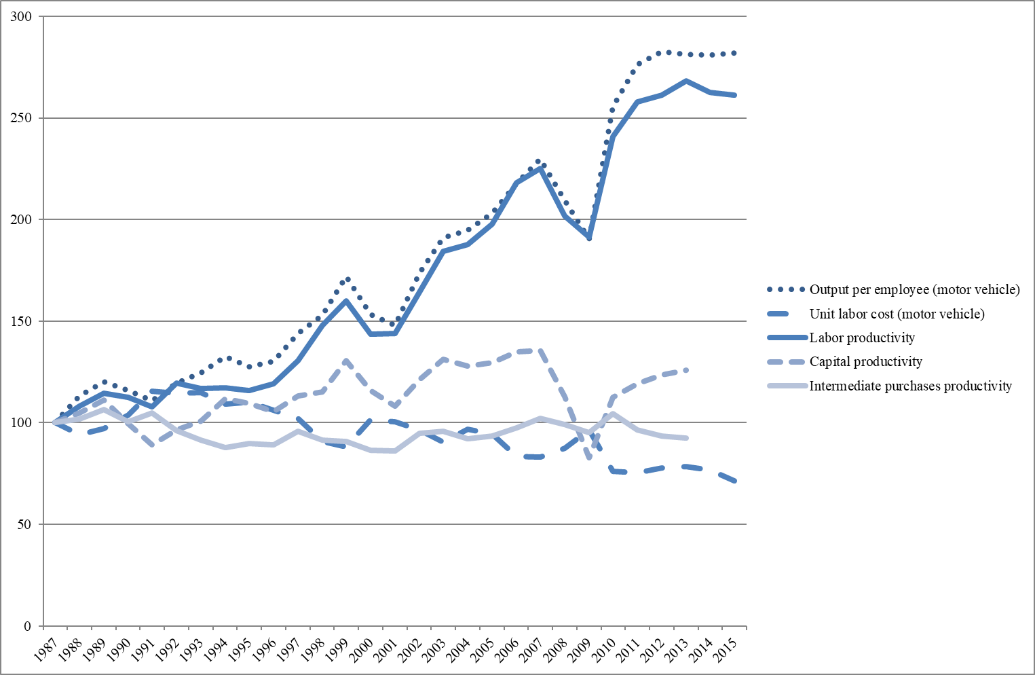

The bailout, followed by the fast rebound of the US market for new cars, has also provided the Big Three with the financial opportunity of modernizing their remaining factories. But rather than pushing new industry 4.0 technologies, the focus has been on replacing existing machines with more sophisticated ones in order to increase quality and flexibility. Overall, while the amount of investments in new machines has been important, automation rates have not increased

Figure 3: Productivity by factor in the US car industry (1987-2015, base 100-1987)

Source: BLS.

These trends are backed up by evidence from the shop-floor. Analysing the introduction of new machines in GM Tonawanda Powertrain plant, Evren Dincer has found little impact on overall headcount. He highlights however more subtle changes linked to the elimination of the lines of demarcation for skill trades, the introduction of a multi-skilled teams approach to maintenance, the breaking up of well-established work rules and the reorganization of the training system for skilled tradespersons

China: Made in China 2025

“Made in China 2025” (MiC 2025) appears to be the most ambitious project in the global arena to develop intelligent manufacturing. The program is a coordinated effort between government at all levels, research institutions and industry to create an advanced industrial base in ten key emerging industries. It is a centrepiece of China’s strategy of “innovation-driven development” that has been promoted since 2013 to accelerate the economic rebalancing from export-led to domestic-market-based growth

MiC 2025 assembles a broad spectrum of industrial actors. The concept does not bet on creating national champions from restructured state-owned enterprises - a strategy that had failed in industries such as automotive, telecommunications equipment and others. It gives a strong role to China’s new rising multinationals in mid- and high-technologies such as solar systems, wind turbines, LED, household appliances or, most prominently, in telecommunications and advanced internet services. MiC 2025, therefore, reflects the increased importance of large non-state-owned enterprises, such as Huawei, Haier or BYD, as drivers of innovation and marks a substantial change in economic power relations in China.

Germany’s Industry 4.0 strategy serves as the main reference point and model. However, MiC 2025 is not merely a program to promote robots and factory automation. It rather aims at the development of entire new industrial sectors and thereby reflects a strong orientation on value chains. As president Xi Jinping has made clear in several speeches, the ultimate goal is to build global production networks under Chinese leadership7.

The focus of public policy discussions in China has in particular shifted from visions of the digital factory without workers to the development of critical infrastructure and advanced data networks and platforms, i.e. artificial intelligence, cloud computing and the “industrial internet”. China’s accelerated efforts in this field are part of a massive global rush to develop data platforms for manufacturing, mostly known as “industrial internet” or “internet of things”. Those are basically operating systems for industrial equipment with apps to connect machines, data centres and control devices in factories, shipyards or construction sites, similar to Android, Apple iOS or other platforms for consumer smartphones.

However MiC 2025 suffers from the diverging, often contradicting dynamics between top-down and bottom-up policies, which have been described as typical for China’s emerging capitalism and its regulation

How does China’s push for digital manufacturing play out at the shop floor? The present picture is highly differentiated among industries and companies at various levels of value chains. These differences reflect the segmented nature of industrial upgrading and innovation, which is characteristic for China’s emerging variety of capitalism.

Among the vast

Against this background, much of the recent automation activities in China’s factories can be characterized as “catching up” with international standards of manufacturing organization, rather than “forging ahead”. There has been a surge in computerized manufacturing data control systems, but this kind of digitalization remains far from intelligent manufacturing based on flexible robots, artificial intelligence and big data networks. Most automation technologies are at the stage of “industry 2.0 or 3.0, but not 4.0”, as Midea-CEO Fang Hongbo explained in recent media interviews9.

The car industry as a whole is not a strategic sector under Made in China 2025. Only New Energy Vehicles (NEV) is among the ten emerging industries of this program. In this area China can hope to leapfrog the incumbent carmakers from developed industrial countries and to build indigenous brands and innovation, a goal that has not been achieved in the traditional car industry dominated by Chinese-foreign joint ventures. Some carmakers, from Germany especially, take part in highly publicized promotions of German-Chinese collaboration in industry 4.0. But in reality, industry 4.0-type manufacturing schemes are not significant at the shop-floor. The prevailing tendency of rationalization is to solidify and optimize methods of lean production and to improve efficiency under the conditions of China’s “new normal”10 with much lower growth rates than in the previous two decades

The situation reflects the general tendency in the global car industry described above: since the level of automation in the core sectors of the car industry generally is high, there is no significant incentive to implement radically new schemes of digital manufacturing.

By contrast, major restructuring of production schemes and value chains is currently happening in the NEV-sector and among car suppliers at the mid- and lower ends of supply chains

In

In the

At the lower ends of auto supply chains, basic processes of metal parts manufacturing, such as grinding, milling and polishing, are the typical application fields for low-end robots. Such robots are typically used to displace semi-skilled migrant workers with long work experience and relatively high wages, who are difficult to find in local labour markets. Automation of this kind replaces the best-paid groups of migrant workers, but usually there is no retraining to qualify them as operators or programmers for automated equipment

A recent study of the automation and labour policies of car suppliers in South China confirms the dynamics of catch-up automation under the conditions of China’s “new normal”

Automation clearly has an impact on workplaces and workers, but in no way as dramatic as the political slogan “robot replaces men” would suggest. In this particular case automation is used to compensate for higher labour costs supported by the newly established collective bargaining system, but it is not part of an overall assault on workforces and their improved collective rights. Rather, cooperative labour relations based on “moderated mobilization” of workers and mild concessions by managers prevail. The workers experience intensification of work and stricter control, but they do not see their jobs immediately threatened. However, they do expect higher wages and a fair share in productivity gains and economic profits, as well as a more rational structure of the wage system that would remunerate the skill improvements and greater efforts required from the workers. Collective bargaining, so far has not much addressed these topics, and remains relatively weak due to its limitation to single factories. But definitely, there is room for qualitatively oriented bargaining strategies as well for industry-wide bargaining at local level.

Conclusion

In this article we have used the framework of performativity to deconstruct the determinist premises of digital manufacturing revolution concepts such as industry 4.0, advanced manufacturing and China 2025. We have shown that as other hypes and fashions these are concepts that aim at bringing into being “improbable futures” and not descriptions of current “disruptive” trends and transformations. As these concepts become popular and capture firms’ and state’s action, the probability that their visions of the future become true increases, but their chances of turning into self-fulfilling prophecies remain low. As exemplified by several case studies in organizational studies, STS and economic sociology, fashions and hypes eventually fade but do however have important side effects and can sometimes trigger profound transformations in the organization of production and work depending on their degree of performativity

In order to measure the degree of performativity of digital manufacturing concepts we have focused our attention on the automotive sector, which has been historically a pioneer in diffusing new manufacturing technologies and remains one of the main buyers of such technologies. The purpose of our analysis has also been to reconnect empirically grounded studies of the evolution of manufacturing with the future of work, employment and manufacturing as a way to dismiss disruptive narratives of technological change and bring back politics and agency in the current debate.

There are some differences in the performativity of the three concepts analysed: while Industrie 4.0 and Made in China 2025 have successfully changed the discourse and agenda in the public and within the companies, the Advanced Manufacturing Initiative does not seem to have developed a similar impact.

To assess the scope for a digital manufacturing revolution to take place in the automotive sector, we have reviewed the historical evolution of automotive manufacturing technologies and organisations focusing in particular on the 1980s-1990s wave of automation. We have shown that previous major attempts of automating final assembly have failed because human based teamwork organizations have proved much more flexible and efficient in dealing with complex and constantly evolving assembly processes. Furthermore, we have also highlighted that the main reasons that have triggered these attempts in the past are not present anymore: namely important gaps in productivity and quality between leading and lagging firms; and shortages of skilled and unskilled manpower willing to work in automotive factories. The scope for a digital manufacturing revolution taking place in the automotive sector appears therefore limited taking also into account that these companies have already to cope with the huge capital costs implied by much more pressing issues such as the cleaning of internal combustion engines, the electrification of cars, and the development of autonomous vehicles.

The analysis of the three main “digital revolution” concepts in manufacturing in Germany (Industry 4.0), in the US (advanced manufacturing) and in China (Made in China 2025) has supported more than it has challenged our historical understanding of the future of manufacturing in the automotive sector. Industrie 4.0 and the Advanced Manufacturing Initiative appear partially as traditional political projects driven by consortiums of dominant industrial firms whose aim is mainly to attract public funding to finance R&D efforts and to support market seeking strategies in a context of crisis and growing international competition. The automotive sector is more involved in Germany than in the US, but in both cases there is no evidence of major disruptive breakthrough of completely new technologies and organizational models – the “smart factory” is evolving in small steps. What we have observed are various forms of experimentation with new digital technologies in Germany, and a catch-up automation (the accelerated replacement of older machines by more advanced ones) in the US. In the case of China 2025, the project of a cloud based customer-driven manufacturing system controlled by domestic internet giants has the potential of being “disruptive”, but this is still for the time being a vision whose implementation is problematic and whose future impacts need to be further assessed. Furthermore, it does not concern the automotive sector – the main Chinese industrial sector. As far as the automotive sector is concerned, the scope for major jumps towards digital cloud-based manufacturing appears again very narrow due to the already high capital intensity of existing factories and the limited applications of these technologies in mass production.

Our analysis dismisses the idea that a fourth industrial revolution is under way and that a radical disruptive break will take place in the coming years. In the short term, we rather expect a path-dependent evolutionary trend. It is unclear at the current stage, if the new technologies might have a more transformative character on work and employment in the middle- and long-term. But even if we assume some disruptive potential, the full development and implementation of concepts like Industrie 4.0 or Advanced Manufacturing will be a process of decades and not years.

However, behind the narratives of revolutionary breaks we have seen that more subtle changes are taking place on the shop-floor of automotive factories. These changes can be the direct consequences of the piecemeal introduction of some new digital technologies (in Germany), or the more indirect outcome of manufacturing revolutionary narratives as they create favourable conditions (notably public subsidies) for replacing existing machines with more sophisticated one (in the US) or for introducing standard cheap robots in small and medium suppliers (in China). What these changes have in common is that they concern the same category of workers: the skilled and semi-skilled workers who occupy strategic positions in the labour market and in the power relations in companies and firms. The threat is not only deskilling, but also the segmentation and polarisation of this group of workers as a way to reduce both labour costs and the scope for collective bargaining in a context of already increasing flexibilisation and intensification of work

If, as we argue, the future of technology and manufacturing is open, because “it consists of an evolving range of possibilities from which people choose”

What trade unions and social partners can do in particular to shape these processes of technological change? We believe that they should start by not accepting these narratives as given; they should question the bias built in these visions by using and sharing the knowledge of real work situations and experimentations, and by cooperating with universities and social scientists in order to build a collective empirically grounded understanding of on-going and forthcoming processes of technological change. As we have shown in the case of the automotive industry, even in routine based standardised jobs in the assembly line, when product complexity and variability is high, human work and tacit collective skills remain central in order to cope with uncertainties and non-standard work situations. Trade unions should pay attention to the status of this “real” collaborative work, the recognition of the tacit skills involved, as well as the conditions under which these skills are integrated (or not) in new digital manufacturing system. Trade unions should try notably to be actively involved in the design and implementation of these technologies whenever possible. They should challenge in particular the top-down revival of the “high technology” drive for automation for the sake of automation pushed by consultants and technology providers, and engage with local engineers and factory managers in bottom-up “human fitting and motivating” automation strategies. Finally, social partners and trade unions should also be vigilant concerning the production and collection of data generated by these new technologies, as it could be used to control and intensify work. Evidences from the logistic sector show that when this is the case, then work conditions worsen, health and safety problems arise, and this vicious circle can be used as an argument for further automating work

References

Abrahamson, E., Fairchild, G. 1999. Management Fashion: Lifecycles, Triggers, and Collective Learning Processes, in

Acatech. 2015.

Autor, D. 2015. Why Are There Still so Many Jobs? The History and Future of Workplace Automation. in

Berggren, C. 1992.

Berggren, C. 1994. Point/Counterpoint: NUMMI vs. Uddevalla, in

Berta, G. 1998.

Borup, M., Brown, N., Konrad, K., Van Lente, H. 2006. The Sociology of Expectations in Science and Technology, in

Bowles, J. 2014. The Computerisation of European Jobs, Bruegel (blog). http://bruegel.org/2014/07/the-computerisation-of-european-jobs/.

Brynjolfsson, E., McAfee, A. 2014.

Brzeski, C., Burk, I. 2015. Die Roboterkommen. Folgen Der Automatisierungfür Den DeutschenArbeitsmarkt, in

Butollo, F., Jürgens, U. Krzywdzinski, M. 2019. From Lean Production to Industrie 4.0. More Autonomy for Employees?, in Meyer, U., Schaupp, S., Seibt, D. (eds),

Butollo, F., Lüthje, B. 2017. Made in China 2025: Intelligent Manufacturing and Work, in

Camuffo, A. Volpato, G. 1997. Building Capabilities in Assembly Automation: Fiat’s Experiences from Robogate to the Melfi Plant, in

Chang, J.H., Huynh, P. 2016.

Daudt, G.M., Willcox, L.D. 2016. Reflexões Críticas a Partir Das Experiências Dos Estados Unidos e Da Alemanha Em Manufatura Avançada,

DiMaggio, P., Powell, W.W. 1983. The Iron Cage Revisited: Collective Rationality and Institutional Isomorphism in Organizational Fields, in

Dincer, E. 2016. The Reindustrialization Of The U.S.: An Ethnography Of Auto Workers In The Industrial Rust Belt, https://doi.org/10.7298/x4057cvd.

Durand, J.-P., Stewart, P., Castillo, J.J. (eds). 1999.

Dziczek, K. 2016. Process & Outcome of 2015 UAW Auto Negotiations, Federal Reserve Bank of Chicago

Ernst, E., Merola, R., Samaan, D. 2019. Economics of Artificial Intelligence: Implications for the Future of Work, in

Frey, C.B., Osborne, M.A. 2013. The Future of Employment: How Susceptible Are Jobs to Computerisation?, Oxford Martin School, no. September.

Freyssenet, M. 1995. La Production Réflexive, Une Alternative à La Production de Masse et à La Production Au plus Juste?, in

Freyssenet, M., Jetin, B. 2011. Conséquence de La Crise Financière Ou Crise d’une Forme de Capitalisme: La Faillite Des Big Three, in

Fujimoto, T. 1997. Strategies for Assembly Automation in the Automobile Industry, in

Gaborieau, D. 2012. «Le Nez Dans Le Micro». Répercussions Du Travail Sous Commande Vocale Dans Les Entrepôts de La Grande Distribution Alimentaire’, in

Geels, F.W., Smit, W.A. 2000. Failed Technology Futures: Pitfalls and Lessons from a Historical Survey, in

Güntner, G., Benisch, M., Dankl, A., Isopp, J. 2015.

Hatzfeld, N., Berta, G., Hoffmann, J., Stewart, P. 2005. Syndicats de l’automobile : Au Temps de l’ouvrier-Masse, Un Bouquet de Trajectoires, in

Hsieh, L.-H., Schmahls, T., Seliger, G. 1997. Assembly Automation in Europe - Past Experience and Future Trends, in

Jullien, B., Pardi, T. 2013. Structuring New Automotive Industries, Restructuring Old Automotive Industries and the New Geopolitics of the Global Automotive Sector, in

Jürgens, U., Fujimoto, T., Shimokawa, K. 1997. "Conclusions and Outlook’. In Transforming Assembly. Experiences in Automation and Work Organizations, 395–407. Springer.

Jürgens, U., Krzywdzinski, M. 2016.

Kagermann, H., Wahlster, H., Helbig, H. 2013.

Kenney, M., Florida, R. 1993.

Klebaner, S. 2018. Isolated Car Manufacturers? The Political Positions of the Automotive Industry on the Real Driving Emissions Regulation, in

Klier, T., Rubenstein, J.M. 2012. Detroit Back from the Brink? Auto Industry Crisis and Restructuring, 2008-11, in

Klier, T. 2013. Restructuring of the US Auto Industry in the 2008-2009 Recession, in

Krzywdzinski, M., Jürgens, U., Pfeiffer, S. 2016.

Kuhlmann, M., Splett, B., Wiegrefe, S. 2018. Montagearbeit 4.0? Eine Fallstudie Zu Arbeitswirkungen Und Gestaltungsperspektiven Digitaler Werkerführung,

Lepadatu, D., Janoski, T. 2018. Just-in-Time Workforce? Temporary Workers as a Structural Aspect of Lean Production in the US Auto Industry, in I

Löhrer, M., Lemm, J., Kerpen, D., Saggiomo, M., Gloy, Y.-S. 2018. Soziotechnische Assistenzsysteme Für Die Produktionsarbeit in Der Textilbranche, in

Lu, Y., Morris, K.C., Frechette, S. 2016. Current Standards Landscape for Smart Manufacturing Systems, National Institute of Standards and Technology, NISTIR 8107: 39.

Lüthje, B. 2018. Going Digital, Going Green: Changing Value Chains and Regimes of Accumulation in the Automotive Industry in China, in

Lüthje, B., McNally, C.A. 2015. China’s Hidden Obstacles to Socioeconomic Rebalancing, East-West Center,

Lüthje, B., Tian, M. 2015. China’s Automotive Industry: Structural Impediments to Socio-Economic Rebalancing, in

MacDuffie, J.P., Pil, F.K. 1997. From Fixed to Flexible: Automation and Work Organization Trends from the International Assembly Plant Study, in

MacKenzie, D. A., Muniesa, F., Siu, L. 2008.

McNally, C.A. 2014. Refurbishing State Capitalism: A Policy Analysis of Efforts to Rebalance China’s Political Economy, in

Meyer, A., Zander, S. Knapper, R., Setzer, T. 2018. Decision Support Pipelines–Durchgängige Datenverarbeitungsinfrastrukturen Für Die Entscheidungen von Morgen, in

Midler, C., Jullien, B., Lung, Y. 2017.

Muniesa, F., Callon, M. 2008. La Performativité Des Sciences Économiques’, Papiers de Recherche Du CSI, no. 10.

Muniz, S.T.G., Belzowski, B.M., Zhu, J. 2019. The Trajectory of China’s New Energy Vehicles Policy, in

Noble, D. F. 1984,

Nohara, H. 1998. Toyota réforme le Toyotisme, in

Nyhuis, P., Hübner, M., Quirico, M., Schäfers, P., Schmidt, M., Reinhart, G. 2017. Veränderung in Der Produktionsplanung Und-Steuerung, in

O’Sullivan, E., Andreoni, A., Lopez-Gomez, C., Gregory, M. 2013. What Is New in the New Industrial Policy? A Manufacturing Systems Perspective, in

Pajarinen, M., Rouvinen, P. 2014. Computerization Threatens One Third of Finnish Employment, ETLA Brief 22 (13.1): 2014.

Pardi, T. 2015. Quand Une Mode Managériale s’institutionnalise, in

Pardi, T. 2017.

Paus, E. 2018.

PCAST. 2011.

Pfeiffer, S. 2017. Industrie 4.0 in the Making–Discourse Patterns and the Rise of Digital Despotism, in

Polanyi, K. 1944.

Polanyi, M. 1966.

Pollock, N., Williams, R. 2010. The Business of Expectations: How Promissory Organizations Shape Technology and Innovation,

Schlick, J., Stephan, P., Loskyll, M., Lappe, D. 2014. Industrie 4.0 in Der Praktischen Anwendung, in I

Shimizu, K. 1999.

Shimizu, K. 2000. Un Nouveau Toyotisme?, in

Sirkin, Harold L., Michael Zinser, and J. Rose. 2015. ‘The Robotics Revolution: The next Great Leap in Manufacturing’. BCG Perspectives.

Sirkin, Harold L., Michael Zinser, and Justin Rose. 2014. ‘The Shifting Economics of Global Manufacturing: How Cost Competitiveness Is Changing Worldwide’. Boston Consulting Group, August.

Tolbert, P. S., Zucker, L.G. 1999. The Institutionalization of Institutional Theory, in

Ullrich, C., Hauser-Ditz, A., Kreggenfeld, N., Prinz, C., Igel, C. 2018. Assistenz Und Wissensvermittlung Am Beispiel von Montage-Und Instandhaltungstätigkeiten, in

U.S. DoC. 2004.

Van Lente, H. 1993.

Wiremann, T. 1991.

Womack, J. P., Roos, D., Jones, D.T. 1990.

Wübbeke, J., Meissner, M. Zenglein, M.J., Ives, J., Conrad, B. 2016. Made in China 2025: The Making of a High-Tech Superpower and Consequences for Industrial Countries, Mercator Institute for China, Studies 17.

Yang, T. 2018.

Acknowledgements

This work was supported by the ILO Research Department as part of the project “L’avenir du travail dans le secteur automobile : analyses transversales” and the cooperation agreement between the French government and the ILO. We thank in particular Guillaume Delautre from the ILO Research Department for his active monitoring and prompt feedbacks.

The article is the responsibility of the authors alone, and its publication does not imply that the ILO endorses the views expressed therein.