Applying labour law to micro, small and medium-sized enterprises:

A comparative study of 16 countries

Abstract

The self-employed and micro, small and medium-sized enterprises (MSMEs) account for the greatest share of employment and make up the largest number of economic units worldwide. However, some countries exclude these economic units from certain obligations under their national labour laws in the belief that such obligations may impair enterprise growth and prosperity. This study considers the ways in which different countries regulate labour rights for MSME workers, its main purpose being to improve understanding of current trends and developments in this area. The 16 countries covered by the study are Brazil, China, Colombia, Costa Rica, Egypt, Germany, Mexico, Nepal, Peru, the Russian Federation, South Africa, Spain, Sri Lanka, Sweden, Turkey and the United Republic of Tanzania.

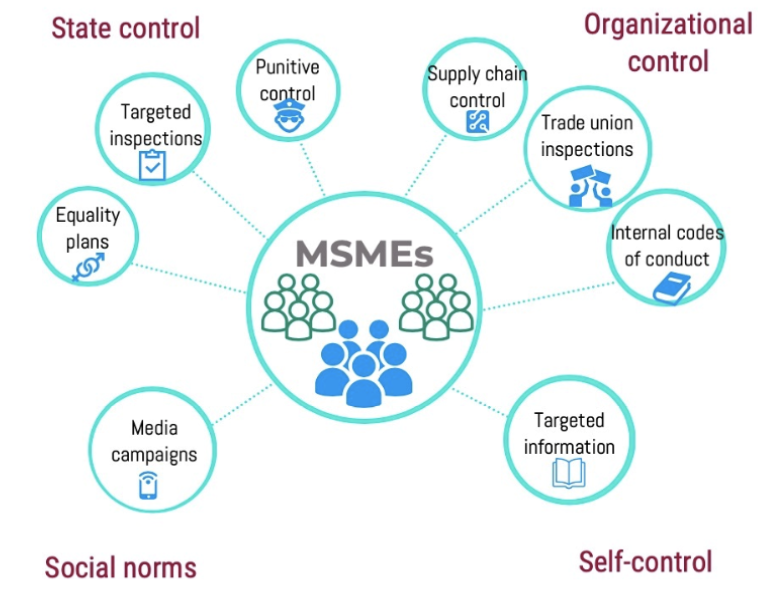

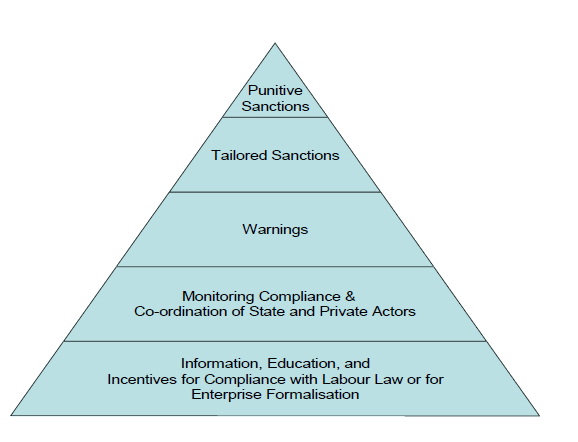

Drawing on comparative analysis of labour law coverage for MSMEs in the above countries, this study identifies a general trend towards the extension of equal protection to all workers regardless of the enterprise size, including those in the informal economy and in self‑employment. To achieve that, governments are relying not only on labour laws but also on other frameworks and policies. This study did not find any country that completely excluded MSMEs from the application of labour laws. Where selective exclusions or special regimes are in place, these apply mainly to micro and small enterprises, while workers in medium‑sized enterprises are often fully covered. Invoking the concept of “social control”, this study highlights a number of innovative approaches used to achieve enforcement of, and compliance with, labour laws among MSMEs – ranging from targeted inspections to wider campaigns designed to raise awareness and change social norms and perceptions.

On the whole, the findings presented in this working paper tie in with those of other studies, showing how labour legislation as such is neither a major obstacle nor a panacea when it comes to promoting enterprise growth and sustainability. It would be worth undertaking further research to explore the ways in which recent labour law reforms in a number of countries have had an impact on the day-to-day experience of MSME workers.

Introduction

The present study is concerned with the application of labour law to workers at micro, small and medium-sized enterprises, including the self-employed (hereafter collectively referred to as “smaller enterprises” or MSMEs). The purpose is to improve understanding of the approaches used by different countries to regulate employment and working conditions in smaller enterprises, which account for more than two thirds (70 per cent) of employment globally (ILO 2019; 2015). Based on the comparative analysis of 16 countries, this study identifies new developments and trends in the coverage of labour laws (including employment protection) for MSME workers.

This introductory chapter provides a brief review of the literature on the regulation of work in MSMEs, presents the study’s aims and underlying research questions, and outlines its key findings.

Applying labour law to MSMEs: A review of the literature

Self-employment and employment in microenterprises represent over 80 per cent of employment in South Asia and sub-Saharan Africa, 70 per cent in the Middle East and North Africa, and 60 per cent in Latin America and the Caribbean (ILO 2019, 11). However, some countries exclude MSMEs from the purview of certain parts of their labour legislation as a way of promoting enterprise growth and the creation of employment (Edwards, Ram and Black 2004; Fenwick et al. 2007). In general, workers at smaller enterprises in many countries tend to enjoy less protection than those in large enterprises

The question of how to regulate work and employment in MSMEs to support enterprise growth and achieve decent work is a highly complex one. Historically, labour law, designed to uphold the “standard” employment relationship between employers and employees, has played a key role in the protection of workers

Those in favour of deregulation argue that labour legislation hinders enterprise growth and undermines productivity (Besley and Burgess 2004; Almeida and Carneiro 2009; Xie 2016; Van Landuyt, Dewaelheyns and Van Hulle 2017). This argument has been advanced in particular by the World Bank (2013) and by some scholars (such as De Soto 2000), who consider a reduction in the regulatory burden of labour laws necessary if enterprise growth is to be fostered. Moreover, the restriction of labour rights has often been mentioned in policy debates during economic downturns, such as those following the global financial crisis of 2007–08 or the COVID‑19 crisis of 2020. In a study on China, Xie (2016, 178) argues that small enterprises “find it hard to operate in strict compliance with labor laws in the way larger businesses do”. Another study finds that small and medium-sized enterprises (SMEs) perform better when they have lower recruitment and dismissal costs (Van Landuyt, Dewaelheyns and Van Hulle 2017). Similarly, a study on Brazil concludes that “stricter enforcement of labor regulation constrains firm size, and leads to higher unemployment” (Almeida and Carneiro 2009, 28).

While smaller enterprises require flexibility to adapt, there is not much support in the literature for the notion that labour laws are an obstacle to enterprise growth or that lowering labour standards leads to an increase in formal employment (Edwards, Ram and Black 2004; Fenwick et al. 2007; Robertson et al. 2016, 25; Brookes, James and Rizov 2016; Reinecke 2002; Bhaumik and Dimova 2014).

For instance, a study by Besley and Burgess (2004) looking at the impact of labour legislation on small enterprises in India concluded that pro-worker labour regulation in that country was associated with a larger informal economy, lower labour force participation and higher unemployment. However, many researchers have criticized that study (see, for example, Bhandari and Sudarsan 2016; Sapkal 2016; Deakin and Haldar 2015; Deakin 2016; Deakin and Sarkar 2011). A more recent study suggests that, contrary to the conclusion of Besley and Burgess

The opposite view is that labour market regulation plays a crucial role in protecting workers but can also promote productivity by leading to the emergence of a better-trained labour force and by linking job quality to higher productivity (Edwards, Ram and Black 2004; Brookes, James and Rizov 2016; Deakin and Haldar 2015). A resource-view approach emphasizes that employees are valuable assets, and that improved working conditions are therefore beneficial to the enterprise (Croucher et al. 2013, 11). A study using cross-country, firm-level data from nine developing countries finds that “certain restrictive institutions like greater protection of employee rights, which are believed to have negative implications for macro-variables like employment growth, may actually enhance production efficiency” (Bhaumik and Dimova 2014, 123). Thus, employment regulation as such does not necessarily harm smaller enterprises (Reinecke 2002; Edwards, Ram and Black 2004; Fenwick et al. 2007; Croucher et al. 2013; Deakin and Haldar 2015).

An important finding is the positive correlation between social dialogue and enterprise growth. A review study shows that social dialogue mechanisms, including trade union presence, works councils and board representation, can increase firm-level productivity (Grimshaw, Koukiadaki and Tavora 2017). Another study found that trade unions did not have a negative effect on firm-level productivity: on the contrary, although there are variations between countries, there is a small positive effect overall (Doucouliagos, Freeman and Laroche 2017). Focusing on small enterprises in particular, a study of small cleaning and catering businesses concludes that social dialogue enhances customer relations and improves workers’ well-being (Ramioul and Kirov 2017).

Lack of knowledge and time to deal with bureaucratic procedures is an important barrier preventing smaller enterprises from complying with labour laws. An empirical study of business regulation in the Niger and Swaziland found that microenterprises did not register mainly because of lack of knowledge about the procedures involved (Joumard, Liedholm and Mead 1992). In some cases, compliance is not feasible because enterprises are located far away from the country’s administrative centre. It is, therefore, too simplistic to say that employers will always try to minimize employment costs and evade or circumvent labour protection obligations (Croucher et al. 2013, 11). Instead, a literature review by Reinecke (2002) found that smaller enterprises were not necessarily affected by regulations as such but by a lack of transparency and clarity in their implementation. The same study pointed out, moreover, that “managers of small enterprises do not mention government regulations, but rather low demand and lack of credit as the key constraints for running and expanding their business” (Reinecke 2002, 31).

An additional challenge to employment and work regulation in smaller enterprises is that most of them operate informally. Low- and middle-income countries have the highest rates of informal employment: in Africa, in particular, 92.4 per cent of economic units are informal (ILO 2018a). The situation is similar in Latin America, where most smaller enterprises tend to operate informally (OECD and CAF 2019, 54).

Although compliance with complex labour regulations can be a problem for smaller enterprises, some researchers argue that the best way to deal with this is not to deregulate or to exclude smaller enterprises from the application of labour laws

Aims and research questions

The main objective of this study is to identify current developments, trends and innovative approaches in the application of labour laws to MSMEs. To that end, labour laws and policies affecting MSMEs have been reviewed for 16 countries: Brazil, China, Colombia, Costa Rica, Egypt, Germany, Mexico, Nepal, Peru, the Russian Federation, South Africa, Spain, Sri Lanka, Sweden, Turkey and the United Republic of Tanzania. The review was concerned with the following questions in particular:

-

How are labour laws applied to MSME workers?

-

To what extent do the selected countries exclude MSMEs from the application of labour laws?

-

What recent trends are there with regard to the regulation of employment and work relations in MSMEs?

-

What innovative efforts have been undertaken to achieve compliance with labour laws in smaller enterprises?

The application of labour laws to MSME workers is often considered from the perspective of economic policies to support enterprise growth, but in fact it also has important implications for achieving the ILO’s Decent Work Agenda and United Nations Sustainable Development Goal (SDG) 8 on decent work and economic growth – that is, for improving the situation of the overwhelming majority of workers worldwide.

Key findings

-

None of the countries studied completely exempts MSMEs from the application of labour laws.

-

Medium-sized enterprises are rarely excluded from the application of labour laws. Most selective exclusions or special regimes apply to micro and small enterprises. This study found just two such provisions (one in Egypt and one in South Africa) for medium-sized enterprises (see Chapter 2, sections on Freedom of association and collective bargaining and Consultation of employees).

-

The most common approach, regardless of the country income level, is the equal application of labour laws to all enterprises, with selective exclusion from some obligations.

-

In all the countries studied, there is equal application of the law with regard to the prohibition of forced labour and child labour, the setting of a minimum wage, working hours, occupational safety and health, and sick leave.

-

Special regimes for social security are common among Latin American countries, where they are normally part of broader policies to formalize the informal economy (as in Brazil, Colombia, Costa Rica and Peru).

-

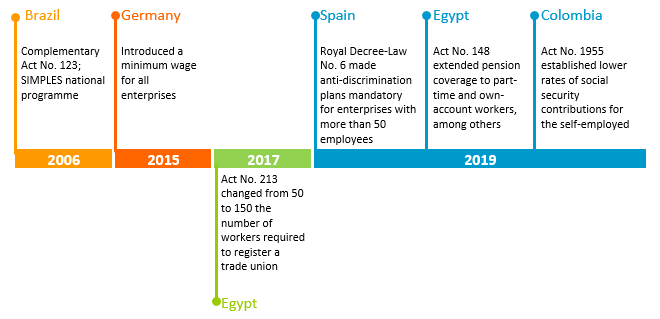

There has been a general trend over the past 15 years to extend the coverage of labour laws to MSMEs. Reforms aimed at extending coverage to workers at smaller enterprises were identified in Brazil (2006), Germany (2015, 2017), Nepal (2017), Spain (2019), Egypt (2019) and Colombia (2019). The only reduction of coverage for MSME workers occurred in Egypt (2017) (see Chapter 3).

-

There is a general trend in many of the countries studied to shift the responsibility for compensating workers during sickness and maternity leave from employers to national insurance schemes (as in Germany and Nepal – see Chapter 3, section on Providing security for workers through national insurance).

-

In Latin America, one commonly finds special simplified tax regimes to promote smaller enterprises’ compliance with labour laws.

Table 1 summarizes recent developments in the application of labour laws to MSMEs, juxtaposed with the earlier findings by Fenwick at al. (2007). The table shows that the complete exemption of smaller enterprises from the application of labour laws is not an approach currently used in any of the countries studied. In Nepal, a legislative reform in 2017 extended labour rights to previously excluded enterprises, namely those with fewer than ten workers. The present study also found that special regimes providing a “parallel” set of rules outside the regular labour law are often used to regulate smaller enterprises in Latin American countries. Equal application with selective exclusions is the most common approach regardless of the income level of the countries studied. Thus, countries such as Germany and Nepal appear in the same group, even though they have very different income and development levels. However, the extent of enforcement of the laws is probably quite different in the two countries, given the disparity between them in terms of institutional capacity to monitor compliance and exercise control.

Table 1. Different approaches in the application of labour laws to MSMEs

|

Application of labour laws to MSMEs |

Fenwick et al. (2007) |

Present study (Vargas 2020) |

|

Equal application |

China |

China |

|

Complete exemption |

Nepal* |

– |

|

Special regimes |

Brazil Peru |

Brazil Colombia Costa Rica Peru |

|

Equal application with selective exclusions |

Chile Denmark Hungary Indonesia Kenya Namibia Philippines South Africa Thailand United Republic of Tanzania Viet Nam |

Egypt Germany Mexico Nepal Russian Federation South Africa Spain Sri Lanka Sweden Turkey United Republic of Tanzania |

The subsequent chapters of this working paper are structured as follows. Chapter 1 outlines the methodological approach, including the scope of the study and the definitions used. Chapter 2 provides a descriptive analysis of the main findings on the labour law coverage of MSMEs. Chapter 3 discusses the main trends observed in the application of labour laws to MSMEs. Chapter 4 gives examples of the policies and programmes used by governments to improve the working conditions and rights of MSME workers. Chapter 5 uses the concept of “social control” to consider innovative approaches for achieving compliance with, and enforcement of, labour laws at MSMEs. Finally, the last part presents the main conclusions of the study.

Methodological approach

This study uses a comparative approach to identify and analyse different legislative approaches to the regulation of labour in MSMEs. It reviews labour laws and policies in 16 countries. While its main focus is on state regulation, the study also explores other potentially complementary forms of control, such as social norms and organizational control. This chapter presents the definitions used, the criteria for the selection of countries, the scope of the labour laws reviewed, and the limitations of the study.

Definitions

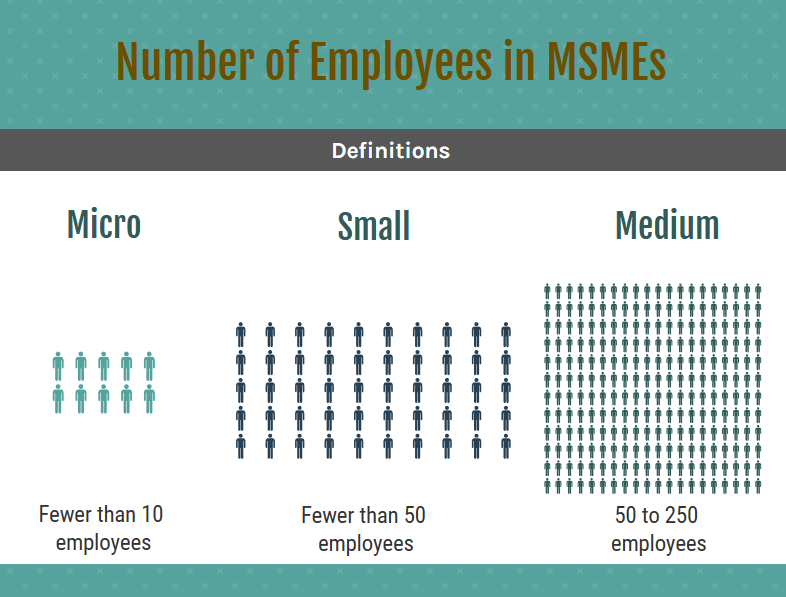

Figure

There are different ways to define smaller enterprises, and most countries have developed definitions that are tailored to their specific situation. This working paper uses national definitions when referring to specific countries (see Annex) and the following definitions in the general parts of the text.

The categories covered by the term “micro, small and medium-sized enterprises” are used to designate economic units that are under a certain threshold in terms of the number of workers, the annual turnover or the capital invested. These thresholds vary from country to country. A common definition sets an upper limit of 250 employees for medium-sized enterprises, with small enterprises being those that have fewer than 50 employees and microenterprises those with fewer than 10 employees (see figure 1).1 For the purposes of this paper, the term MSMEs, or “smaller enterprises”, is considered to include the self‑employed and own-account workers employed in the formal or informal sector.

Since MSMEs are defined as enterprises under a certain threshold, it is important to note that in this paper the term “enterprise” is used in a comprehensive sense to include economic units regardless of their legal status (formal or informal/officially registered or not). It also includes the self-employed, family enterprises and agricultural units.

Most countries covered by this study defined microenterprises as those having fewer than ten employees. This raises the question of whether the self-employed should be counted as microenterprises. A recent study by the ILO

The term “own-account worker” is used interchangeably with the term “self-employed” in accordance with the Resolution concerning the International Classification of Status in Employment (ICSE), adopted by the 15th ICLS in 1993.

This study uses the term “workers” in a broader sense, inspired by the principles underlying the ILO’s Decent Work Agenda, particularly the principle that “all those who work have rights at work”. Given that in many smaller enterprises the distinction between workers and owners is more nuanced than in larger ones, the term “worker” is also used for own-account workers, while the term “employer” is used for owners of smaller enterprises that hire workers. The term “worker” also refers in this paper to members of producers’ cooperatives and workers using online platforms to provide services or products. Consequently, neither “worker” nor “employee” is used here in the sense of the standard employment relationship, which refers mainly to dependent employment.

This paper pays special attention to workers in informal employment, whether in the formal or the informal economy. The term “informal economy” is used in the sense of the Transition from the Informal to the Formal Economy Recommendation, 2015 (No. 204), where it is defined as “all economic activities by workers and economic units that are – in law or in practice – not covered or insufficiently covered by formal arrangements”, with illicit activities explicitly excluded.

Informal employment includes: (a) the self-employed (with or without employees) in their own informal sector enterprises; (b) contributing family workers; and (c) employees (in formal and informal enterprises) not covered by labour laws (ILO 2003).

Although the term “informal economy” will be used throughout this paper, it is important to mention that there is a significant body of literature criticizing the categories “formal” and “informal” to describe employment and enterprises because the latter often find themselves in a situation of “semi-formality”, where they comply with some but not all of the regulations (Maldonado 1995; Williams, Round and Rodgers 2007; ILO 2018a).

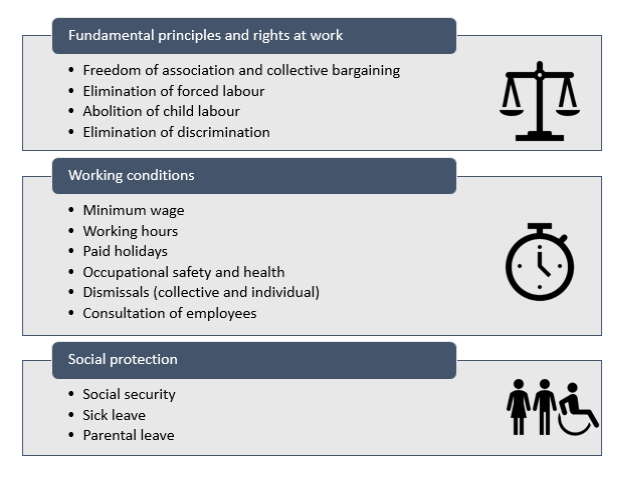

This study is concerned with the scope, coverage and application of labour laws in relation to MSMEs. Labour laws may be defined broadly as rules set by the State that regulate the conditions of work. As such, they are an important means to attain the goal of decent work (Bronstein 2009, 2). The specific areas covered by the labour laws reviewed in this study are presented further down (see figure 4).

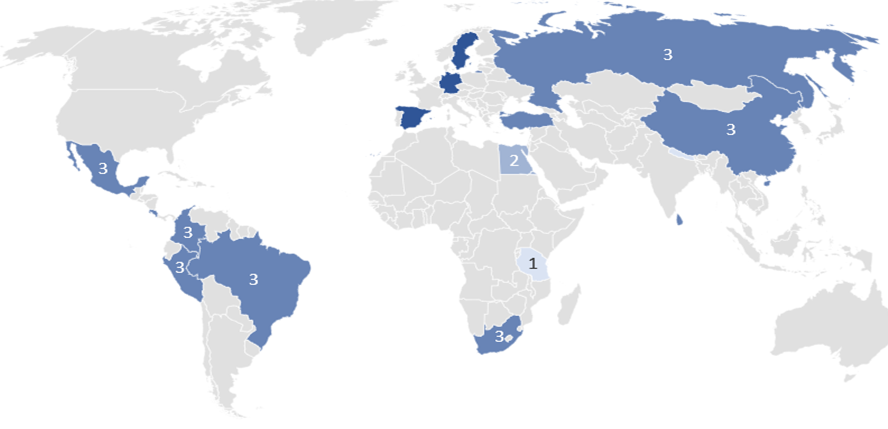

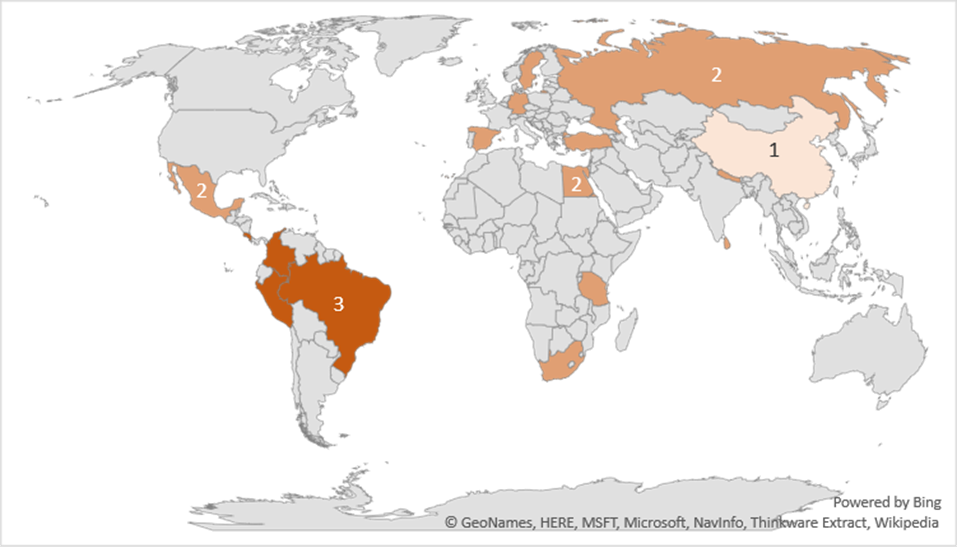

Countries

The countries selected for this study are shown in different shades of blue in the map in figure 2 below. The sample of countries covers different geographical regions, levels of economic development, shares of informal employment and legal systems. While the selection of countries was not random, it was carried out with a view to including different regions and income levels.

Figure

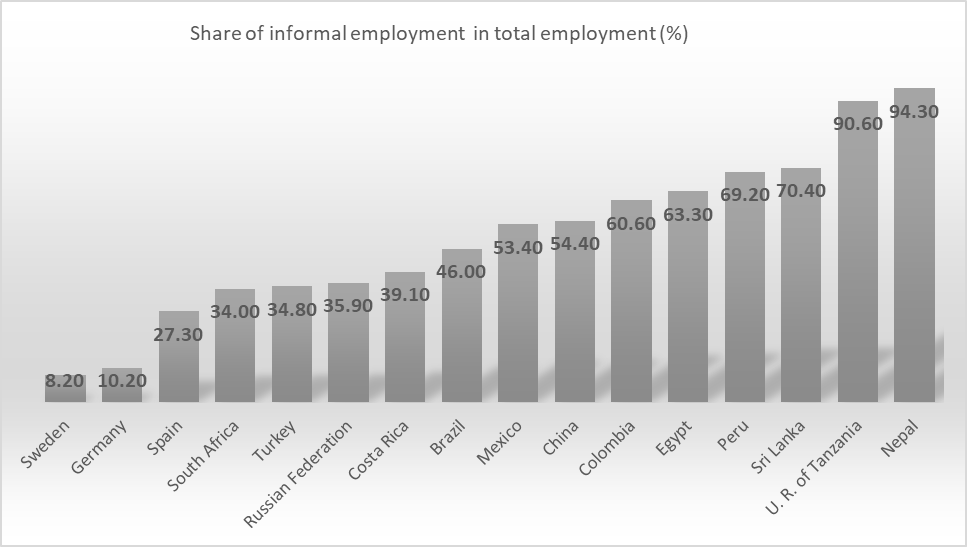

Figure 3. Share of informal employment in the countries studied

Scope of labour laws

The scope of the labour laws reviewed in this study reflects international labour standards that support the principles of decent work, and gives a comprehensive picture of the legal protection of MSME workers. Although additional areas of labour law could have been included, a selection was necessary to make the collection of data feasible. The laws reviewed also provide relevant information on some of the targets under SDG 8 on decent work and economic growth. These include the eradication of forced labour, the prohibition and elimination of the worst forms of child labour, the protection of labour rights and the promotion of safe and secure working environments for all workers. The areas covered by the labour laws reviewed in this study are listed in figure 4 below, where they have been divided into three main groups: fundamental principles and rights at work; working conditions; and social protection.

Figure 4. Scope of labour laws included in the study

Labour law coverage of MSMEs

Achieving decent work for MSME workers remains a major challenge for many countries around the world. As noted in a report prepared at the request of the ILO Committee on Employment and Social Policy, a key obstacle to the achievement of decent work is the lack of legal coverage for workers in smaller enterprises, which are often excluded from the application of labour law (ILO 2006). This chapter presents the results of a comparative study on the application of employment and labour laws to MSME workers.

Different approaches to labour law coverage

Fenwick et al.

-

Equal (or full) application: all labour laws apply equally to enterprises of all sizes (as in China).

-

Selective exclusions: special provisions in general labour laws exclude enterprises below a certain threshold size from some requirements (the most common approach).

-

Special regimes (parallel labour laws): enterprises below a certain threshold size are excluded from the general application of labour laws and, instead, there is a special legal regime with lower standards that applies to them (as in Brazil and Peru).

-

Complete exemption: enterprises below a certain threshold size are excluded entirely from the application of labour laws (as in Nepal until 2017).

Equal application

The first approach listed above is to apply equally all the provisions of labour laws to MSME workers. The only country in the sample that currently follows such an approach is China.2

Selective exclusions

The most frequent approach in the regulation of MSMEs is equal application but with the exemption of such enterprises from some of the requirements through special provisions in general labour laws. Thus, the applicability of certain sections of labour laws and employment protection legislation varies according to the size of the enterprise. The most common exclusion in the countries studied concerns the requirement to set up an occupational safety and health (OSH) committee or to appoint OSH delegates. Twelve countries in this study exempt enterprises below a certain threshold size from the requirement to set up an OSH committee.

Some countries have only a few exclusions (one or two), while others have several (three to six). For example, South Africa has comprehensive coverage for MSMEs and there are only two exclusions in the application of the law: these concern the election of OSH representatives in enterprises with fewer than 20 employees and the composition of workplace forums for enterprises with more than 100 employees. The country with the highest number of exclusions is Turkey. Nevertheless, what is important is not so much the number of exclusions as the way in which these affect the promotion of fundamental rights and the enhancement of basic working conditions.

Special regimes

An intermediate approach is the creation of special regimes for smaller enterprises. Special regimes are used to establish lower standards for workers at micro and small enterprises in Brazil, Colombia, Costa Rica and Peru. Instead of providing for exclusions from the general labour law, these countries have special laws covering some aspects of labour for MSME workers. These regimes usually have to do with social security contributions, but they may also cover wider issues related to working conditions, such as rules for dismissals, working hours and holidays. Such special regimes, which are particularly common in Latin America, are often part of broader policies aimed at promoting the formalization of smaller enterprises.

For example, Peru has a special legal framework for micro and small enterprises that includes a chapter containing labour regulations.3 Workers at microenterprises are not covered by workers’ pension insurance but they do have access to a social pension. They are also not covered by life insurance or the scheme known as the Supplementary Insurance for Risks at Work (SCTR).

Complete exemption

The opposite approach to equal application is total exemption, which existed in Nepal until 2017. The previous law – the Labour Act, 2048 (1992) – was applicable only to enterprises with ten or more employees or workers. Excluding smaller enterprises from the full application of labour law leaves workers without the protection of fundamental rights, and one would expect only very few countries to retain this approach. While this study did not find any country currently using complete exemption, there are still some countries that exclude certain categories of workers (namely, agricultural workers, family workers and the self‑employed) from specific parts of their employment protection laws.

Figure 5 shows, using different shades of colour, the type of application of labour laws to MSMEs that pertains in the countries studied.

Figure 5. Labour law coverage of MSMEs in the countries studied

Table 2 summarizes this study’s findings on the specific labour law provisions that apply to MSMEs. Countries are grouped according to their level of economic development (low, lower-middle, upper-middle or high income).4 As can be seen, a country’s income level does not determine whether MSMEs are excluded from the application of labour laws. An interesting example is Germany: a high-income country that excludes companies with fewer than ten employees from the application of the law on unfair dismissals. However, this important limitation is compensated for by generous unemployment insurance. In contrast, the United Republic of Tanzania, a low-income country, and Sweden, a high-income country, have – at least on paper – almost equal protection for all workers regardless of the enterprise size.

Table 2. Labour law coverage of MSMEs in the countries studied

|

Level of economic development |

High |

Upper middle |

Lower middle |

Low |

|||||||||||||

|

Area of labour law |

Germany |

Spain |

Sweden |

Brazil |

China |

Colombia |

Costa Rica |

Mexico |

Peru |

Russian Federation |

South Africa |

Sri Lanka |

Turkey |

Egypt |

Nepal |

United Republic of Tanzania |

|

|

Fundamental freedoms and rights |

Freedom of association and collective bargaining† |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

Elimination of forced labour |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Abolition of child labour |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Protection against discrimination |

* |

* |

* |

√ |

√ |

√ |

√ |

√ |

* |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Working conditions |

Minimum wage |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

Working hours and overtime |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Holiday |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

S |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Occupational safety and health (OSH) |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Special OSH requirements (e.g. OSH committee) |

* |

* |

* |

* |

√ |

√ |

* |

* |

√ |

√ |

* |

* |

* |

* |

* |

* |

|

|

Collective dismissal |

* |

* |

√ |

√ |

√ |

* |

√ |

√ |

√ |

* |

√ |

* |

* |

√ |

* |

√ |

|

|

Unjustified individual dismissal |

* |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

S |

√ |

√ |

* |

* |

√ |

√ |

√ |

|

|

Consultation of employees |

* |

* |

√ |

– |

√ |

– |

– |

– |

– |

√ |

* |

√ |

* |

– |

* |

√ |

|

|

Social protection |

Social security |

√ |

√ |

√ |

S |

√ |

S |

S |

√ |

S |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

Sick leave |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

|

Parental leave |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

* |

√ |

√ |

√ = equal application to all enterprises regardless of size. * = selective exclusions (obligations vary according to enterprise size). – = information not available. S = special regime with lower standards for MSMEs.

The following sections look at each of the areas of labour law covered by this study, providing details on different approaches to the regulation of labour and employment conditions in MSMEs.

Fundamental freedoms and rights at work

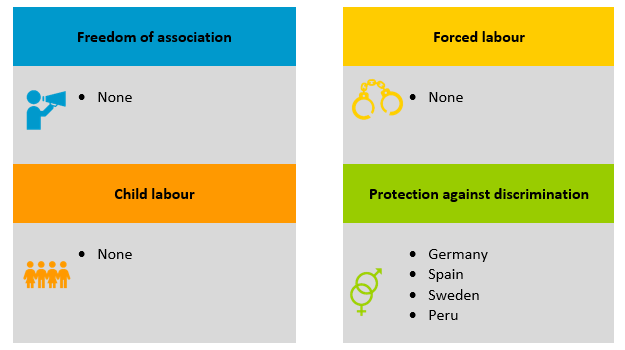

There is equal application of the prohibition of forced and child labour to MSMEs in all the countries selected for this study. However, MSMEs in Germany, Spain, Sweden and Peru are excluded from the application of special proactive obligations to reduce discrimination in practice, such as the obligation to draw up a non-discrimination plan.

Figure 6. Selective exclusions concerning fundamental freedoms and rights at work

Freedom of association and collective bargaining

All of the countries studied protect the fundamental rights of freedom of association and collective bargaining. However, in some of them, the law requires a minimum number of workers for the establishment of trade unions at the enterprise level. This requirement as such does not contradict the principles of freedom of association, but it can limit the exercise of this right in practice if the threshold is too high. Moreover, it can prevent workers from joining sectoral or general unions. Legislation should ideally provide MSME workers with the opportunity to join sectoral or regional unions and to be covered by broader collective agreements.

Table 3 shows whether workers in smaller enterprises in the countries studied are allowed to join trade unions and, where applicable, the minimum number of workers required to establish a trade union. As already mentioned, high thresholds for enterprise-level unions can impose unnecessary constraints. Eight of the countries covered by this study stipulate a minimum number of employees for establishing enterprise-level trade unions. In the United Republic of Tanzania, for example, the law requires at least 20 employees for the registration of a trade union.5 In Egypt there has been backsliding on the right of freedom of association following the adoption of a new law in 2017, whereby a union committee inside a company may only be established with a minimum of 150 workers;6 the previous law required just 50 workers. Out of the around 1,000 independent unions that had existed in Egypt until their dissolution in March 2018, only 122 were able to register their status under the new law (ITUC 2019, 13).

Table 3. Applicability of freedom of association and collective bargaining laws to MSMEs in the countries studied

|

Country |

Applicable to MSMEs |

Country |

Applicable to MSMEs |

|

Brazil |

√ |

|

◊ ≥ 20 |

|

Chinaa |

√ |

|

◊ > 3 |

|

Colombia |

◊ ≥ 25 |

|

√ |

|

Costa Rica |

◊ ≥ 12 |

|

√ |

|

Egypt |

◊> 150 |

|

√ |

|

Germany |

√ |

|

√ |

|

Mexico |

◊ ≥ 20 |

|

◊ > 7 |

|

Nepalb |

◊ > 10 |

|

√ |

√ = equal application to all enterprises regardless of size. ◊ = while there is freedom of association, there is a threshold for establishing unions at the enterprise level (i.e. a minimum number of workers as indicated).

A study by Webster and Bishoff (2011) has identified four strategies by trade unions in dealing with workers from micro and small enterprises (MSEs): (a) extending current forms of representation to MSE workers; (b) ignoring this group of workers because they are considered marginal; (c) resisting non-standard forms of employment and refusing to admit such workers as union members; and (d) adapting their structures to represent MSE workers. In Sweden, for instance, trade unions can influence wages in MSMEs that have no trade union members when the company is affiliated to an employers’ organization covered by a wider sectoral agreement (Andersson and Thörnqvist 2007, 63). More generally, labour laws can play a role in enabling MSME workers to join sectoral trade unions that can enhance the ability of such workers to exercise their rights of association and collective bargaining.

In some countries, self-employed workers may join trade union organizations, as is currently the case in Spain, Sweden and Germany.7

For workers in non-standard forms of employment and in the informal economy, non‑governmental organizations (NGOs) and member-based associations are also important, since such workers may experience greater difficulties in joining trade unions (Chen, Jhabvala and Lund 2002). Indeed, the widespread informal economy poses a challenge to traditional labour unions, and some scholars have argued that it is necessary to launch a new type of labour movement (Webster, Joynt and Sefalafala 2016).

Low union membership is common to many countries and there is, moreover, a “representation gap”, as many workers are based in workplaces without trade union recognition

While union membership is essential, an important way of ensuring that workers at smaller enterprises can enjoy the right of freedom of association and collective bargaining is the use of collective agreements that are negotiated centrally but extended to cover all workers in the same sector. In South Africa, collective agreements can be extended to non-parties within a sector or industry

Elimination of forced labour

The elimination of forced or compulsory labour is regulated through the ILO’s most widely ratified instrument, the Forced Labour Convention, 1930 (No. 29), Article 2 of which defines forced labour as “all work or service which is exacted from any person under the menace of any penalty and for which the said person has not offered himself voluntarily”. Significantly, SDG target 8.7 calls for “immediate and effective measures to eradicate forced labour”.

Forced labour is prohibited in most countries. The estimates presented in ILO and Walk Free Foundation (2017) suggest that 25 million people worldwide are victims of forced labour, with 16 million in forced labour in the private economy, of whom 57.6 per cent are women. The same study also indicates that the largest share of adults in forced labour is accounted for by domestic workers (24 per cent), followed by construction (18 per cent), manufacturing (15 per cent), and agriculture and fishing (11 per cent). These are sectors with a large number of MSMEs

All the countries studied have laws prohibiting forced labour that are applicable to enterprises of all sizes. Nevertheless, forced labour affects a considerable proportion of the population in Turkey, the United Republic of Tanzania, Nepal and Egypt

Two traditional systems of bonded labour in Nepal called kamaiya and haliya were abolished by the Government in 2000 and 2008, respectively, releasing thousands of people from slavery in the agricultural sector

Policies addressing bonded labour, or debt peonage, in MSMEs have been adopted and implemented in Brazil and Colombia, notably the use of mobile inspectors located in remote areas in both countries

Abolition of child labour

All the countries included in this study officially regulate child labour, allowing children from the age of 14 to 16 years to work under special conditions and prohibiting work under a certain age. Most of them also prohibit the employment of adolescents in occupations that entail a high risk for their health and development. Global estimates indicate that there are 152 million victims of child labour worldwide, of which 73 million are in hazardous work. Child labour is most prevalent in the agricultural sector (71 per cent); it occurs to a lesser extent in services (17 per cent) and in the industrial sector, including mining (12 per cent) (ILO 2017a, 5). Moreover, child labour is also encountered at the household level in the form of unpaid domestic work.

In Costa Rica, the law places work carried out by children aged between 15 and 18 years under a special protection regime that ensures equal pay, opportunities and treatment.10 The law specifically prohibits children from working in mining and bans the employment of children under 15 years in domestic work.11 In China and the Russian Federation, the minimum working age is 16, and the law in both countries similarly establishes a special protection regime for children under the age of 18.12

Although child labour occurs mainly in low-income countries, high-income countries and their enterprises are often criticized from the perspective of corporate social responsibility for not ensuring that their products have been manufactured without the use of child labour elsewhere. In this regard, there are numerous initiatives related to SDG target 8.7 that seek to eradicate child labour beyond the borders of a single State. For instance, France and the Netherlands have both adopted due diligence laws requiring large companies to determine whether child labour, among other human rights violations, occurs in their supply chains (ILO et al. 2019, 47).13

In Germany, children from the age of 13 are allowed to work for a limited number of hours per week and to work during holidays in light work such as babysitting or assisting with agricultural work (Palmer 2015).

Some studies (for example, Carter 2017) suggest that children’s work over the age of 14, as long as it is regulated and combined with school activities, may be regarded as a means for families to overcome poverty. However, there is a risk of abuse and exploitation in families and smaller enterprises, particularly in low-income countries, where the State does not have the capacity to enforce the law and where there is a culture of acceptance of child labour.

In Turkey, as in various other jurisdictions analysed in this study, the worst forms of child labour are prohibited by criminal law. Thus, the Turkish Criminal Code (articles 80 and 117) specifically forbids forced labour, including the forced labour of children, and it also forbids commercial sexual exploitation and the employment of children in hazardous occupations. However, despite the strong legal framework, a number of children in the country are forced into sexual exploitation and are recruited by non-State armed groups. An even greater number are engaged in hazardous work in seasonal agricultural and in small and medium-sized manufacturing enterprises (United States 2018, 1154–1156). In South Africa, all work done by children under the age of 15 is prohibited.14 However, a survey of activities of young people conducted in 2015 found that 81,000 children were involved in child labour prohibited by the law (South Africa 2018).

In Mexico, estimates from the national statistical office indicate that there are 2.3 million children aged between 5 and 17 years engaged in economic activities. Of these, 2.1 million children are working illegally, with 38.7 per cent of them being under the minimum working age and the rest being engaged in other prohibited work (INEGI 2019).15 Prohibited work by children occurs mainly in the agricultural sector (34.5 per cent); commercial activities (22.3 per cent), with many children working as street vendors; and in the services sector (20.3 per cent). In the Russian Federation, children are involved in street work and in the worst forms of child labour, such as being exploited for the production of pornography (United States 2014, 709). In Peru, many children work as street vendors and car cleaners, or in small agricultural farms, mainly in micro and small enterprises (Mendoza 2019).16

Child labour, including its worst forms, is a recurring problem in Nepal

Elimination of discrimination in the workplace

Discrimination in the workplace is generally prohibited in most countries. Workers should not be discriminated against on the grounds of gender, race, sexual orientation, age, disability, trade union affiliation or religion, among other characteristics. Most countries included in this study have a legal framework against discrimination at work. Moreover, some countries have laws that not only prohibit discrimination but encourage employers to make workplaces more inclusive. In Sweden, for example, employers are required to work actively to prevent discrimination in the workplace. Specifically, employers with 25 or more employees must have a policy and contingency plan in place outlining specific actions and measures taken by the company.17 Such a proactive approach could be worth considering for other countries: it implies going beyond mere prohibition, which is unlikely to eliminate discrimination unless specific actions are taken.

Some of the countries covered by this study have introduced special requirements to advance equality between men and women in companies above a certain size. This is the case in Spain, Peru, Germany and Sweden. In 2019, Spain enacted Royal Decree-Law No. 6/2019, which set out urgent measures aimed at ensuring equal treatment and opportunities in employment and occupation for men and women. The new law amended some provisions of Organic Law No. 3/2007 on effective equality between men and women. The amendment mentions as part of its rationale a lack of effectiveness in achieving the Organic Law’s aims. The main component of Royal Decree-Law No. 6/2019 – the obligation to have an equality plan in place, with concrete measures for removing obstacles to equality between women and men – applies to enterprises with 50 or more employees. Organic Law No. 3/2007 established this requirement only for enterprises with more than 250 employees. An innovation of the Royal Decree-Law is the requirement for employers to justify that differences in remuneration between male and female workers are not related to their sex if the average remuneration for workers of one sex is higher than the other by 25 per cent. The new law thus creates a mechanism for raising awareness of unjustified salary differences between men and women. Equal pay for work of equal value is one of the targets of SDG 8 on decent work and economic growth, and achieving that target is a challenge all over the world, even in high-income countries. An important indicator of discrimination is the gender pay gap: in 2019, the median salary of men was 21 per cent higher than that of women (PayScale 2019).

Another common area of discrimination relates to maternity protection and how it is managed in MSMEs (Stumbitz, Lewis and Rouse 2018).18 Lewis et al. (2014) find that while maternity protection is regulated in both developed and developing countries, restrictions on its applicability to MSMEs may exist even in developed countries – for example, with regard to breastfeeding time and support. For instance, while breastfeeding time is protected in Germany, Spain and the United States, the US Patient Protection and Affordable Care Act (2009) establishes that only firms with 50 or more employees are obliged to provide breastfeeding support. A study of maternity discrimination in the United Kingdom of Great Britain and Northern Ireland – a country not covered by this paper – found that smaller workplaces were more prone to maternity leave discrimination and “were less likely to agree that [it] is in their interests to support pregnant women or those on maternity leave”

In Peru, a law from 2012 established a 10 per cent hiring quota for people with disabilities in the public sector, and a 3 per cent quota in the private sector (in companies that hire more than 50 workers).19 In Germany, a business with more than 20 employees has to employ at least one severely disabled person or pay a monthly compensation to the State (Kock 2004, 1379). In China, there is a requirement for companies with more than 30 employees to reserve at least 1.5 per cent of job opportunities for people with disabilities

Working conditions

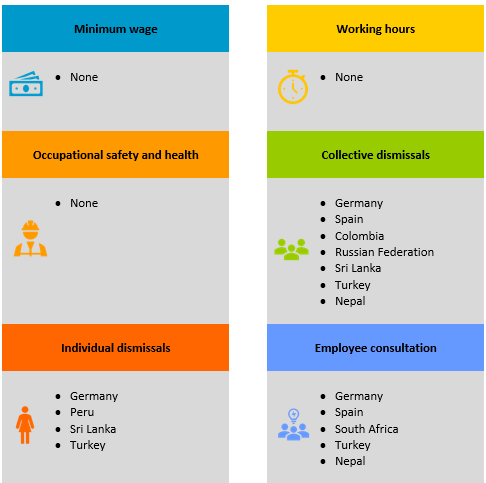

None of the countries covered by this study excludes MSMEs from the application of laws setting a minimum wage or laws regulating working hours. However, selective exclusions are found in the case of laws dealing with dismissals (collective and individual) and the consultation of employees (see figure 7).

Figure 7. Countries with selective exclusions or special regimes for MSMEs in relation to working conditions

Minimum wage

There is equal application of minimum wage laws for all workers in all the countries included in this study. With the exception of Sweden, all countries in the sample have set minimum wages. Nevertheless, the great majority of workers in Sweden are covered by wages set in collective agreements that apply to non-union members, including MSME workers

Smaller enterprises can find it harder to pay a minimum wage. In Spain, there has been intensive debate in the media about the difficulties that smaller enterprises will face in paying the recently increased minimum wage (Cabirta 2019). An interesting example is Turkey, where the Government created a support fund for smaller enterprises to compensate for a large increase of the minimum wage in 2019.22

A recent study of the effects of introducing a minimum wage in Germany in 201523 showed that enterprises adapted to the wage increase by reducing hours and increasing work intensity

Working hours

The countries studied have no selective exclusions on working hours for smaller enterprises, and maximum working hours vary between 40 and 48 hours per week. However, research on working conditions in MSMEs has found that employees often work more hours without pay

An interesting example of a culture of long working hours without overtime payments is Spain, where a new regulation was recently introduced to tackle this problem. According to a study of 4,000 employees at Spanish SMEs, there is a culture of long hours at work in that country; workers who complete all their work in the regular hours and demand more flexibility are penalized (Fundación máshumano 2014). The same study found that 70 per cent of enterprises considered workers who stayed for longer than the regular working hours to be more productive. To improve the enforcement of working hours in smaller enterprises, the Spanish law was reformed in 2019, with the introduction of a requirement for MSMEs and self‑employed workers with at least one employee to register daily the working hours of their workers. Employers failing to comply with this requirement are subject to a fine ranging from €600 to €6,000.24

Annual holiday

In almost all of the countries studied, legislation on paid time off for holidays is applied equally to MSMEs. The only exception is Peru, where employees of micro and small enterprises have a special regime with a minimum statutory 15 days of paid holidays for every year of service, compared with 30 days under the regular labour regime.25 In general, paid time off varies greatly from country to country. At the lower end of the spectrum are China (5 to 15 paid days off) and Mexico (initially 6 days, with the number increasing with seniority). Spain and Brazil offer the highest number of paid days off: a total of 30 days in both cases.

Occupational safety and health

Laws on occupational safety and health (OSH) generally apply to all workers, regardless of the size of the enterprise. However, in some countries certain categories of workers are excluded. This is the case in Spain and Turkey,26 which exclude domestic workers from the application of OSH laws. In Spain, although domestic workers are excluded from the OSH law, the household must ensure that the work of its employees is carried out in proper safety and hygiene conditions.27 In Sri Lanka, OSH issues are regulated by Factories Ordinance No. 45 from 1942, which does not cover workers in agriculture, offices (public and private) and the transport sector, among others.

Thirteen countries in this study exempt smaller enterprises from special OSH requirements, such as the establishment of a safety committee, conducting a risk assessment or appointing a safety officer. This is the case in Mexico, where assessing whether a “favourable organizational environment” pertains or not is mandatory only for work centres with more than 50 workers, as is the obligation to offer facilities for people with disabilities.28 In the Russian Federation, all employees are covered by OSH laws, but the employer is not required to undertake assessments of occupational hazards and risks for home workers and remote workers.29 In contrast, Colombia has a mandatory OSH management system for all enterprises regardless of the number of employees.30

Some countries require enterprises to have OSH specialists. This is the case in China, which in 2014 introduced a stipulation that enterprises with more than 100 workers must have a production safety committee or a full-time safety officer. This was a substantial change extending the application of safety laws to smaller enterprises, since under the previous law that requirement applied only to enterprises with more than 300 employees.31

Another common mechanism for improving OSH is the establishment of a workers’ representative body. Most countries define a certain threshold of workers for the establishment of OSH committees or representatives. Two interesting cases are the positions of occupational monitor (vigía ocupacional) in Colombia and safety and health supervisor (supervisor de seguridad y salud) in Peru, which are both mandatory for all enterprises regardless of size. In contrast, most countries have a threshold of 5 to 20 workers for the election of OSH representatives.

Table 4 shows the extent of application of OSH laws to smaller enterprises and also the minimum number of employees that enterprises must have for the establishment of OSH consultation mechanisms (such as elected committees, delegates or representatives drawn from among the workers) to become mandatory.

Table 4. Applicability of occupational safety and health laws and regulations to MSMEs in the countries studied

|

Country |

OSH laws and regulations |

Threshold for special OSH consultation body |

Country |

OSH laws and regulations |

Threshold for special OSH consultation body |

|

Brazil |

√ |

– |

|

√ |

* > 1 > 20 |

|

Chinaa |

√ |

– |

|

√ |

– |

|

Colombia |

√ |

* > 1 > 10 |

|

√ |

* > 20 |

|

Costa Rica |

√ |

* > 10 |

|

√ |

* > 5 > 50 |

|

Egypta |

√ |

– |

|

√ |

* > 25 |

|

Germany |

√ |

* > 20 |

|

√ |

* > 5 |

|

Mexico |

√ |

– |

|

√ |

* ≥ 50 |

|

Nepal |

√ |

* ≥ 20 |

|

√ |

* > 20 |

√ = equal application regardless of enterprise size. * = selective exclusions (obligations vary according to size of enterprise, > # of workers). — = information not available.

There seems to be a common understanding that protecting the safety and health of workers is essential, and that a certain degree of flexibility is needed with regard to the specific procedures used to achieve that

Dismissals

A dismissal is “collective” when it affects a significant number of workers in a company and is based on the same cause, such as retrenchment, redundancy, bankruptcy or technological change. A dismissal is “individual” if it concerns a specific worker and has to do with personal reasons. In some cases, the rules for collective or individual dismissals do not apply to smaller enterprises. Table 5 provides a summary of the worker thresholds used to determine whether laws on collective and individual dismissals are applicable.

Table 5. Applicability of laws on collective and individual dismissals to MSMEs in the countries studied

|

Country |

Collective dismissal |

Individual dismissal |

Country |

Collective dismissal |

Individual dismissal |

|

Brazil |

No |

√ |

Peru |

√ |

S |

|

China |

√ |

√ |

Russian Federation |

* > 50 |

√ |

|

Colombia |

* > 10 |

√ |

South Africa |

√ |

√ |

|

Costa Rica |

No |

√ |

Spain |

* > 10 |

√ |

|

Egypt |

√ |

√ |

Sri Lanka |

No |

* > 15 |

|

Germany |

* > 20 |

* > 10 |

Sweden |

√ |

√ |

|

Mexico |

√ |

√ |

Turkey |

* ≥ 20 |

* > 30 |

|

Nepal |

* > 10 |

√ |

United Republic of Tanzania |

√ |

√ |

√ = equal application regardless of enterprise size. * = selective exclusions (obligations vary according to size of enterprise, > # of workers). S = special regime. No = there are no special legal provisions regardless of the enterprise size.

There are countries that do not have special legislation for collective dismissals, such as Costa Rica, Brazil and Sri Lanka. Some significant backsliding occurred in Brazil in 2017, when a law was adopted that revoked the requirement to consult the relevant trade union on collective dismissals.32 In other countries, the procedures regarding collective dismissals apply only to enterprises that have a minimum threshold of workers ranging from 10 and 50 employees. For instance, in Germany, the procedure for collective dismissals applies only to enterprises with more than 20 employees.33 Similarly, in Colombia, Nepal, Turkey and the Russian Federation, enterprises with a certain number of workers do not have to follow the special procedures for collective dismissals.

In contrast, in South Africa there is equal application of the law regardless of the size of the enterprise, and employers must follow consultation procedures for any dismissal; there are additional rules for companies with more than 50 employees.34 Although consultation with the trade union before collective dismissals is common in many countries, a large number of MSME workers are not unionized (Moore, Jefferys and Cours-Salies 2007; ILO 2018c), which means that in practice they are less protected than those benefiting from the mechanisms of social dialogue.

Most of the countries studied have equal application of the law regarding compensation for individual dismissals. However, Peru has a special regime for micro and small enterprises involving a less onerous compensation.35 Germany, Sri Lanka and Turkey exclude enterprises under a certain threshold from protection against individual dismissals. Germany excludes enterprises with fewer than ten employees from such protection.36 The German system provides relatively low levels of employment protection for workers at small enterprises. However, low protection is compensated for through unemployment insurance and strong labour market and social policies

If dismissal occurs, a certain protective cushion can be provided by unemployment insurance, and so it is important that workers be eligible regardless of the size of the enterprise. However, unemployment protection currently covers only a small proportion of the global labour force (ILO 2017b, 40).

Consultation of employees

Employee consultation mechanisms are essential to bring about social dialogue. However, in many countries the law excludes smaller enterprises from the obligation to set up works councils37 or other representative mechanisms. Additionally, research shows that informal practices of employee consultation are more widespread in MSMEs than in larger enterprises

Table 6. Applicability of employee consultation laws to MSMEs in the countries studied

|

Country |

Applicable to MSMEs |

Country |

Applicable to MSMEs |

|

Brazil |

– |

Peru |

– |

|

China |

√ |

Russian Federation |

* > 50 |

|

Colombia |

– |

South Africa |

* > 100 |

|

Costa Rica |

– |

Spain |

* > 5 > 50 |

|

Egypt |

– |

Sri Lanka |

√ |

|

Germany |

* > 5 |

Sweden† |

√ |

|

Mexico |

– |

Turkey |

– |

|

Nepal |

* > 10 |

United Republic of Tanzania |

√ |

√ = equal application regardless of enterprise size. * = selective exclusions (obligations vary according to size of enterprise, > # of workers). – = information not available.

In the European Union, Directive 2002/14/EC requires employers to inform and consult with workers on at least three important areas, regardless of the size of the enterprise: (a) company development and economic situation; (b) the development of employment; and (c) decisions leading to substantial changes in the organization of work. Sweden, Germany and Spain have different consultation mechanisms, which operate via trade unions or works councils.

Among the countries studied, works councils exist in Germany, Spain and Sri Lanka. However, employee consultation mechanisms can vary depending on the enterprise size. In Germany, works councils are constituted in enterprises with more than five employees. In Spain, there are company committees in workplaces with more than 50 employees and staff delegates in workplaces employing fewer than 50 but more than 5 workers.38 In South Africa, workplace forums exist in companies with more than 100 employees.39 No information could be found on employee consultation mechanisms in the Latin American countries in the sample.

In Sweden, there are several mechanisms for employee consultation and a long history of cooperation between workers and management. Since most workers are unionized, representation is mainly channelled through the unions, which must be consulted on important decisions affecting workers and the company. Moreover, each enterprise with more than 25 employees must have representatives from the union on its board.40

Employee consultation does not have to be a complicated procedure and can bring important benefits in terms of achieving decent work. Raising awareness of the importance of social dialogue in the workplace is essential to achieve change beyond legal regulation. A cultural shift is required, as many countries have hierarchical cultures that prevent employees from voicing their needs and concerns

Social protection

Most countries included in this study have equal social security coverage for MSME workers. However, there is a trend among Latin American countries towards special regimes with less onerous social security contributions for MSMEs, as is the case in Brazil, Colombia, Costa Rica and Peru.

Social security

Brazil has had a simplified system of tax and social security contributions for micro and small enterprises since 1996. In Costa Rica, enterprises with up to five employees are part of a separate social security system. In Mexico, workers in family enterprises, employers and independent workers are exempted from mandatory social security contributions.41 In Peru, workers at microenterprises are not obliged to register with, or contribute to, the pension system. In Brazil, micro-entrepreneurs and own-account workers with a gross annual revenue of less than 60,000 Brazilian reais (approximately €12,000) who hire no more than one employee and are registered in a special programme,42 have to pay only 5 per cent of the minimum wage as a contribution. In Egypt, there is a selective exclusion: enterprises with fewer than 50 employees do not have to offer two years of unpaid maternity leave in addition to the regular 90 days of paid leave.

Table 7 shows the special regimes and selective exclusions that the countries studied have in place regarding social security contributions for workers at smaller enterprises.

Table 7. Applicability of mandatory social security contributions for MSMEs in the countries studied

|

Country |

Applicable to MSMEs |

Country |

Applicable to MSMEs |

|

Brazil |

S |

Peru |

S |

|

China |

√ |

Russian Federation |

√ |

|

Colombia |

S |

South Africa |

◊ |

|

Costa Rica |

S |

Spain |

√ |

|

Egypt |

* > 50 |

Sri Lanka |

√ |

|

Germany |

√ |

Sweden |

√ |

|

Mexico |

S ◊ |

Turkey |

√ |

|

Nepal |

√ |

United Republic of Tanzania |

√ |

S = special regime with reduced contributions. √ = equal application regardless of enterprise size. * = selective exclusions (obligations vary according to size of enterprise, > # of workers). ◊ = some workers are exempted from mandatory contributions, such as domestic workers or the self-employed.

A major challenge in achieving universal social protection for workers from smaller enterprises (including the self-employed) is that many of them operate informally (ILO 2019, 6). In recent years, some countries have modified their labour laws to extend social security coverage to self-employed workers and those in the informal economy. In Colombia, a law adopted in 2019 established an obligation for independent workers with a contract for the provision of services to pay pension and health insurance contributions based on 40 per cent of the value of the contract.43 In the Russian Federation, social security contributions are mandatory even for the self-employed, including individual entrepreneurs. In contrast, in Mexico, contributions by self-employed workers are purely voluntary.

It is also possible to establish discounts or incentives for social security contributions in smaller enterprises. In Turkey, employers with at least ten employees in regions prioritized by the Government receive a discount on their social security contributions.44 In Colombia, Act No. 1429 of 2010 provides tax incentives for small enterprises (with fewer than 50 workers) to encourage them to formalize their employees by paying social security contributions.

Extending social security coverage to workers who have historically been excluded is an important trend that can be observed in many countries. In Egypt, a recent law from 2019 provides pension benefits to workers traditionally excluded, such as temporary and seasonal workers, housekeepers, small-scale agricultural tenants, employers, entrepreneurs and one‑person companies.45

Sick leave

In almost all the countries studied, there is no special regulation for, or exclusion of, MSMEs as far as sick leave is concerned. Thus, the rules relating to paid sick leave apply to all enterprises regardless of their size. In many countries, sick leave is paid through a national insurance scheme. In Colombia, sick leave is paid by the national insurance fund regardless of the size of the enterprise. Although sick leave in Germany is paid by the employer, there is a rule that allows employers with fewer than 30 workers to recover sick pay from the employers’ cost-sharing fund.46

Maternity leave

With the exception of Egypt, all countries included in this study provide equal maternity leave benefits for MSME workers. In Egypt, women working in enterprises with more than 50 employees can take unpaid leave for up to two years to take care of a newborn child, while workers at smaller enterprises are entitled to the standard 90 days of maternity leave.47 In Germany, before 2003, enterprises with fewer than 30 employees could apply for compensation to cover the payment of maternity leave. However, a decision of the Federal Constitutional Court declared this law to be unconstitutional and now all companies can apply for this benefit.48 In most countries, maternity leave is provided mainly for women in formal employment, while women working in informal employment or self-employment are often excluded from this important right (Lewis et al. 2014, 20).

Another problem is the lack of enforcement for maternity leave rights. In countries with cumbersome bureaucratic procedures, mothers may find it difficult to exercise their rights after giving birth. In this regard, having a supportive workplace culture that enables both mothers and fathers to achieve a good work–life balance is essential. Paternity leave is also an important step towards gender equality, and many countries are already including some sort of leave arrangements for fathers in their labour laws. Finally, regulation for maternity and paternity leave entailing minimal or no additional cost for MSMEs is a key policy to enhance protection for workers with children

Special categories of workers

There are two categories of workers who have historically been excluded from the application of labour law: agricultural and domestic workers. The agricultural sector is composed mainly of the self-employed and MSME workers (ILO 2019, 18). In the case of domestic workers, they are employed by the household and many legislations treat them as a special category of workers. However, the traditional exclusion of these two occupational groups is now giving way to a trend towards full coverage (as in Mexico). Another category of workers who are sometimes excluded from the application of parts or the whole of the labour law are migrant workers

Agricultural workers

Agricultural workers represent approximately 28 per cent of employment worldwide and the sector is predominantly informal

In contrast, in countries such as Colombia there is only one labour law that also applies to agricultural workers, but there is widespread non-compliance and lack of enforcement, partly because of limited labour inspections in rural areas

Domestic workers

Out of the 16 countries covered by this study, eight (Brazil, Colombia, Costa Rica, Mexico, Nepal,51 Russian Federation, Sweden and United Republic of Tanzania) have equal application of labour laws to domestic workers. In 2019, the Mexican Parliament approved a reform of the federal labour and social security laws to improve the protection of domestic workers, who had previously been excluded from mandatory social security. This reform established that domestic workers would be entitled to legal benefits, such as holidays, holiday bonuses and rest days, making social security contributions compulsory. Equal protection by the law is an important step that can be accompanied by other measures such as simplified registers, economic incentives and spaces for social dialogue

In Egypt, Germany, Peru, South Africa, Spain, Sri Lanka and Turkey, domestic workers are excluded from certain labour rights or are covered by a special legal regime. In Germany and Turkey,52 domestic workers are excluded from the main occupational safety and health laws. Moreover, in Germany there is no working-time limit for round-the-clock care workers (Trebilcock 2018, 162). In South Africa, domestic workers have a lower minimum wage.53 In Egypt, domestic workers are (like agricultural workers) excluded from maternity leave rights.54 In Sri Lanka, the laws regulating domestic work date from 1936 and so, not surprisingly, they do not provide for many working rights.55 As of February 2020, the Peruvian Parliament was discussing a bill to equalize the rights of domestic workers.56

Historically, a significant number of countries have excluded domestic workers wholly or partially from the application of labour laws (ILO 2013, 46). The ILO (2017b, 1) estimates that there are 67 million domestic workers worldwide, of which 80 per cent are women; employment is predominantly informal. However, in recent years, there have been significant improvements for domestic workers as a result of international efforts to ensure that the value of their work is recognized. Eight out of the 16 countries covered by this study have ratified the Domestic Workers Convention, 2011 (No. 189).57

Domestic workers working for different households are categorized as self-employed in some countries. In Brazil, Constitutional Amendment No. 72 from 2013 and Enabling Act No. 150 of 2015 established equal rights for domestic workers. However, domestic workers who work less than three days a week for the same household – referred to as diaristas (daily workers) – are not covered by the constitutional reform (Costa, Barbosa and Hirata 2016). In Spain, domestic workers who work less than 60 hours per month for a particular employer can pay their own social security contributions – that is, their status is similar to that of the self‑employed.58 In contrast, in Colombia59 and Costa Rica60 it is mandatory to pay daily or weekly social security contributions. Domestic workers engaged on a daily basis are therefore not considered self-employed and have the same rights under the law as other workers.

Trends in the application of labour law to MSMEs

The previous chapter discussed various legal reforms enacted over the past 15 years, identifying a general trend towards extending labour and employment rights to MSME workers. The most comprehensive reform to extend the coverage of labour laws to MSME workers was undertaken in 2017, namely in Nepal, which is classified as a low-income country. The previous labour law did not apply to enterprises with fewer than ten employees, and so this legal reform involved a far-reaching extension of labour rights for many workers. This example illustrates that developing economies, too, are trying to extend coverage to workers at smaller enterprises. Moreover, some countries, such as China, have maintained full application of the labour law to smaller enterprises.

This study identified a greater number of legal reforms to expand the labour law coverage of MSMEs than there were instances of backsliding over the same period. Figure 8 presents a timeline of reforms that have either expanded or reduced the labour law coverage of MSMEs since 2006. The only reduction of coverage for MSME workers occurred in Egypt; the overwhelming majority of legal changes were made to extend coverage.

Figure 8. Timeline of labour law reforms affecting MSMEs in the countries studied

However, there remain some legal exclusions that leave certain groups of workers without equal protection. In particular, exclusions still exist for agricultural and domestic workers, who are excluded from the application of parts or the whole of the labour law in some countries. These exemptions currently pose a significant challenge to the achievement of decent work and of SDG target 8.3 on the formalization of MSMEs.

This chapter explores three trends in the extension of the labour law coverage of MSMEs: formalization programmes; extending national insurance; and providing rights for the self‑employed.

Formalizing informal workers at MSMEs through tax incentives

In the previous chapter it was pointed out that some countries are trying to implement formalization policies to improve employment conditions and tax compliance, particularly in MSMEs.61 Informal employment is common among MSMEs seeking to hire workers “off the books” in order to reduce labour and tax costs, because, among other reasons, it is easier for smaller enterprises to avoid labour inspections

Formalization of small enterprises in Colombia

In Colombia, Act No. 1429 of 2010, or the Employment Formalization and Promotion Act, provides tax incentives to small enterprises that register and formalize their employees by paying social security contributions for them. This law applies to businesses set up after the enactment of the law that fall into the category of small enterprises, that is, those with fewer than 50 workers and assets totalling less than 5,000 minimum wages (approximately €1.1 million). Instead of paying the regular income tax, small businesses pay nothing during the first two years, 25 per cent of the regular tax in the third year, 50 per cent in the fourth year, 75 per cent in the fifth year, and 100 per cent in the sixth year. However, a study of the impact of this law on overall informal employment suggests that the results have not matched expectations (Farne, Baquero and Álvarez 2012). The national informality rate was 65.7 per cent in April–June 2010 and 65.6 per cent in April–June 2011. The same study also found that enterprises registered under this formalization programme paid social security contributions for just 1,584 employees out of the total of 11,599 employed (Farne, Baquero and Álvarez 2012). Thus, one can argue that tax incentives by themselves are not sufficient to promote substantial formalization of jobs. Other studies conducted several years after the enactment of the law found similar results and concluded that the new law had not had any noticeable impact on the formalization of employment and the reduction of informality rates (Espinel Pinzón 2016; Alvarez, Telles and Posada 2015).

There is a tendency to set up formalization programmes linked to tax incentives. However, the case of Colombia shows that formalizing employment is a complex undertaking that requires much more than just tax reductions.

A single-tax regime for micro and small enterprises in Brazil

For many years, Brazil has tried out different policies and regulations to encourage the formalization of own-account workers and micro and small enterprises

The SIMPLES fiscal regime, including the MEI programme, had covered approximately 12 million workers by 2017 (Cetrángolo et al. 2018, 123). Some of the positive results indicate that SIMPLES has reached enterprises that would otherwise be outside the law (Fajnzylber, Maloney and Montes-Rojas 2011) and helped to reduce informality among workers by extending social security rights

Critics point out that the Brazilian Government has failed to recover considerable fiscal revenue and has spent large amounts of taxpayers’ money on the administration of these programmes

Providing security for workers through national insurance

There is a general trend in many of the countries studied to shift the responsibility for compensating workers during sickness and maternity leave from employers to the national insurance schemes. This relieves small businesses from a considerable burden because it is harder for them to afford such payments.64 This trend may be observed in both high- and low-income countries. In Germany, the Federal Constitutional Court declared that maternity leave payments through the national insurance scheme should apply to all enterprises regardless of their size, so that neither small nor large companies face disincentives to hire women. In Nepal, a recent legal reform shifted the responsibility for providing compensation for work‑related injury and disability from the employer to a national insurance scheme .