Technological solutions to guaranteed wage payments of construction workers in China

Abstract

For many years, wage arrears have been a prevalent problem facing rural migrant workers in the construction sector in China. The difficulties of addressing wage arrears are multifaceted, but are clearly exacerbated by the complex layering of subcontracting that occurs in construction sector. In recent years, China adopted a series of policies and laws to facilitate the timely and full wage payment to migrant workers. With the legal framework in place, central and local governments of China have implemented solutions to improve the efficiency of labour inspection system in addressing wage arrears, thanks to the application of digital technologies. This paper examines how technology was put to use in the design and implementation of an online information platform—National Construction Workers Management and Service Information System — that registers rural migrant workers and ultimately brings them under the realm of public policy to protect them against abuses. The paper examines in detail the Enterprise Wage Payment Online Supervision System (EWPOSS) of Zhejiang Province and analyses how the IT-enabled system has contributed to improving the efficiency of the local labour inspectorates in addressing wage arrears. The paper concludes that digital solutions offer great potential to tackle negative aspects associated to informality if accompanied by adequate policy and legal frameworks, sound digital infrastructure and effective and robust labour inspection systems.

Introduction

The construction industry is one of the industries with a high concentration of internal migrant workers in China. According to the National Bureau of Statistics of the People’s Republic of China, in 2019, there were 103,805 construction enterprises in the country and more than 54 million construction workers. Among the construction enterprises, only 3,309 are state owned enterprises (SOEs).1 For many years, wage arrears2 have been a prevalent problem in the construction sector, especially with regards the wages of rural migrant workers. In 2016, the percentage of wage arrears for migrant workers in the sector was reportedly 1.8 per cent, making this the highest ranked sector on the incidence of wage arrears. The manufacturing industry ranked second with a wage arrears incidence of 0.6 per cent.3

The difficulties of addressing wage arrears in the construction sector are multifaceted, but the main causes can be summarized as follows:

-

Firstly, it is a common practice to have multi-layer subcontracting in the construction sector. Due to the generally large workload and long construction cycle, the complicated contracting system is usually managed by a general contractor who is contracted by the principal construction enterprise. The general contractor usually subcontracts out the construction work to multiple foremen who may subcontract further for specific tasks. The foreman contractors typically find migrant workers to carry out the bulk of the labour on the construction project. Therefore, the contracting chain in the construction sector is multi-layers starting from the general contractor, multiple subcontractors, foreman contractors and workers. If the capital chain within the system becomes broken or stuck, wage default can occur, impacting especially the workers who fall at the end of the contracting chain.

-

Secondly, disputes on project payments due to the quality or timeliness of project service delivery can lead to wages arrears. As a general practice, the wage fund is a part of the project funds and will be paid together to the contractor when the work is finished according to the contract. The perceived quality of the work and/or missed completion dates may trigger a dispute over the project payment, resulting in the contractor failing to pay the full wages on time. Compared with other industries, disputes between upstream and downstream contractors are more likely to occur in the construction sector, resulting in delays in project payment, which in turn affects the timely payment of wages.

-

Thirdly, construction workers, mostly internal rural migrants, change jobs often and many of them do not sign labour contracts. In China, because most of the construction workers usually have some social relations with their foreman, perhaps originating from the same village or being related, they are usually engaged with an oral agreement only with the foreman. Many do not have a written contract. The foreman usually signs a professional contract with a subcontractor as an individual. When the cycle of the work agreed is not the same as the expected cycle of wage payments, or the foreman does not receive the full project payment on time upon completion of the work, the workers’ wages will be delayed or not fully paid.

When a dispute on wage payment arises, it is always difficult to confirm how much should be paid to the workers due to the lack of written contracts. In some cases, the labour inspectorate has managed to recover wages on behalf of migrant workers, but by that time, many of the workers will have left the construction site for other cities and will be out of reach of the local inspectorate.

To address the underlying problem of wage arrears, numerous policies have been formulated to address the three main causes of wage arrears mentioned above. To implement the adopted policies, digital solutions are being adopted and are showing some positive effects.

The methodology applied to examine how the application of digital solutions stands to transform the long-standing challenge of wage arrears in the construction sector in China is as follows:

-

A desk review of secondary information was conducted on first, the general condition of wage arrears in the construction sector in the sample province and the whole country over the last three years, and second, on how information technology has been utilized in different localities to promote smart labour inspection system.

-

On site visits were made to (i) government stakeholders to collect information on how an online information platform is being developed and operated at different government levels and (ii) construction sites to collect information on how different stakeholders connect with the information system and how data are collected from companies.

-

Key informant group discussions and interviews were conducted with officials and staff of the housing and construction departments, human resource and social security department, labour inspectors, construction companies, contractors and construction workers. The information to be collected through the interviews and meetings included the background of the data system design and implementation, its operation, types of data collected, efficiency of data collection, gaps and challenges of the current data system and areas for improvement.

The remainder of the paper is organized as follows: the following section 1 describes the legal framework set by the Government of China to combat the long-standing challenge of wage arrears in the construction sector. Section 2 describes the pathway through which digital technology was applied to facilitate solutions to the registry of workers and wages in the constructions in the national rollout of the National Construction Workers Management and Service Information System (NCWM&SI System). Section 3 goes deeper on a local application linked to the NCWM&SI System – the Enterprise Wage Payment Online Supervision System (EWPOSS) in the Zhejiang Province – and highlights how the system works to register workers and working time, guarantee worker-approved wage payments, limit defaults and penalize defaulters, increase transparency, and increase the efficiency of the labour inspectorate system. Finally, a Conclusions section offers guidance on the building blocks needed for a successful application of technology-assisted public services that can trigger increased formalization of enterprises and workers.

The legal framework in China to address wage arrears

In recent years, China adopted a series of policies and laws to guarantee wage payment to internal migrant workers. Among these are three legal documents that are regarded as landmarks for the governance of wage arrears:

-

The first is Amendment VIII of the Criminal Law of the People's Republic of China, adopted at the 19th Session of the Standing Committee of the Eleventh National People's Congress on February 25, 2011. The amendment adds one paragraph to Article 276 of the Criminal Law as follows:

After the promulgation of the amendment to the Criminal Law, some progress has been made in curbing malicious wage defaults. According to the 2016 National Survey Report on the Monitoring of Migrant Workers by the National Bureau of Statistics, the percentage of migrant workers who were owed wages by their employers were 1 per cent of migrant workers in 2013, 0.76 per cent in 2014 and 0.99 per cent in 2015.5

-

The second is the "Opinion on Comprehensively Controlling the Wage Delinquency of Migrant Workers" issued by the General Office of the State Council in 2016. The Opinion proposed 16 specific measures within five areas, including regulating the wage payment behaviour of enterprises, improving the monitoring and guarantee system of wage payment, promoting the construction of the social credit system of wage payment, handling wage default cases in accordance with the law, and improving the compliance of remuneration payments and employment formalization in the construction sector. Departmental responsibilities for fulfilling the obligations under the Opinion were clarified and coordinated governance among different departments was emphasized to promote the formation of a mechanism for the management of wage arrears from the central to local government, with a division of duties and cooperation among departments.

According to the 2016 Opinion, the central government must establish a joint meeting system among 12 departments and units, including the Ministry of Human Resources and Social Security (MOHRSS) and the National Development and Reform Commission, to comprehensively deal with the problem of wage arrears, especially in relation to migrant workers. At the local level, a coordination mechanism led by government officials and involving relevant departments was established and improved. In particular, in 2017, China adopted the Interim Measures for the Management of the "Blacklist" on Wages Arrears of Migrant Workers (MOHRSS, September 2017) and the Memorandum of Cooperation on Joint Retribution of Employers and Related Personnel for Serious Wage Arrears of Migrant Workers (MOHRSS and 30 other government departments, November 2017). These two legal documents aim to establish inter-ministry coordination mechanism to punish employers who have serious compliance problems relating to wage payment to rural migrant workers through a social credit system, which restricts access of the relevant employers to luxury consumption, credit loans and credit cards, and disqualifies them from serving as legal representative or senior manager of any company.

-

The third document is the Regulation on Ensuring Wage Payment to Migrant Workers, which was signed by Chinese Premier Li Keqiang on December 30, 2019 and came into effect on May 1, 2020. In 2019, in order to uproot the causes of wage arrears, the State Council adopted the Regulation, which provides not only comprehensive and tough measures for guaranteeing wage payment to rural migrant workers but also a strong legal basis for safeguarding the rights and interests of migrant workers in terms of wages and remunerations. The Regulation consist of seven chapters and 64 articles. Among the relevant elements of the 2019 Regulation are:

-

clarification of the local government's supervisory responsibility for wage payment and the collaborative supervisory responsibility of human resources and social security administrative departments and housing and urban-rural development departments;

-

establishment of the rules of wage payment and clearly stating the legal liability for violating corresponding requirements, including among contractors and subcontractors;

-

clarification of the primary party accountable for wage payment under different circumstances;

-

stipulatation that special measures should be taken to address wage arrears in the construction sector; and

-

establishment of a guarantee system for project funds, a management system for the separation of labour costs and project funds, and a special account system for rural migrant workers' wages, etc.

-

Guided by the above-mentioned legal measures, central and local governments of China have made various experiments to improve the efficiency of labour administrative system in addressing wage arrears, including through the use of information technology.

Digital solutions for worker registration and payment of wages

2.1 Background

To address wage arrears, three integrated steps were taken in line with the Opinions on Comprehensive Management of Wage Arrears of Migrant Workers issued by the State Council in 2016 and the Regulation on Ensuring Wage Payment to Migrant Workers in 2019 (Regulation 2019). The three processes involved setting up:

-

a digital system for real name registration of all construction workers;

-

a special financial account for workers’ wages (separating labour costs from other cost); and

-

a wage payment system through which the general contractor is required to pay wages to workers directly instead of through subcontractors.

Due to multi-layer subcontracting, it is often unclear who has worked on the construction site. Even workers themselves do not know for whom they have worked. To address this situation, Article 28 of Regulation 2019 requires that the general contractor or the subcontractor sign a labour contract with the migrant worker and register all workers with his/her real names. Those who are not registered should not be allowed to enter the construction site. The general contractor is required to assign a staff member to supervise recruitment, working time and wage payment at the worksite of the subcontractors. The 2019 Regulation for the first time sets clear requirements that all workers at the construction site must sign a labour contract with the employer and stating that the general contractor has the primary responsibility for wage payments.

Using digital technology, the real name registration system provides an instrument for the general contractors to implement the legal requirement and for the administrative authorities to supervise the general contractors. In May 2014, the Department of Construction Market Supervision of the Ministry of Housing and Urban-Rural Development (MOHURD) commissioned the China Construction Industry Association to develop a national digital real-name registration system for construction workers.

The development was taken up under the management of the China State Construction Engineering Corporation (CSCEC), as leading general contractor. In May 2016, the Third Bureau of CSCEC used the real-name registration system for construction workers in two projects where they served as general contractor. They further integrated the function of managing wage payment to migrant workers and achieved good results. At the end of February 2017, the General Office of the State Council issued the Opinions on Promoting the Sustainable and Healthy Development of the Construction Industry, which calls for "carrying out real-name management of construction workers, recording their identity information, training, vocational skills, and employment records". This Opinion accelerated the process of the pilot application and has led to the spread of the worker registration system in the construction sector nationwide.

In 2017, the

On October 26, 2018, the General Office of the MOHURD issued a Notice on the Launch of NCWM&SI System, which requires provincial housing and urban-rural construction authorities to accelerate the implementation of the digital registration system and improve the relevant management system. MOHURD and MOHRSS jointly issued the Administrative Measures on the Real-name Registration System for Construction Workers (Trial) in February 2019.

2.2 How the real name registration system works

The overall architecture of NCWM&SI system is as follows. Firstly, the system uses an ID card number as the unique identification for registration of workers. It uses mobile internet, Internet of Things and big data to capture all basic information about workers from the time they enter the construction industry, including information on work history and skills level. With such information, more relevant employment services can be provided to workers.

Secondly, the MHURD established the system and issued NCWM&SI System data trial standards and exchange trial standards. The provincial housing and urban-rural construction departments are expected to develop the system for their own regions in accordance with the requirements of the two trial standards, and to achieve interconnection and data exchange with the central database of the national system. All 34 provinces, municipalities, and autonomous regions nationwide had connected to the online real name information system for construction workers by June 30, 2019.

The local departments are required to integrate the system into their daily work, improve the system's functions, realize data interconnection and sharing within the region, and ensure data security, accuracy, completeness, and timeliness.

The NCWM&SI System consists of three subsystems:

-

The first is the

contracting enterprise management system , which is used by the general contractors and integrates the wages paid by the general contracting enterprises. -

The second is the

subcontractor management system , also known as theconstruction enterprise management system , which is an information management system mainly serving the construction enterprises, and sharing information on workers' wages and special accounts for workers' wages between construction enterprises and general contracting enterprises. -

The third is the

project site management system , which can mainly check the entry and exit records, attendance and identity of workers at the construction site.

Through the above three systems, general contractors and construction enterprises (subcontractors) are expected to clearly monitor the identity, working hours and days, wage payment standards and wage payment of construction workers entering construction sites.

2.3 Measures to ensure data security and privacy protection

To ensure data security and privacy protection of the system, both technical and management measures are adopted. The technical measures include:

-

formulating the “cloud + end” safety schemes supported by experts in the field of information security;

-

adopting various security reinforcement measures, such as the security gateway,firewall, intrusion prevention system and the bastion host to resist external attacks;

-

establishing the safety risk discovery and early warning function to prevent data leakage when the security breaches occur;

-

using domestic encryption algorithm、user authentication to ensure interface security, encrypted transmission and storage security and passing the relevant nation password application security evaluation; and

-

deploying corresponding safety protection equipment and the security protection scheme strictly according to national criteria of security protection of computer information systems and passing the relevant evaluation and assessment.

Management measures include:

-

formulating unified safety management regulations,clarifying the data-using specifications,setting data permissions and duty of confidentiality of different persons and different levels, and establishing strict prohibition against use of data for other purposes;

-

conducting regular attack and defence drills on the platform to spot loopholes and repair them in a timely manner; and

-

establishing an emergency response plan for safety accidents to ensure rapid response and timely repair when accidents occur.

2.4 NCWM&SI in practice

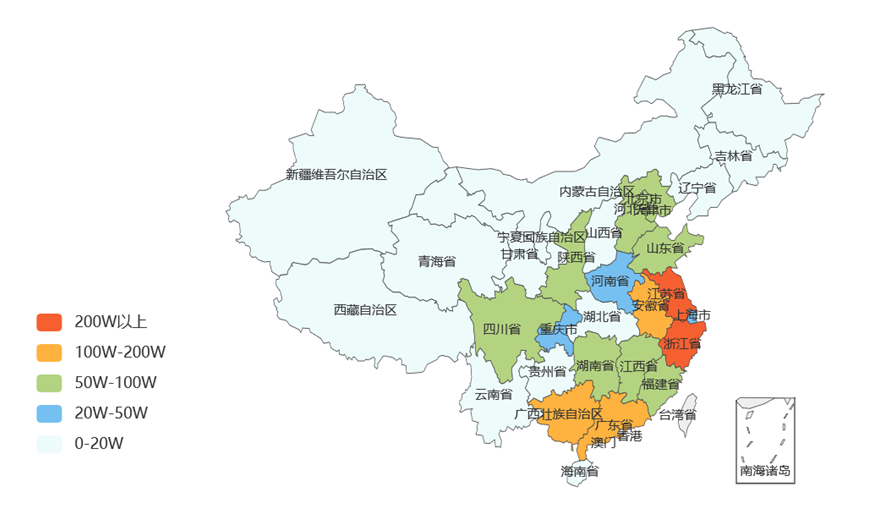

As of August 2021, all 31 provinces, autonomous regions and municipalities directly under the central government in mainland of China were connected to NCWM&SI System as required. However, the number of construction workers actually registered to work in the provinces varies greatly. The number of registered workers by the August 2021 were more than 2 million in Jiangsu, Zhejiang, Shandong, Sichuan and Guangdong provinces; 1 to 2 million in Beijing, Guangxi, Anhui, Hunan, Fujian, Jiangxi, Hebei and Henan provinces; 500,000 to 1 million in Tianjin, Shaanxi, Hubei, Chongqing and Guizhou; 200,000 to 500,000 in Gansu, Ningxia, Shanghai, Hainan, Shanxi, Inner Mongolia, Liaoning and Jilin; and less than 200,000 workers in Xinjiang, Qinghai, Tibet, Yunnan and Heilongjiang provinces. In total, more than 21.5 million construction workers who work in the construction industry were registered on the system by mid-2021 compared to 11.5 million at the end 2020.

Figure 1 Registered migrant workers in construction on the NCWM&SI system nationwide as of December 2020

Source: jzgr.mohurd.gov.cn

Figure 2 Registered migrant workers in construction on the NCWM&SI system nationwide as of August 2021

Source: jzgr.mohurd.gov.cn

In eight months after the adoption of the 2019 Regulation, the number of registered construction workers in NCWM&SI System almost doubled, marking the considerable progress made on the enforcement of the Regulation on Ensuring Wage Payment to Migrant Workers.

The Regulation has provided a sound basis for the legal enforcement of migrant worker registration through the following operations:

-

issuance of permits to start construction made dependent on having registered the identities of workers and having established the special wage account (Art. 55 of the 2019 Regulation);

-

construction projects are required to update wage payment information and the names of workers on a monthly basis (Art. 56 of the 2019 Regulation);

-

registration of names and payment information is subject to both the labour inspection system and the inspection system of the Department of Housing and Urban-Rural Development (Art. 56);

-

the close cooperation between the local labour department and Department of Housing and Urban-Rural Development is established under the supervision of the central government; and

-

the wide use of the information database for the purpose of COVID-19 prevention.

At the provincial level, there are three types of local systems linked to the NCWM&SI System:

-

the system established by the Department of Housing and Urban-Rural Development that is mainly used as a management information system of construction workers and sharing information with the labour department;

-

the system established by local labour department used for the supervision of wage payment in construction sector; and

-

the system established by the local government or being a subsystem of e-government system integrated into both the construction market supervision function and the wage payment supervision function.

Use of information technology in monitoring payments in Zhejiang Province

In line with the 2019 Regulation, the Human Resources and Social Security Department of Zhejiang Province established the wage payment supervision system and integrated all necessary requirement for the general contractor, construction site and wage payment. This system benefits from the support of the provincial Department of Housing and Urban-Rural Development.

3.1 An overview of the worker registration and wage arrears monitoring system in Zhejiang Province

Zhejiang Province is one of the fast-growing regions in China. According to the 2019 Statistical Communiqué of the National Economic and Social Development of Zhejiang Province, the preliminary calculation of the annual GDP of Zhejiang was 623.52 billion yuan. The private sector in Zhejiang is highly developed, with the province home to Alibaba, one of the world’s largest e-commerce platform companies.

Since 2017, in Zhejiang, the local administration has closely integrated the modernization of the administrative governance system in accordance with the 2019 Regulation. Starting with a "No Wages in Arrears" campaign, the administration applied digital governance tools in accordance to the specifications of the NCWM&SI System. In May 2020, the Department of Human Resources and Social Security, the Department of Housing and Urban-Rural Development, the Department of Transport, the Department of Water Resources and the Hangzhou Central Branch of the People's Bank of China jointly issued the

EWPOSS is a specialized wage payment and supervision system. By means of a data interface, the NCWM&SI System uploads real-time information on construction projects and workers to the EWPOSS to facilate decentralized supervision of wage payment through the data interface on the basis of the real-name system.

Specifically, if the construction, transportation, and water conservancy departments at the local and municipal levels have established its real-name registration system or have connected to NCWM&SI System, the data will be imported from the real-name system, and project managers will be able to view real-name and attendance information directly through the EWPOSS. If the real-name system is not established at the local and municipal levels, transportation, water conservancy projects and project departments can collect and upload the information through ID card reading terminals recognized by the Ministry of Public Security. The system is connected to NCWM&SI System through the provincial interface, and meanwhile, the projects side can view the relevant information on the real-name system.

3.2 Construction of EWPOSS of Zhejiang Province

3.2.1 Goal of the system and key problems to be addressed

The EWPOSS of Zhejiang Province uses blockchain technology to achieve full supervision and real-time storage of enterprises' wage payment behavior from three key links: real-name attendance, wage confirmation and payment instructions, and builds a closed loop of wage payment monitoring with full chain traceability and full process monitoring with the participation of the authorities, banks, enterprises and construction workers.6 The system is mainly used in the construction sector, and its goal is to implement the requirements set out in the 2019 Regulation. The objectives of the EWPOSS, in accordance to the Regulation, are set out as follows:

-

First, to standardize the real-name registration and attendance record and special wage account management. The general contractor is responsible for the real-name registration of projects. All construction projects in progress must register accounts on the EWPOSS, access the real-name registration system, upload labour contracts7 and register information of workers who have left the construction sites. General construction contractors register wage account information in the system, allocate labour costs required and entrust banks to pay wages to the workers’ individual bank accounts.

-

Secondly, to guarantee monthly wage payment in full amount. EWPOSS facilitates multiple layers of checks on the amount of wages to be paid; that is, the system will automatically send the wage confirmation information to the migrant workers after project management has entered the information about the amount of migrant workers' wages on a monthly basis. Once the migrant worker confirms the amount to be received through an application on his/her mobile phone, the general contracting unit will approve the payment of wages and the bank will pay the wage to the bank account of the migrant worker directly under the order of the general contractor. If a migrant worker disagrees with the amount of wages, he/she can apply for dispute mediation directly on EWPOSS.

-

Thirdly, to build a guarantee mechanism for wage payment. Banks are encouraged to launch special loan products for the project to guarantee the wage payment of migrant workers, so as to alleviate the shortage of short-term labour costs caused by the internal approval process or the settlement cycle of construction projects. Construction units and general contracting units can apply for a special loan credit for wage payment from the bank where the wage account is opened. In case the wage account is temporarily unable to pay the full amount of wages, the bank will use the special loan to pay the wages first. To offset the risks, the banks will require the construction units or general contracting units to provide guarantees.

-

Fourthly, to prevent wage arrears through real-time monitoring and early warning measures. Through the EWPOSS, it is possible to monitor the risk of non-payment of wages from multiple angles, such as the flow of special funds, the amount of wages paid, and the level of wages of different positions and grades, and to send the monitoring information to the joint early warning system for handling wage arrears in real time.

-

Fifthly, to improve legal compliance and help micro, small and medium enterprises (MSMEs) to comply with regulations. Access to the EWPOSS has been gradually provided to MSMEs on a voluntary basis. The MSMEs may be incentivized to use the systems by the opportunity to receive the service of banks on wage payment and payroll management, thus reducing the administrative costs associated with wage payments.

3.2.2 How the system works

The system includes three sub-systems: the enterprise wage payment monitoring system (government end), the enterprise wage payment system (enterprise end) and Xin Le Da system (worker end). The main functions of the three systems are decribed here.

On the regulatory/governmental end:

-

Identify rural migrant workers, through collecting, verifying and summarizing information on name, gender, place of origin, address, type of work, bank account and work performance, etc.

-

Visualize the management of the wage guarantee fund. Through the wage guarantee fund module of the EWPOSS, it is possible to set the amount of wage deposit payable according to the enterprise's qualification, manage the registration of the enterprise's deposit payment and refund. The government department in charge can register online and record the payment status, amount, time, related items and other information to ensure the quick start of a wage security payment in case of abnormal status.

-

Visualize the management of the special wage account. Enterprises at all levels within the project have opened special bank accounts for the wage payment, and enterprises at all levels can calculate and pay wages through the system. All wages are paid through banks, but the employer is ultimately responsible for ensuring wage payment. With the online system, any change of the amount of fund in the special account can be traced.

-

Ensure payment of full amount of the wages. The amount of wages of migrant workers shall be calculated on a monthly basis and sent to the migrant workers themselves through the wage monitoring system to confirm the amount of wages, and the general contractor shall approve the payment of wages according to the confirmed amount of wages.

-

Supervise the onsite notice board with the information on workers’ rights and instructions on how to get support. Through an onsite camera, EWPOSS also monitors whether a notice board has been set up at the construction site, which is for displaying information on wage standards, attendance record of each workers, name and phone number of responsible labour inspector, hotline number of local labour inspection and other detailed information updated on a monthly basis to ensure that the information is true, accurate and transparent.

On the enterprise end:

-

Open and maintain a special bank account, upload employee roster, attendance data, tripartite agreement, right protection notice board and deposits. The enterprise is responsible for ensuring that the project department uploads payroll according to the actual attendance of workers and directing the bank to pay wages.

On the worker end:

-

Construction workers can download Xin Le Da App via scanned QR code or through application stores. The app transmits wage information and faciliates wage confirmation and offers health alerts, electronic contracts, recruitment information and information on training opportunities. The app also offers free movies and other social programmes.8

3.2.3 Data collection, documentation and sharing (within and outside the province)

Due to the scope of labour inspection, the EWPOSS of Zhejiang Province is only applicable to projects under construction within Zhejiang Province, but the information of related construction workers and projects is shared in real time on the NCWM&SI System. Moreover, the payment of workers' wages is made through bank transfers, as bank cards have the function of inter-provincial payment, so there is no geographical restriction on the payment of wages to construction workers even if they have left the province. In particular, it should be noted that the website interface of the EWPOSS of Zhejiang Province, which began operation in 2020, clearly indicates that the system is a national version, and that both the information of construction workers and construction enterprises are not limited to those within the province, and that there is a data interface with NCWM&SI System for real-time data sharing.

3.2.4 Information security measures

To ensure information security and protect data privacy, according to the information received from the labour inspection bureau of Zhejiang province, both technological methods and managerial methods are adopted. In the EWPOSS, the business side and the regulatory side are physically separated. On the enterprise end, the general contractor of a construction site may purchase IT services from many technology companies (or banks) to facilate the EWPOSS system. On the regulatory end, the date collected from every enterprise are stored in the Government Cloud which is under the supervision of the Big Data Bureau of Zhejiang Province. Blockchain technology is adopted to ensure the data security.

To ensure data security, on the regulatory side, all users are under strict access control. Data calling or sharing requirements must be reported to the Big Data Bureau of Zhejiang Province for purpose and security audit. To ensure that enterprises update data about workers and wage payment on a timely basis, the local labour inspectorate carry our random inspection to verify data authenticity.

3.2.5 The efficiency and effectiveness of the system

According to the local Human Resources and Labour Department, until May 2021, EWPOSS has covered all construction projects in Zhejiang Province, supervising 14,000 construction projects that are under construction and 5.016 million workers. A total of RMB 98.9 billion has been paid to workers through the system. EWPOSS has realized online monitoring of compliance of all legal requirements, including real name registration, wage payment guarantee of general contractor, special bank account for wages, making general contractor as the primary party accountable for paying wages to workers, confirmation by workers of the wage amount to be paid, and wage payment to the workers.

The labour inspectorate in the province continue to promote the adoption of the EWPOSS by MSMEs engaged in manufacturing. Through May 2021, 740 enterprises and nearly 65,000 employees in the manufacturing sector have also registered on the EWPOSS.

The labour inspectorate of Zhejiang believes that the use of information technology has significantly improved the effectiveness of labour inspection in construction sector. Before the EWPOSS was put into use, it was not possible to realize real-time monitoring of all construction projects in Zhejiang Province, but information technology has since made it possible to monitor the whole process, from workers' engagement at the construction site to the monthly wage payment. Nowadays, if a project fails to pay wages to workers through the bank within the stipulated time, the system will automatically alarm the local labour inspectorates to intervene. This enables labour inspectorates to detect and resolve the cases in a timely manner.

The full operation of the EWPOSS has led to a significant decline in wage delinquency cases in the construction field in Zhejiang. In 2020, although affected by the pandemic, the cases of wage delinquency in construction sector were reported to have declined by 8.4 per cent from the previous year (information from the labour inspectorate).

3.3 Lessons learnt on the application of the EWPOSS in Zhejiang Province

Based on data provided by the local labour inspectorate, group discussion with the labour inspectorate of Zhejiang Province, local Housing and Construction Department, technology service providers, general contractors and subcontractors of four construction sites and some migrant workers, we make the following conclusions on lessons learnt in the application of the EWPOSS:

-

Firstly, it is critical to embed the application and enforcement of roles and responsabilities within the EWPOSS within the legal enforcement of the 2019 Regulation. The local labour inspectorate repeatedly emphasized that progress in rolling out the EWPOSS to all construction site in Zhejiang was due to the legal precedence of the 2019 Regulation.

-

Secondly, the close cooperation between the regulatory departments is the premise and foundation for the effective operation of the system. According to the discussion with the local labour and human resource departments, we found that the EWPOSS involves the cooperation of five regulatory departments, including the local branch of central bank, not only in legal enforcement but also in data sharing. For example, housing and construction departments, water conservancy departments and transportation departments now require all construction sites under their supervision to provide the information about real name registration and special wage account opening as required by the 2019 Regulation when the construction enterprise applies for permission to start the project. The information is then shared with the labour department, which enabled the labour department to inspect wage payment activities of the general contractors and subcontractors. All departments now welcome the sharing of information and adherence to the regulatory requirements through the EWPOSS.

-

Thirdly, workers are empowered to play a role in wage payment compliance. As required by the 2019 Regulation, every construction site must have a bulletin board at a very obvious position to display three kinds of information(Art. 33): 1) the information of the construction site, including the construction party, general contractor, subcontractors, regulatory department, the person from the general contractor in charge of the wage payment in this construction site; 2) information on wage standards, including local minimum wage standard, the day of wage payment, etc; 3) the information on workers’ rights, including the telephone number of the regulatory department of construction site, the telephone number of the local labour inspectorate to report illegal labour-related activities, the application channel for labour dispute mediation and arbitration, the application channel for legal aid, the public legal service hotline, etc. In Zhejiang, a QR code is also included in the information of the 3rd category with the slogan that “you can know your wage and report any illegal labour activities at any time on your phone by scanning this QR code with your phone”.

A photo taken of the construction site information bulletin board in Yongjia County, Wenzhou City, Zhejiang Province, May 2020.

-

Fourthly, trainings in different forms on the use of the EWPOSS are helpful. To help the construction enterprises use the system, the local labour inspectorates at city and county level organize training courses for users at the construction site and invite the technical service provider of the EWPOSS to answer questions and solve technical problems. To promote the use of the App among workers, they also provide videos on the function and use of the App.

Some aspects of the EWPOSS are still to be improved. For instance, the required wage payment cycle is monthly. However, the actual work cycle of some workers at construction sites is not monthly. It often happens that some workers work for the project for less than one month and request to be paid immediately when they want to leave the site. In addition, when banks are not open during holidays or weekends, subcontracting companies need to pay wages in cash instead of through a bank account. Although these are special situations, they need to be considered and resolved in the next step of implementation.

In interviews, it was found that some workers are still reluctant to have their wages paid to them through bank accounts. They prefer to receive cash instead. The wages of construction workers are generally higher than the individual tax threshold in China, but many workers have not yet developed the concept of paying taxes in accordance with the law and are therefore more likely to demand cash payments to avoid paying taxes. In some case, it is found that the subcontractors or the individual contractors well understand the workers’ tendency to avoid paying tax and reached agreements with workers to pay only a part of the wages through the bank account and the rest in cash. Then the part to be paid in cash is delayed or even used by the subcontractors or the individual contractors for other purposes and not paid to the workers in the end. To avoid such situation, on one hand, it is necessary to suggest raising the individual tax threshold when revising the tax law; on the other hand, it is necessary to raise social awareness on the responsibility of citizens to pay taxes in accordance with the law.

Conclusion

Through the detailed observation of one case study where digital technology was applied towards the objective of improving the efficiency of labour inspection and generating a solution for a specific shortcoming faced by informal workers – specifically wage arrears faced by migrant workers in the construction sector in China – this study provides a positive example of e-formalization. The development and implementation of the EWPOSS in Zhejiang Province and the national application of the NCWM&SI System as tools to end wage arrears in the construction sector have proven successful because certain preconditions were set, namely that the systems: 1) were backed by policy and legal frameworks that enable enforcement on the ground; 2) benefit from the sound infrastructure of information technology in the country; and 3) were supported by an effective and robust labour inspection system.

References

Chacaltana, Juan, Vicky Leung and Miso Lee. 2018. New technologies and the transition to formality: The trend towards e-formality. ILO.

ILO. 2021. Is Asia ready for e-formalization?. 25 May.

National Bureau of Statistics. 2016. 2016 National Survey Report on the Monitoring of Migrant Workers. State Council of the People’s Republic of China.

Acknowledgements

The paper was prepared for the ILO-ESCAP Research Forum on “Technology and the Transition from Informal to Formal Economy”, held virtually from 18-19 January 2021. The authors express our gratitude to the Forum’s committee for selecting our paper for inclusion and providing helpful feedback on the draft throughout the process. Thanks are extended to Youngmo Yoon and Christian Viegelahn for their thoughtful comments on early drafts, Phu Huynh and Juan Chacaltana for excellent feedback during the Forum, Sara Elder for coordinating the event, providing comments and editing the document, Qingyi Li for language editing and facilitating the contract and publication process, and Dr Wenjing Li and Wei Tu for their technical advice and review. The author also wishes to express her appreciation to all those who participated in the interviews and group discussions, especially those working in the Bureau of Labour Inspection of the Ministry of Human Resources and Social Security and the Bureau of Labour Inspection and Enforcement of the Human Resources and Social Security Department of Zhejiang Province.