Costs and benefits of investing in transformative care policy packages: A macrosimulation study in 82 countries

Abstract

This study examines the annual investment required for universal, collectively funded childcare and long-term care services, as well as adequate paid care leave and breastfeeding breaks to parents in 82 countries. Simulations of policy reforms show that extending paid leave and breastfeeding breaks to all employed parents (including those in informal employment) at an adequate level of pay would require about 0.3 per cent of GDP of annual investment by 2035. Extending universal childcare would require additional annual investment of 1.5 per cent of GDP by 2035 over and above current public spending of 0.3 per cent. For long-term care, the annual additional investment by 2035 would be 2.5 per cent of GDP, over and above current public spending of 0.6 per cent. Such care investments could also provide powerful economic stimulus, creating up to nearly 300 million jobs by 2035, and recouping some of the investment through increased tax revenue.

JEL classification: C67, H51, J16

Keywords: maternity leave, parental leave, childcare, long-term care services, care economy, social infrastructure, economic stimulus, investment, input–output analysis, gender equality, sustainable development goals

Key findings

-

Funding high-quality universal care provision is an investment in the care economy and social infrastructure, with long-term and wider benefits accrued beyond their direct users.

-

Not only would care investment address care needs, it could also provide a powerful economic stimulus to help deal with the aftermath of the COVID-19 pandemic, which saw many jobs and livelihoods destroyed.

-

Together with increased provision of paid care leave, such investment has gender-equalizing effects on employment and caring roles.

-

The estimations in this report simulate the annual investment costs and potential employment creation by 2030 and 2035 of instituting universal childcare, paid childcare leave, breastfeeding breaks and long-term care services, covering 82 countries representing 87 per cent of the world employment and 94 per cent of the world GDP.

-

Following ILO Conventions and Recommendations on maternity protection, workers with family responsibilities, social protection and decent work as well as the UN 2030 Agenda for Sustainable Development, policy parameters were chosen to close the country-specific childcare gap between the end of childcare-related leave (maternity, paternity and parental leave) and entry into the school system, as well as providing free formal long-term care to all those in need.

-

Expanding paid childcare leave to each employed parent at an adequate level of pay (67 per cent of average earnings), as well as breastfeeding breaks, would require spending an additional US$269 billion in 2030, and a further US$109 billion by 2035 (in 2019 prices), or 0.3 per cent of 2035 GDP across all regions, ranging from 0.2 per cent in Asia to 0.5 per cent in Africa.

-

Universal provision of childcare after the end of paid leave would require additional annual spending of about US$1.6 trillion by 2030 and a further US$291 billion by 2035 (in 2019 prices), or 1.5 per cent of 2035 GDP, ranging between 1.1 per cent in Europe and 4.2 per cent in Africa.

-

Universal provision of long-term care services to all adults and children with care needs would require additional annual spending of about US$2.5 trillion by 2030 and a further US$578 billion by 2035, or 2.5 per cent of 2035 GDP, ranging from 1.9 per cent in Europe to 2.8 per cent in upper-middle- and high-income countries in Asia.

-

These investments could generate 280 million jobs by 2030, and a further 19 million by 2035, for a total of 299 million jobs. Of these jobs, by 2035, 233 million (78 per cent) will go to women and 251 million (84 per cent) will be formal jobs. Economies would be transformed in more caring ways, including with employment in care services representing about 8 per cent of the total employment post-investment (up from 1 per cent in 2019), closer to shares found in the Nordic countries that already have near-universal provision.

-

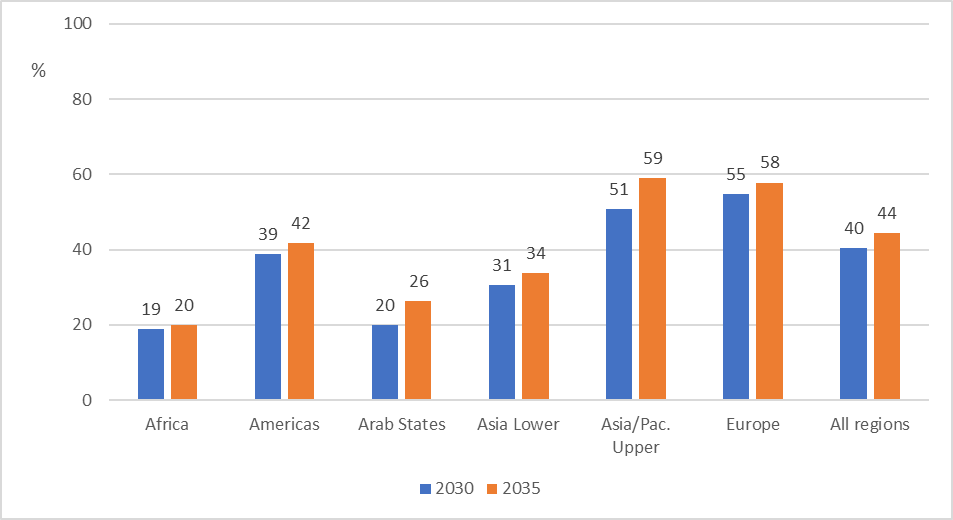

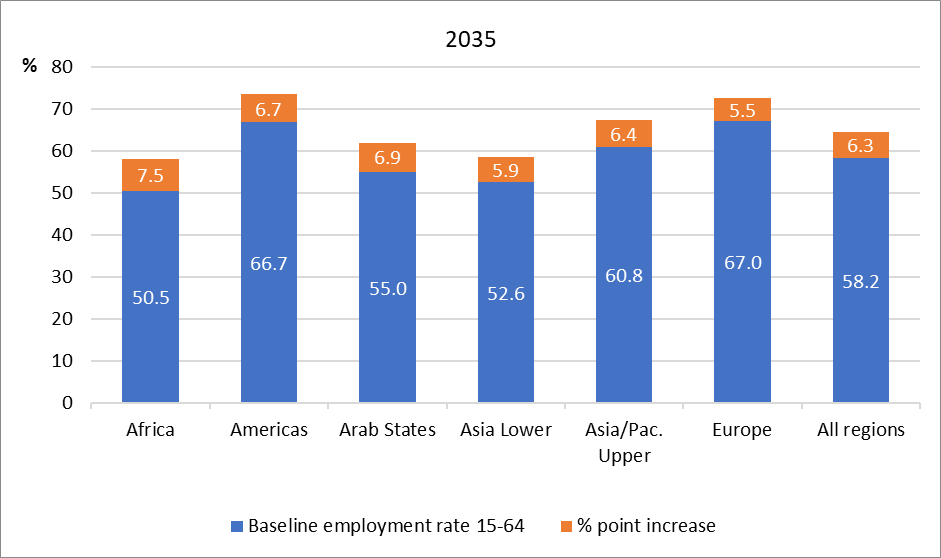

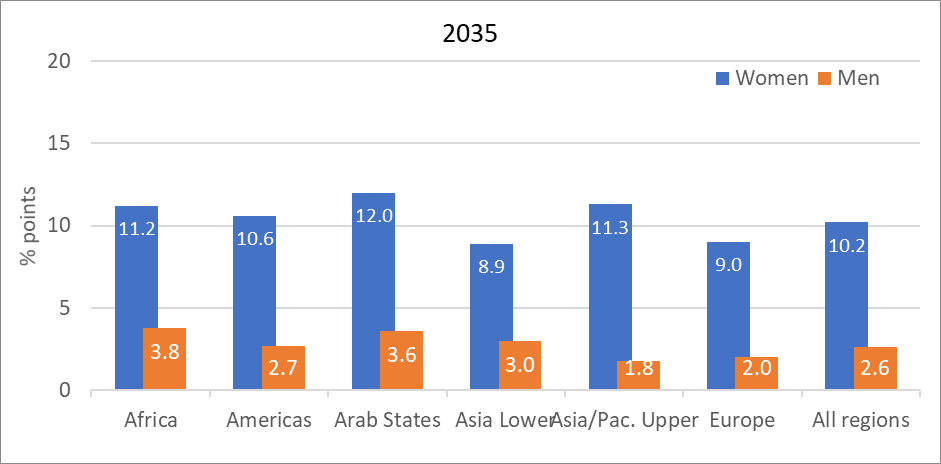

By 2035, employment rates would increase by 6.3 percentage points overall, ranging from 5.5 percentage points in Europe to 7.5 in Africa. Employment rates of women would rise by 10 percentage points overall, ranging from 9 percentage points in Europe and lower-income countries in Asia to 12 percentage points in the Arab States.

-

The gender gap in employment rates would fall by around 7.5 percentage points in all regions, and would close almost completely or become negative in a third of the countries studied.

-

By 2035, GDP would be higher than its projected baseline by 3.6 per cent across all regions and by up to 6 per cent in Africa. Tax revenue from increased earnings and employment would rise as well, reducing the total funding requirement of care policy packages from 4.2 per cent of GDP (before taxes) to a net 3.2 per cent of GDP (after taxes).

While transformative benefits extend beyond financial concerns, funding the investment beyond immediate tax revenue would require mobilizing diverse resources, from domestic progressive tax reforms that increase the tax base (including social security coverage) to international cooperation on debt restructuring and fighting corruption and illicit financial flows.

Introduction

The COVID-19 pandemic has laid bare the acute care crisis in most economies around the world, which rely on unpaid care work and impose a heavy burden on women (ILO 2020). Investment in a care-led recovery is not only necessary to address the care deficits around the world that pre-dated the pandemic, but also to provide a powerful economic stimulus. A care-led recovery would also be more gender-equal than equivalent investment in many other industries (De Henau and Himmelweit 2021).

Care services are a component of the so-called care economy and a form of social infrastructure due their wide-ranging benefits, including making sure the population is healthy and able to function, and thus participate in the economy. As such, care services require direct public investment to ensure quality and sustainability of provision (De Henau et al. 2016; ILO 2018a). Without people being well looked after, an economy cannot function and prosper, in the same way that without telecommunications and transport means, an economy would grind to a halt. Yet in most countries, spending on education, healthcare and social care services is not considered as spending on infrastructure, despite the wider benefits to society such services provide beyond their direct users. Without support from the State, unpaid carers – an overwhelming majority of whom are women – would not be able to access gainful employment and economic independence. Many governments are also reluctant to consider public spending on these services as constituting an investment, unlike, for example, spending on construction projects (which ironically may include the building of education and care facilities), despite both care services and construction projects offering longer-term benefits to the economy. Childcare and long-term care services of high quality confer educational, health and productivity gains that improve the well-being and quality of life of care recipients as well as reduce any crisis spending down the line (Huston, Bobbitt, and Bentley 2015; UN Women 2019).

This study estimates the annual public investment required to provide adequately paid individual maternity, paternity and parental leave, extending current provision to each parent and to informal economy workers in line with international labour standards and with a view to closing current policy gaps in legislation and provision. It further examines the annual public investment costs of providing adequate free universal provision of both childcare and long-term care of high quality. It then simulates the short-term employment benefits of such a package of investments. This work builds on previous work by the ILO on routes towards achieving the 2030 Agenda for Sustainable Development and implementing social protection systems, including social protection floors (ILO 2018a; ILO 2021a; Bierbaum and Schmitt 2022).

The study also builds on and extends previous work by Ilkkaraçan and Kim (2019) on simulating investment in education and health and social care for 46 countries. In this study, the focus is on gender-equalizing policies of paid childcare leave, breastfeeding breaks, childcare and long-term care provision. This study presents estimations covering 82 economies from around the world, representing all regions, income levels and welfare regimes (see appendix table A.1 for a full list of countries/territories). This represents, we believe, the largest degree of coverage ever undertaken at such a level of detail on policy needs and public spending related to the care economy. In total these countries and economies represented about 87 per cent of the world’s employed population and 94 per cent of the world’s GDP in 2019.

The study also simulates the employment effects that such investment would produce, using input–output multiplier techniques to derive total employment creation and the effect on gender employment gaps and tax revenue.

Scope and conceptual framework

The conceptual framework follows from the seminal ILO report

Investing in the care economy ties in well with the 2030 Agenda for Sustainable Development and the ILO Decent Work Agenda. It is central to the ILO Declaration for the Future of Work (ILO 2019) and the Global call to action for a human-centred recovery from the COVID-19 crisis that is inclusive, sustainable and resilient (ILO 2021a). The 2021 International Labour Conference Resolution concerning the second recurrent discussion on social protection (social security), which serves as a follow-up to the 2008 ILO Declaration on Social Justice for a Fair Globalization, sets forward a framework for universal social protection and also includes a reference to the care economy (ILO 2021b). These frameworks have been endorsed by governments, employers’ organizations and workers’ organizations from all over the world and are grounded on international labour standards. “Large-scale investment in the care economy” is also a key transformative measure of the UN Secretary-General’s Our Common Agenda (UN 2021a) and, more recently, the Global Accelerator on Jobs and Social Protection for Just Transitions initiative to accelerate the implementation of the Sustainable Development Goals (SDGs) by 2030. The Accelerator will aim to create at least 400 million jobs, primarily in the green and care economies, and contribute to extending social protection floors to the people currently not covered by any social protection measure (about 4 billion men, women and children) by 2030 (UN 2021b).

Taking a progressive approach, the modelling rationale for this study aims at building and strengthening existing provisions to progressively set up a system of high-quality, affordable and comprehensive provision of long-term care (LTC) services for children and adults with disabilities and older persons with care needs as well as early childhood care and education (ECCE), together with expanded provision of adequately paid childcare leave for both parents. For young children, the aim is to close the so-called “care policy gap”, defined by Koslowski et al. (2021) as the difference (in months or years) between the end of adequately paid childcare leave provided after the birth of a child and the start of an ECCE entitlement (when available) or mandatory primary school age. For disabled and frail adults, the care gap to close could be seen as the heavy reliance on long hours of unpaid care work by family members, which affects carers’ well-being, or the absence of care altogether (unmet needs).

There are different views on standards of quality and affordability, including whether, for example, the provision of care should be entirely free at the point of use or include small co-payments by users (either capped or means-tested). Although there may be grounds for considering such differences, this study primarily focuses on the total “costs” of provision, implicitly assuming that the provision of care will be free at the point of use. 1 ILO international labour standards usually follow an approach that is focused on achieving outcomes without being overly prescriptive on the chosen means so long as basic principles are met, but for the purposes of this study, the rationale is to examine transformative collectively funded packages of leave (time), rights, care-related cash benefits (income security) and services that, in combination, have showed superior advantages over market-based solutions in terms of efficiency, quality and effectiveness of care provision as well as employment creation (ILO 2018a; ILO 2021; ILO 2022). 2

Financing such spending may require increases in general taxation and social insurance contributions. This paper does not examine the detailed country-specific tax reforms that may be necessary to fund the full costs of provision, but discusses different options, in line with discussions happening more generally around financing the gaps in social protection floors (Bierbaum and Schmitt 2022; UN Women 2019; Durán Valverde et al. 2020; ILO 2020). However, at a minimum, the simulations in this study estimate the effect of such care investments on short-term tax returns (based on existing fiscal systems). Therefore, this paper’s main contribution is to simulate notional spending requirements (net of some of the tax revenue) on the supply-side of services within the next 10 to 15 years with sensible yet transformative scenarios for universal provision based on national priorities and population needs. The proposals are based on the assumption that countries will strive to progressively meet those policy scenarios and time some milestones as “minimum or floor steps” towards higher or faster coverage, according to national circumstances and based on national tripartite consultations and the participation of representatives of paid and unpaid care workers and women’s and child’s rights groups and those who provide and receive care.

These transformative scenarios are benchmarked on a few well-performing countries at the global or regional levels. Some countries have established high standards of provision either in regard to childcare, long-term care or paid care leave, or all three. Therefore, each of the relevant indicators of high-quality provision – for example, recipient-to-staff ratios – has been averaged across the top country performers to develop the benchmarks for the simulation scenarios in this study. The precise list of countries used varies by indicator, as detailed in the methods below.

These scenarios have been adapted for lower-income countries to take account of the local specificities on costs, employment and wages, but wherever possible and justified, relatively homogenous assumptions across the different economies have been utilized. For example, the international childcare literature on both lower-income and high-income countries has shown the benefits of high-quality childcare that starts early, which in all cases includes safety, a stimulating carer–child relationship, play-based learning, space, resting time, healthy meals and well-trained staff (ILO 2021a; ILO and UNICEF 2019; Simeu et al. 2017; Britto et al. 2017; Huston, Bobbitt, and Bentley 2015; Li et al. 2013). From there it is possible to derive quantitative indicators of quality standards, such as low child/staff ratios and high wages that match the qualifications at the degree level of the main childcare workers and are on par with teachers in schools (including provision for training to reach those levels).

Expanding such investment takes time and requires significant resources and planning. The costs and employment effects are modelled for the year 2030, taking into account population changes. More transformative scenarios close to universal high-quality provision have been simulated for upper-middle- and high-income countries, and intermediate scenarios have been developed for lower-middle- and low-income countries. A further expansion has been modelled for 2035, where scenarios for lower-middle- and low-income countries are adjusted upwards to get much closer to those of the upper-middle- and high-income group.

The policy scenarios follow the Sustainable Development Goal (SDG) objectives and are inspired by ILO Conventions and Recommendations on maternity protection, workers with family responsibilities, social protection and decent work. They also take into account the findings of a major ILO report,

In a nutshell, the estimations consist in simulating the annual public spending requirement for providing collectively funded 3 policy packages including:

-

individual childcare leave (maternity, paternity and parental) with durations extended according to national priorities and paid at full earnings or at least 67 per cent of earnings (based on the average wage) for formal employees, and at least at minimum wage level or 45 per cent of the average wage for those informally employed;

-

breastfeeding breaks of at least one fully paid hour per day for mothers returning to work after leave, for a period of at least 6 months; 4

-

free, full-time, full-year, high-quality early childhood care and education (ECCE) provision in collective settings to all children under primary school age (from the end of the paid leave period), with low child/staff ratios and professional childcare personnel with a mix of qualifications reflected in their wages (from at least above the minimum wage to primary school teacher wage or equivalent);

-

free, high-quality long-term care (LTC) to all children and adults, based on estimation of need prevalence, with adequate recipient-to-carer ratios and a mix of qualified personal care workers paid at 75 per cent of nurses’ wages and some with entry-level training paid at least at a rate above the minimum wage.

Justification for these parameters and imputation techniques are all explained in detail in the respective method sections that follow.

Other than the annual investment required to achieve these ambitious targets, the paper also estimates the labour market benefits of investing in care leave policies and care services as follows:

-

impact on direct employment in the care sector by gender (in full-time equivalents);

-

impact on indirect employment stemming from needing inputs from other sectors (also by gender);

-

impact on direct and indirect short-term tax returns from increased earnings and economic activity.

Since GDP is still the prevalent yardstick for comparison of economic activity between countries, the paper also examines changes in GDP due to multiplier effects that relate to the different spending efforts and fiscal returns. All estimations use 2019 as the reference year (for socio-demographic data and prices). However, as the estimations are carried out for 2030 and 2035, the relevant population variables 5 and real GDP 6 are projected to those dates to recalculate baseline employment, care spending and average wages. 7 Average wages follow GDP per capita projections. All other relative variables are kept constant as per 2019. For example, employment rates are those of 2019, applied to a working-age population projected to 2030. Wage rates in different industries and occupations are kept constant relative to the average wage as per 2019.

In sum, this study is an exercise in simulating the spending requirements and employment effects of the care policy reforms relative to the baseline spending and employment in the scenario year, not an exercise in projecting the change in spending and employment between 2019 and the scenario years. The simulated baseline scenario simply projects population by age group and GDP to the years of 2030 and 2035 while keeping constant the relative variables in the economy as they stood in 2019, such as relative prices and wages in each industry, current care spending in proportion of GDP and employment rates and composition. With respect to the ILO (2018a) terminology, the 2035 results presented below could be interpreted as the difference between the high-road and status quo scenarios’ effects, in which the status quo scenario is the baseline, business-as-usual care spending and employment projected to 2035 if no policy reform is implemented. The same holds for interpreting the 2030 results. In addition, 2030 in the model represents either a high-road scenario for high- and upper-middle-income countries or an intermediate scenario for low- and lower-middle-income countries.

Childcare leave and breastfeeding

2.1. Identifying the gap in provision and eligible groups

Paid childcare leave provisions available to households and linked to the birth and care of an infant include maternity, paternity and parental leave (box 1). Entitlements and funding mechanisms vary widely between countries, even between those with relatively well-established policies, such as European Union (EU) Member States, as described in the ILO

Box 1

ILO definitions and frameworks for maternity, paternity and parental leave and breastfeeding breaks

_________

(1) Other relevant ILO standards are the Social Security (Minimum Standards) Convention, 1952 (No. 102), and the ILO Social Protection Floors Recommendation, 2012 (No. 202).

(2) Other relevant ILO standards are the Social Security (Minimum Standards) Convention, 1952 (No. 102), and the ILO Social Protection Floors Recommendation, 2012 (No. 202).

(3) Article 22.

(4) Article 10(3–4).

(5) Recommendation No. 191, Para. 10(3), and Recommendation No. 165, Para. 22(2).

Source: ILO 2022.

Obviously when closing the childcare policy gap, the length of the leave expansion will depend on the choice of the start of any ECCE entitlement, which in many countries also needs to be decided. The ILO

The main two elements required for simulating the paid leave expansion are:

-

the size of the eligible employed population; and

-

the average earnings of eligible parents/potential parents.

Typically, the size of the eligible population would depend on legal frameworks (for example, the qualifying period of the employment contract; whether self-employed are eligible), as well as employment rates and birth rates in each country. In the model for this study, eligibility is extended to all potential parents who are gainfully employed, including those in the informal economy. This implicitly assumes no qualifying condition of employment duration. The study does not estimate the size of the population of employed parents based on the current employment rate of mothers, given the endogeneity of their employment situation to the existence of adequate provision of leave (and also of ECCE), as noted above.

For costing purposes, one needs the size of the eligible population prior to the birth of the first child. For fathers this is taken by their actual employment rate, which is often higher than for childless men of the same age and unlikely to change after the implementation of the leave reform (Kleven et al. 2019). For mothers, the study uses as a proxy the employment rate of women of childbearing age (15–54) without children. The rationale is that with better leave entitlements (followed without a gap by childcare provision), mothers will not need to drop out of the labour market (or reduce their working hours), and so their employment pattern will resemble their pre-birth pattern, which is taken to be similar to that of childless women of the same age (Kleven et al. 2019). In a few countries the presence of children cannot be estimated, so the study uses the overall employment rate of women of childbearing age.

The study draws a distinction between formal employees, formal self-employed workers and informal employment (whether as an employee or self-employed). The modelled care leave provision assumes that both formal employees and formal self-employed persons will receive a proportion of their employment income while on leave, and the assumed employment income of self-employed persons would be established at the average wage across all employees (hereafter AW). 9 Despite the different natures of maternity, paternity and parental leave, the same wage replacement rate as that of maternity leave is assumed for parental and paternity leave, since income earning is suspended for all leave takers, including men. The underpinning reason is based on data on care leave uptake by fathers and literature on the role of policy incentives, including on the level of paternity and parental leave benefits, in promoting men’s leave participation. As men tend to be over-represented among higher paid workers and still suffer stigma for leave uptake, adequate replacement rates would be necessary for gender-transformative policies that provide financial incentives for men to take leave and better share in unpaid care work. 10

It is further assumed that workers in the informal sector would receive a minimum flat-rate benefit, assumed to be equivalent to the minimum wage, if it exists, or otherwise set to 45 per cent AW (as this is the level at which minimum wages often lie, where they exist, in the sample of countries used in the study). 11 This aims to reflect the need to improve working conditions for those in the informal sector without incentivizing the reliance on informal employment over time and while facilitating workers’ transition from the informal to the formal economy and toward similar levels of income replacement as formally employed parents (ILO 2016; 2021c).

The rationale for using the average wage (AW) rather than actual individual wages for the calculations of earnings replacement rates is two-fold. First, there are data modelling restrictions: it is difficult to estimate accurate wage data for individuals whose employment needs to be estimated, given the current endogeneity of female earnings to employment. Second, using the AW enables quantitative comparisons of legal differences. In some countries certain childcare leave benefits are paid at a flat rate (such as in Australia and France for parental leave); while in other situations benefits are paid as a proportion of individual earnings (most countries for maternity leave) – sometimes with a ceiling (many European countries) and in some cases with decreasing replacement rates over time (such as in Belgium and the United Kingdom of Great Britain and Northern Ireland). Since the aim is to estimate the gap in provision and to cost it, the different systems of payment and duration are converted into a harmonized indicator of weeks paid at 100 per cent AW equivalent. That is, the duration of leave is weighted by the average payment by public funds in proportion to average earnings. In the case of proportional payments with a ceiling, if the ceiling is lower than average earnings, this will be reflected in the calculation (see below for a few examples).

Costings are done separately for maternity, paternity and parental leave benefits, but the types of leave are also aggregated for each parent given that in some countries the “parental leave” period is not fully distinguished from the period of payment for a “maternity leave” per se (for example, in Australia, Norway and Sweden). Moreover, the simulations only consider paid childcare leave provision that is afforded by social insurance and public schemes, excluding any provision paid for by employers. Given the focus on budgetary requirements rather than effective take-up, it is assumed that, in addition to maternity and paternity leave and to individually reserved parental leave periods, the remaining paid parental leave period that can be shared between parents is shared equally, even though in practice those periods are almost always exclusively taken up by mothers (Koslowski et al. 2020).

Here are a few examples of what this harmonizing method means for the total paid childcare leave available to mothers:

-

United Kingdom : 6 weeks of maternity leave at 90 per cent AW without ceiling, followed by 33 weeks at a low flat-rate (about 26 per cent AW); no paid parental leave. Moreover, employers only recoup 92 per cent of this from the State. So all in all, this is equivalent to 13 weeks at full pay at average earnings (= (6 x 0.9 + 33 x 0.26) x 0.92). -

Denmark : 18 weeks of maternity leave paid at full earnings up to a ceiling worth 73 per cent AW, followed by 32 weeks of fully paid parental leave (with no father’s quota, so it is assumed to be shared equally) up to a ceiling of 79 per cent AW. 12 This is equivalent to 26 weeks at 100 per cent AW (= 18 x 0.73 + 16 x 0.79). -

New Zealand : 26 weeks at 100 per cent AW up to a ceiling that is about 50 per cent AW (and no paid parental leave). This is equivalent to 13 weeks at 100 per cent AW (= 26 * 0.50).

It is acknowledged that offering, say, 15 weeks of maternity leave at a 100 per cent replacement rate is not the same for the recipient and their family as offering 30 weeks paid at 50 per cent, in terms of career impact, loss in daily earnings, time to care, etc. (and not all countries offer the flexibility of choosing between multiple options anyway). However, for budgetary purposes, which is what this study is focusing on, the two options would cost the same amount annually.

Table 1 shows the current average offer of paid childcare leave to formal employees and formal self-employed for different regions of the world. It shows the total leave available for mothers (when maternity leave and the period of parental leave available to mothers are added up) and for fathers (same). The total period is weighted by the AW as illustrated in the examples above. On average across all regions, formal employee mothers receive the equivalent of 16 weeks of fully paid childcare leave at 100 per cent AW equivalent, whereas men only receive just under 2 weeks. Formal self-employed mothers only receive 4 weeks of paid childcare leave at full pay equivalent, while self-employed fathers receive less than a week.

Table 1. Current provision of paid childcare leave by status of employment (weeks paid at 100 per cent AW equivalent)

|

|

|

|

||

|

|

|

|

|

|

|

Africa |

4.5 |

0.1 |

0.5 |

0.0 |

|

Americas |

11.3 |

0.5 |

7.5 |

0.5 |

|

Arab States |

0.0 |

0.0 |

0.0 |

0.0 |

|

Asia Lower |

16.9 |

0.2 |

1.3 |

0.1 |

|

Asia/Pac. Upper |

19.0 |

2.1 |

0.3 |

0.1 |

|

Europe |

25.7 |

9.4 |

20.2 |

6.5 |

|

All regions |

16.2 |

1.8 |

3.8 |

0.8 |

Note: Regional average weighted by countries’ share of regional employed population in 2030. Reference year is 2021 for legal systems. “Asia Lower” stands for lower-middle- and low-income countries in Asia (including Kyrgyzstan); “Asia/Pac. Upper” stands for upper-middle- and high-income countries in Asia and the Pacific (including Kazakhstan); Europe includes Russian Federation, Turkey and Israel. Arab States include Saudi Arabia only. Childcare leave is the sum of maternity leave and paid parental leave available to mothers, or the sum of paternity leave and paid parental leave available to fathers, both measured in 100 per cent of average wages equivalent (non-reserved leave period is split equally).

Source: Author’s calculations.

Existing paid care leave available in each of the 82 countries in the study is measured in weeks paid at 100 per cent AW equivalent. In line with the principles of international labour standards, schemes paid for by the employer (employer liability) were excluded, as this system is not considered “a collectively funded” provision, which might pose challenges in terms of coverage and compliance. Even if the leave payment was mandatory, employers might still be reluctant to hire female employees to avoid the extra cost.

In Africa, only three countries (out of the 13 covered in this study) provide the equivalent of 14 weeks of fully paid leave to female formal employees (Cote d’Ivoire, Senegal and Tunisia); while more populous countries such as Ethiopia and Nigeria offer no maternity leave benefits that are covered through social insurance, which explains the low weighted average of the region in table 1 above. No country in that regional sample offers fathers two weeks of paid leave; while provision for the self-employed is very limited. Note as well that for most African countries, even where public provision exists, the coverage of qualifying employees is very small given the large expanse of informal employment (in some cases greater than 90 per cent), for which – by definition – no mandatory social insurance provisions exist. 13

In the Americas, the provision of leave for mothers is higher, but the aggregate results remain low because the United States of America, a country with a large population, offers no social insurance-based paid leave to mothers. Also, only Canada and Colombia offer employee fathers a paid leave of two weeks (at 80 per cent AW).

In the Arab States (which in this study refers only to Saudi Arabia), no social insurance-based provision exists.

In Asia and the Pacific, 10 economies out of the 22 sampled for that region do not provide maternity benefits through social insurance. Paid leave provision for fathers barely exists in this group either, with only four (high-income) countries – Australia, Japan, Republic of Korea and Singapore – offering a minimum of 2 weeks paid fully. Both Japan and the Republic of Korea offer nearly equal care leave for employee mothers and fathers.

Europe offers, on average, far longer periods of paid leave to mothers, around 26 weeks, as well as 9 weeks to fathers (at 100 per cent AW equivalent). This masks a wide range of paid leave schemes for mothers among countries, from more than 50 weeks in Bulgaria, Romania and Estonia, to fewer than 14 weeks at full pay equivalent in Malta, Switzerland, Ireland, Turkey, Cyprus and the United Kingdom. In this latter group, either the employer is expected to foot a large proportion of the bill (Malta) or the payment is low relative to the average wage (United Kingdom).

More countries in Europe than in the other regions offer at least two weeks of paid paternity leave or parental leave reserved for fathers (again at full pay equivalent), but few countries offer equal or near equal provision to both fathers and mothers. Only Spain and Iceland do so.

The gaps that need filling in each country reflect these existing provisions. Maternity leave policy scenarios are based on the minimum requirements of the most up-to-date ILO standards on maternity leave, as detailed in Convention No. 183 and Recommendation No. 191. Paternity leave policy scenarios are inspired by the principles of Recommendations Nos. 165 and 191 as well as the 2021 International Labour Conference Resolution concerning the second recurrent discussion on social protection (social security). In addition to the latter, parental leave policy scenarios are also inspired by the principles of Conventions Nos. 102 and 183 and Recommendations Nos. 165, 191 and 202. These scenarios are related to national care policy gaps that countries will progressively fill by extending paid childcare leave provision at the household level, with gender equality considerations.

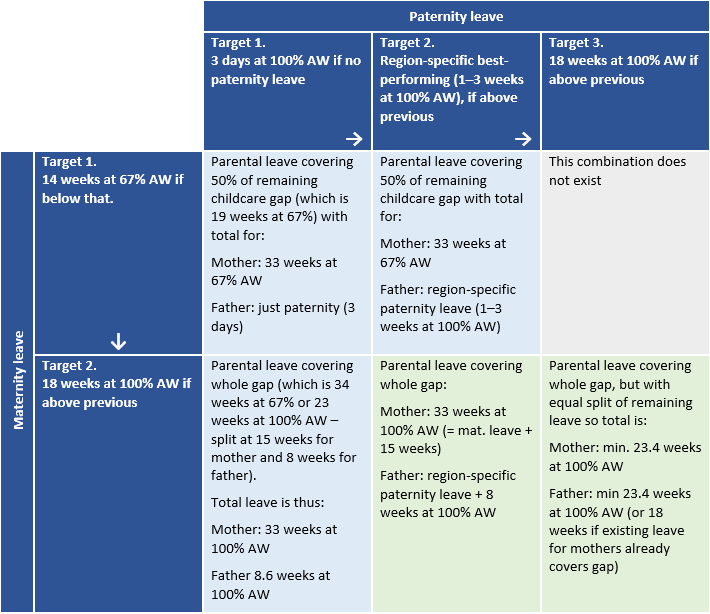

Table 2 below shows how these different scenarios for maternity, paternity and the resulting parental leave are combined for different countries. The principle behind these scenarios is that each country improves its offer to reach the next target up. By 2035, the scenario achieved by each country in 2030 is then moved up further to the next one, leaving only two groups: the two cells in the bottom row and the last two columns of table 2 (thick frame).

Table 2. Paid childcare leave scenarios for 2030 and 2035

Note: For 2030, countries can target the scenarios found in either the blue or green cells; while for 2035, only the green cells of the table are possible targets. Note that not all the parameters have been agreed upon by tripartite constituents. The scenarios are illustrative.

It is important to note that these scenarios are established for the sake of costing budgetary requirements. Each country will decide the favoured combination of leave for each parent and the start of universal childcare, as discussed in Section 3. It is important to consider the balance between children’s needs, parents’ preferences and risks to parents’ careers and gender equality, including providing strong incentives for fathers’ involvement in care provision. Although the leave period extends to about one year (combined) in the 2035 scenarios of this illustrative package of policies, in practice the leave period could be shorter: for example, both parents may take significant portions of the leave together (such as the 18 weeks of maternity and paternity leave, so the partner can help the mother recover), or the mother could return to work after, say, 6 months, with either the child accessing ECCE services or the partner subsequently taking up months of parental leave, or a combination of both, on a part-time basis. The scenarios here thus present an upper-bound in terms of costings, with significant overlap expected with childcare provision.

2.2. Costing the gaps in provision

The annual spending requirement to fill the gap in provision of paid childcare leave is the product of the following four factors:

-

number of annual live births;

-

employment rate of women and men aged 15–54 (split between each type of employment);

-

average weekly target earnings; and

-

coverage gap in fully paid weeks equivalent (gap between current provision and target).

Data for annual births and population by age has been taken from the UN Population Division’s World Population Prospects 2019 database (including projections to 2030 and 2035). Employment rates and employment status are derived from micro-data for each country (labour force surveys or equivalent) and the ILOSTAT employment database. Data on informal employment is given by micro-data and/or the ILO (2018b) report

Data on parental/maternity/paternity leave systems is taken from legal sources compiled by the ILO for this study, including secondary sources (Koslowski et al. 2020; 2021).

The study assumes that the number of births per year gives a proxy for the annual number of mothers, implicitly ignoring multiple births. The number of fathers potentially eligible for leave is a proportion of the number of mothers in order to account for the greater prevalence of single mothers than single fathers. The available micro-data was used to calculate this proportion as the ratio of fathers with children aged zero to mothers with children aged zero.

Note that for five countries/territories in Asia it was not possible to identify the presence of children in the micro-data (Hong Kong (China), Japan, Indonesia, Israel and Malaysia), and access to micro-data for four additional countries was not possible (New Zealand, Kazakhstan, Singapore, Saudi Arabia). So, for these nine countries, the proportion of fathers was imputed from the regional average (with Saudi Arabia taking the average of Asia and the Pacific).

For each employment type (employee, self-employed, informal), the eligible population for paid care leave is therefore:

-

For mothers : the product of the birth rate, the employment rate of childless women aged 15–54 and the share of the relevant employment status (employee, self-employed or informal employment) in total employment. -

For fathers : the product of the birth rate, the ratio of fathers/mothers, the employment rate of fathers aged 15–54, and the share of the relevant employment status in total employment. 15

For the five countries/territories where the micro-data did not have information on parents, the employment rate of men and women aged 15–54 was used as proxy. For the four countries with no micro-data at all, the study used the employment rate of men and women aged 15–64, which was taken from the ILOSTAT database (ILO, n.d.).

Two scenarios were simulated, one for 2030 and one for 2035 (as per the scenarios in table 2). Note that in both the 2030 and 2035 scenarios, mothers in informal employment are given 14 weeks of maternity leave and a further 11 weeks of parental leave. Fathers are given 3 days of paternity leave and a further 8 weeks of parental leave. Again, for parental leave, these are illustrative scenarios, with some overlap expected with childcare policies, depending on national priorities.

2.3. Cost simulation results

2.3.1. Paid childcare leave expansion

Based on the scenarios illustrated in table 2 and the costing method explained in section 3.2, results for costing the expansion in paid childcare leave are shown in table 3. The bulk of the costing stems from the need to expand provision for fathers in most countries and to create some universal provision for those in informal employment in low- and lower-middle-income countries.

Table 3. Average cost of expansion of paid care leave by region of the world (2019 prices)

|

|

Breast-feeding breaks |

Expansion of paid maternity, paternity and parental leave |

Breast-feeding breaks |

Expansion of paid maternity, paternity and parental leave |

||

|

|

2030 |

2030 |

2035 |

2030 |

2030 |

2035 |

|

Region |

millions US$ |

% GDP 2030 |

% GDP 2035 |

|||

|

Africa |

1 149 |

12 153 |

16 921 |

0.04 |

0.48 |

0.54 |

|

Americas |

10 675 |

81 704 |

147 981 |

0.03 |

0.24 |

0.39 |

|

Arab States |

117 |

1 306 |

2 453 |

0.01 |

0.13 |

0.22 |

|

Asia Lower |

1 363 |

16 037 |

21 744 |

0.02 |

0.18 |

0.19 |

|

Asia/Pac. Upper |

9 590 |

69 731 |

92 304 |

0.03 |

0.19 |

0.20 |

|

Europe |

8 147 |

57 407 |

65 553 |

0.03 |

0.22 |

0.23 |

|

All regions |

31 041 |

238 338 |

346 957 |

0.03 |

0.22 |

0.27 |

Note: “Asia Lower” stands for lower-middle- and low-income countries in Asia (including Kyrgyzstan); “Asia/Pac. Upper” stands for upper-middle- and high-income countries in Asia and the Pacific (including Kazakhstan); Europe includes Russian Federation, Turkey and Israel. Arab States include Saudi Arabia only. Breastfeeding breaks scenarios for 2030 and 2035 are the same, so only 2030 results are shown.

Source: Author’s calculations.

Across all regions, public spending would need to rise by about US$238 billion by 2030 and a further US$109 billion by 2035 to fill the gap in universal provision (in 2019 prices). This represents an average of 0.27 per cent of 2035 GDP overall, varying from 0.2 per cent of GDP in Asia to 0.5 per cent in Africa. Results for lower-middle- and low-income countries of Asia and Africa are comparable to those estimated by Duran-Valverde et al. (2020) 16 for universal maternity benefits packages of about 0.5 per cent of GDP required in Sub-Saharan Africa and 0.1 per cent in South-Eastern and Southern Asia, representing 10 per cent and 3 per cent, respectively, of their total cost estimate for a universal package of the four social protection benefits: children, maternity, disability and old age.

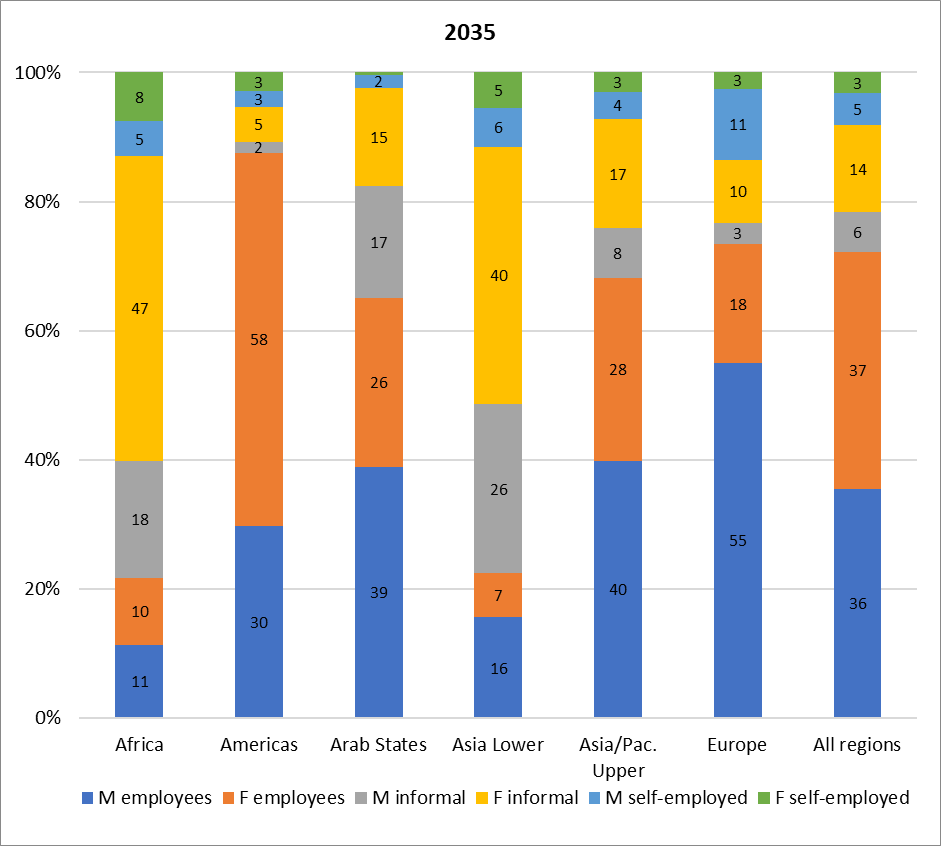

Figure 1 shows that for upper-middle- to high-income countries, the majority of the gap to fill comes from formal employees. The Americas contrast with Europe, as the former requires a greater expansion of mothers’ paid leave (dominated by the United States), while in Europe it is fathers’ leave expansion that contributes most to the costs among formal employees.

In lower-middle- to low-income countries in Africa and Asia, the bulk of the required additional spending contribution comes from informal employment.

Figure 1. Breakdown of total cost of childcare leave expansion by gender and employment status (by 2035)

Note: “Informal” includes both employees and self-employed that are informal. “M” stands for men and “F” for women. “Asia Lower” stands for lower-middle- and low-income countries in Asia (including Kyrgyzstan); “Asia/Pac. Upper” stands for upper-middle- and high-income countries in Asia and the Pacific (including Kazakhstan); Europe includes Russian Federation, Turkey and Israel. Arab States include Saudi Arabia only.

Source: Author’s calculations.

Countries with spending requirements above 0.5 per cent of GDP are mostly in Africa, though Nepal, Cambodia and Pakistan also require public spending well above 0.5 per cent of GDP.

Note that Bangladesh and Sri Lanka contrast with Nepal and Pakistan in terms of the expansion in percentage of GDP required, despite all four countries currently having no leave provision and similar rates of informal employment and wage levels (in US$ purchasing power parity (PPP)). This is due to two factors. First, the ratio of the average wage to GDP per capita is lower in Sri Lanka and Bangladesh (0.56 and 0.97, respectively) compared to Pakistan (1.43) and Nepal (2.00). Second, the minimum wage in Pakistan and Nepal is above two-thirds of the average wage, whereas it is only 12 per cent in Bangladesh and 39 per cent in Sri Lanka. This reduces the spending requirement on informal employment in the latter two countries, by construction. The same explanation lies behind the relatively lower spending requirement in Ghana and Rwanda compared to the other African countries.

Countries in Europe have more generous existing provisions of paid leave, although a few countries (Cyprus, Israel, Switzerland and the United Kingdom) would still need to spend more than 0.4 per cent of their GDP to expand their provision, mostly reflecting the less generous maternity leave currently provisioned for in these countries compared to the remainder of the region. Note that in some countries, current provision of paid childcare leave for mothers (in 100 per cent AW equivalent) extends well beyond the scenarios simulated in table 2. So, in many cases, closing the gaps could simply require a redesign of long and often low-paid parental leave schemes, sometimes earmarked to mothers only, to be more equally shared and better paid leave entitlements, without needing any additional spending. 17 This would be a welcome gender-equalizing process.

2.3.2. Breastfeeding breaks

Although most countries do offer provision of paid breastfeeding breaks for employees of at least 60 minutes per day, only three countries do so via the social insurance system (Croatia, Slovenia and Spain). Therefore, it was assumed that all the other countries, even those providing breaks via the employer, need to budget for 60 minutes per day for 6 months at 100 per cent AW to employee mothers. The study has assumed this target to be reached by 2030. Total costs add up to about US$31 billion in 2030 for the whole world (table 3), which is about 0.03 per cent of GDP. Although 6 months are costed, it is expected that there will be significant overlap between the childcare leave provision and breastfeeding breaks in countries with more generous parental leave for mothers, so that the two budgets do not add up fully. 18

Early childhood care and education

Early childhood care and education (ECCE) services and programmes are broadly classified into two types:

-

early childhood educational development (ECED) programmes designed for children in the age range of 0–2 years; and

-

pre-primary education programmes designed for children from 3 years of age to the start of primary education (ILO 2018a).

Services available to parents can be either regular centre-based ECCE, licensed homebased ECCE or in-home services (domestic workers). Hiring a domestic worker (in-home services) to care for a child may be the preferred childcare option for infants and toddlers when publicly provided childcare is lacking or not trusted. ILO research shows that a high reliance on domestic workers for care services is indicative of insufficient care service provision in countries (ILO 2018a). Therefore, the focus of this study is to model formal childcare provision in centre-based or community settings (home-based professional childminders) – but not in-home care work (nannies) – for both of the above age groups.

3.1. Parameters for a new model of universal childcare

Estimating the parameters required to provide universal full-time childcare of high quality is relatively straightforward, based on the methodology developed by De Henau (2022). This work builds and expands on the ILO (2018a) report

The main parameters used for this simulation are:

-

number of children to be enrolled/offered a place;

-

opening hours per week and per year;

-

staff pay and qualification (and provision for training costs);

-

ratio of children per staff; and

-

overhead costs.

The model of childcare services constructed here assumes group-based ECCE facilities, which can take varied forms adapted to local contexts, such as small community settings in rural areas, school annexes in urban centres, childminders’ houses, etc. Childcare workers’ wages are modulated according to their level of qualifications, ranging from the wages of school teachers to those of professional childminders. Wages are set to progressively increase as staff gain training over the years (see table 4 below).

3.1.1. Target enrolment rates

Enrolment rates are distinguished between earlier ages (commonly termed as “early childhood care and educational development” – ECED), often up to the age of 3, and “pre-primary” ages, from 3 up to entry into primary school. 19 The age of entry into primary school varies between countries, with the majority of countries studied having an entry age of 6. Eight countries have an entry age of 5; while 17 have an entry age of 7. This will influence the costings, and the study did not adjust for this difference so as to keep these national specificities.

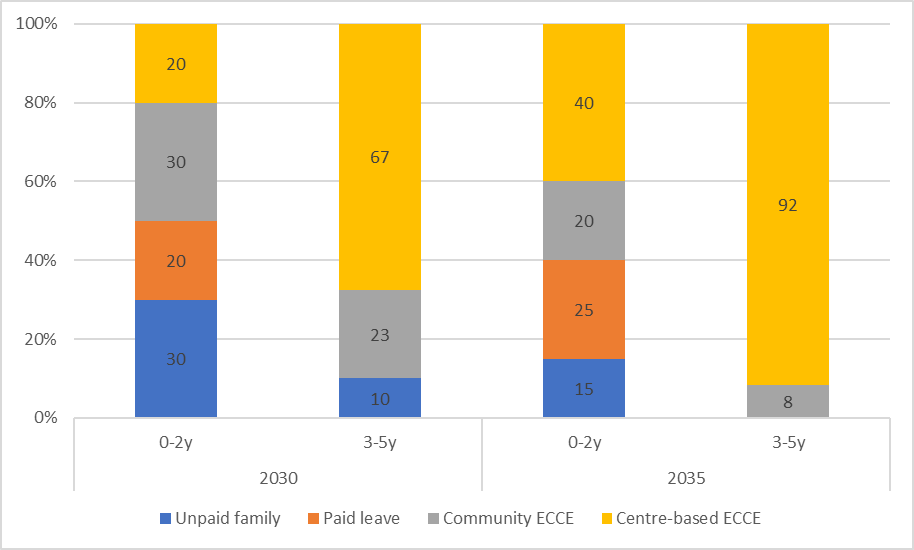

Figure 2 shows an illustrative enrolment rate in each type of care provision by age of the child, for the 2030 and 2035 targets. To reflect different qualification mixes, the figure distinguishes enrolment in childcare facilities by type of educational credentials: staff trained at the teacher level equates to ECCE and staff trained at the professional childminder level (including homebased professional childminders) equates to community childcare. 20 In practice both types of staff can operate in the same facility. It is assumed that upper-middle- to high-income countries will achieve the 2035 target in 2030, as they will start with a more developed childcare system. 21

The modelled target enrolment ratios in ECCE and community care for 2030 represent 50 per cent of the age group 0–2 years (75 per cent of the age group 1–2 years), which is in line with the assumptions in Ilkkaraçan and Kim (2019) and ILO (2018a). The target for higher-income countries is, however, more ambitious, at 60 per cent of the age group 0–2 years (90 per cent of the age group 1–2 years). As mentioned earlier, the first year of the child’s life, which is to be covered by paid leave, can be a modulated mix of leave and early childcare provision, depending on the country’s and the parents’ priorities.

The target enrolment rate for the pre-primary group is 100 per cent, again in line with ILO (2018a); although for lower-income countries the 2030 target is set at 90 per cent. This intermediate target would still satisfy SDG target 4.2.2 of ensuring all children have at least one year in pre-primary settings before entry into primary school. The other main difference between the 2030 and 2035 enrolment targets is the mix of community and ECCE provision (or mix of qualifications within a facility), which will impact on wages and thus overall costs.

Figure 2. Target enrolment rates of children in each type of “care” by age

Note: “Unpaid family” refers to unpaid parental care (not employed).

3.1.2. Opening hours

The modelled provision of early childhood care is set to 40 hours per week for all countries, to reflect full-time coverage, including commuting time. In practice, countries will differ in their average full-time working hours, especially in more agrarian economies, but by setting a 40-hour model, with implicit coverage of 5 hours of commuting time, the study effectively assumes a norm of 35 hours per week of full-time employment for parents to converge towards over time.

The provision is also costed for 52 weeks, ignoring potential holidays. This is to overcome the problem of lack of childcare provision available during school holidays in many countries that have school-based provision, such as kindergartens and preschools for children aged 3+.

3.1.3. Staff pay and qualifications

Other than the demographic composition of each country, staff pay and qualifications represent the most important part of the variation in costs. As the ILO (2018a)

For simplicity and to guarantee high quality, it is assumed that the qualification mix of childcare staff (whether in group-based or community settings) follows the breakdown of ECCE/community enrolment shown in figure 2. For example, in 2035 for the age group 0–2 years, 60 per cent of children enrolled in formal childcare will be looked after by an average of two-thirds teacher staff (teacher-level credentials) and one-thirds childminder staff. For the age group 3–5 years, 92 per cent of the staff will have teacher-level credentials. Childcare workers (ECCE) trained at teacher level have at least two years of post-secondary training and preferably hold a bachelor’s degree, depending on national educational standards for school teachers.

Under the model for this study, staff trained at professional childminder level (community) 22 are to be paid at 120 per cent of the minimum wage or equivalent to reflect a different level of educational credentials.

In upper-middle- and high-income countries the average wage of childcare workers with teacher-level credentials were set to those of pre-primary school teachers, where data is available, or to primary school teachers if not. 23 In most countries with data on both, the pay level of the former is very close to that of the latter anyway (OECD, n.d.). For those countries with missing data, the study has established that the level of pay would be at the average wage (AW), since primary teachers’ wages are close to that level in upper-middle- and high-income countries with available data.

In lower-middle- and low-income countries the level for teacher-level childcare workers was set at twice the AW. This corresponds to about 2.5 to 3 times GDP per capita and is in line with primary school teachers’ earnings, using data from a more fine-grained analysis carried out by De Henau (2021) for five African countries, which is close to the assumptions in Ilkkaraçan and Kim (2019), if slightly lower. 24 However, for those countries whose average wage for professional occupations is less than twice the AW, the ratio was set to 1.5. 25

Given the sensitivity of the costings to the level of the AW, further investigation would be needed to ascertain the quality of the data for these countries. The ratio of AW to GDP per capita available in low- to lower-middle-income countries varies from 0.6 in Indonesia and 0.9 in Nigeria and Ghana to more than 2 in Kyrgyzstan, Morocco and Nepal. In higher-income countries the ratio is closer, with the AW generally below GDP per capita.

The study also includes some provision for other staff, mainly for administration, cooking and maintenance, given as 2 full-time equivalent (FTE) staff per 50 children, paid at half the teachers’ wage. The study also considers the costs of training childcare staff, in proportion to the initial training required (for example, three years for a bachelor’s degree) depreciated over the typical years of employment, based on one staff for 25 trainees. This represents about 0.006 FTE per ECCE staff annually, paid at the level of teachers/lecturers. 26

All are costed in FTE based on 40 hours per week for simplicity. Provision is made for employers’ social security contributions and pension contributions, as well as holidays and sickness leave during which the staff is to be replaced, given the required “presential” time (that is, time spent directly with children) calculated below. About 14 per cent of the working time of ECCE staff is deemed “non-presential”, to deal with administrative or special requests, and an additional 10 per cent of working time is earmarked for holiday and sickness replacements at full pay (see De Henau 2019).

3.1.4. Child/staff ratios

Child/staff ratio is the other important factor that will drive the annual spending requirement through staffing costs. It is difficult to quantify “process” indicators of quality, such as the quality of the relation between teachers and children or of the pedagogical approach used. Instead, the model uses the typical proxy for this, which is the child/staff ratio, with the “norms and standards” ratio set at a low level (that is, few children per staff) for each age group to guarantee at least some structural quality. There are no international guidelines or standards for specific child/staff ratios (ILO 2018a), so the model follows assumptions found in the literature on best practice as well as various national norms and standards across different regions.

For high- and upper-middle-income countries, a ratio of 4 children aged 0–2 per staff and 8 children aged 3–5 (pre-primary) per staff is applied and reached by 2030, in line with the six best-performing OECD countries in the dataset and the literature of successful indicators of quality childcare (Huston, Bobbitt, and Bentley 2015). The few countries in which child/staff ratios are lower keep their lower ratios (for example, Iceland and Norway).

For low- and lower-middle-income countries, the ratio is set to 5 children aged 0–2 and 15 children aged 3–5 per staff, also in line with standards and norms in various countries and best practice (Huston, Bobbitt, and Bentley 2015). 27 It is more generous than the 10 children 0–2 found in the ILO’s

3.1.5. Overhead costs

In line with Wils (2015) and the ILO (2018a), overheads (non-wage costs) are set to 33 per cent of the total wage bill in all countries by 2035, although an intermediate proportion of 50 per cent is assumed for low- and lower-middle-income countries in 2030. This is because, by construction, childcare wages in 2030 are relatively lower in these countries than in 2035, so it is expected that the proportion of non-wage costs to be higher in 2030 since these are fixed costs per child that are unrelated to changes in staff pay (such as heating costs, food, equipment). Overheads include sufficient provision for healthy meals for children to reduce stunting.

3.2. Cost calculations of early childhood care and education (ECCE) provision

Table 4 below summarizes the main parameters for the costing calculations in the new model of universal high-quality ECCE provision.

The staff required per facility in full-time equivalents (FTE) depends on the respective child/staff ratios of each age group. It is the sum across the two age groups of the respective ratios of staff per child, multiplied by 1.24, to reflect the 24 per cent additional, non-supervision time needed per full-time equivalent staff (that is, 14 per cent for non-presential time 28 and 10 per cent to cover for holidays, care leave and sickness). Each childcare employee receives their respective monthly wage as calculated above (all in FTE).

Total costings per year are therefore the annual wage bill of childcare staff across all facilities, plus that of auxiliary staff and training staff, accounting for any employer’s social security contributions on top of gross earnings, and adding overhead costs.

This provides the total annual investment required for high-quality provision that overhauls the current system. Given that existing systems are often substandard in most countries in terms of child/staff ratios and pay, it would not make much sense to only cost the expansion of high-quality coverage for those not yet enrolled, thereby creating a two-tier system. Instead costing the expansion would need to take into account the current indicators of opening hours, fees, staff pay and child/staff ratios. A quicker way to make sure the right “additional” provision is costed is to simply take the total cost as calculated above (on children currently enrolled and those projected to be in each scenario) and subtract current public spending on ECCE, as this level of spending will reflect all the costs related to the current substandard provision and enrolment.

For example, in the United Kingdom, the net enrolment rate in formal ECCE of children aged 3–5 is 100 per cent (EU-SILC data 29), but falls to 41 per cent in FTE and to 24 per cent in free FTE when accounting for the average proportion of public subsidy. So, the expansion to cost for this age group would need to provide for 76 per cent of children, not 0 per cent. Moreover, such an expansion costing method would also need to account for a necessary rise in pay levels given the substandard wage levels and qualifications of current childcare workers in the United Kingdom. The complexity of the data required to cost such an expansion accurately, especially for non-EU countries, drives the alternative, more straightforward approach used in this study. Admittedly, such an approach still relies on accurate current funding data to subtract from the total, but it is likely that countries with no information on public spending on ECCE would tend to have negligible public spending anyway, as the results show in the next section.

Table 4 provides a summary of the main costing parameters retained. Note that some costs are not explicitly modelled, such as the additional costs of building the infrastructure (facilities) and administering the massive expansion of childcare services (although they are implicitly included in the overheads). 30 These are not negligible costs, but detailing them is beyond the scope of this study. Costing improvements in education systems more broadly (both in terms of quality and coverage) is also beyond the scope of this study, although it is important to note that political priorities in terms of budget allocation will be at play in many countries that would benefit from improving their compulsory education systems as well as early childcare provision.

Table 4. Main parameters of the simulated ECCE model

|

|

|

|

|

Age group enrolment |

60% of 0–2-year-olds (high- and upper-middle-income countries by 2030) 50% of 0–2-year-olds (low- and lower-middle-income countries by 2030. 60% by 2035) |

100% of age group from 3 years till entry to primary school (high- and upper-middle-income countries by 2030) 90% for low- and lower-middle-income countries by 2030 and 100% by 2035. |

|

Child/staff ratio (maximum) |

4 (high- and upper-middle-income) 5 (low- and lower-middle-income) |

8 (high- and upper-middle-income) 15 (low- and lower-middle-income)

|

|

Opening hours (supervision time) |

40 hours per week, 52 weeks per year |

|

|

Wage costs |

High- and upper-middle-income group: Pre-primary teacher or primary teacher wage (or average wage if missing) for 82% of childcare staff, and 120% minimum wage for 18% of staff. Low- and lower-middle-income group: twice the average wage or equivalent to teacher wage for 63% of childcare staff, and 120% minimum wage for 37% of staff (in 2030). Same qualification mix as for higher-income countries in 2035. All wages are then augmented by the country-specific rate of social security contributions of employers to obtain the total wage cost per employee. |

|

|

Additional time |

10% for covering holiday/sickness/care leave 14% for covering non-supervision time |

|

|

Other staff |

2 auxiliary FTE staff per 50 children (catering, admin, maintenance) 0.006 FTE per ECCE staff for training |

|

|

Overheads |

High and upper-middle: 33% of staff costs Low and lower-middle: 50% of staff costs |

|

|

Number of children per facility |

50 (divided by age group according to share of age group in ECCE target population) |

|

|

Non-modelled costings |

Construction costs (facilities), although indirectly included in overheads (mortgage repayment/rent) Compulsory education costs (to fill gaps in attainment levels when training new ECCE workers) |

Note: Facilities are assumed to have 50 children, but this can be modulated according to the type of provision. (For example, in community settings or childminders’ homes, it can be assumed that for every 50 children across different homes, two auxiliary staff are counted to help childcare staff). Note that these parameters have not been agreed upon by tripartite constituents. The scenarios are illustrative.

3.3. Results – Annual spending on early childhood care and education (ECCE) provision

Table 5 shows the total annual spending required to deliver universal provision of high-quality ECCE services as modelled in the previous section. It distinguishes between the notional expansion in funding required compared to current (estimated) levels of public spending, available from various international databases (Eurostat, OECD Family Database, UNESCO Institute of Statistics (UIS) Database). 31

Table 5. Annual spending requirements in ECCE by region (2019 prices)

|

|

Baseline |

Expansion |

Baseline |

Expansion |

Baseline |

Expansion |

Baseline |

Expansion |

|

|

2030 |

2035 |

2030 |

2035 |

||||

|

Region |

billions US$ (2019 prices) |

% GDP 2030 |

% GDP 2035 |

|||||

|

Africa |

2.3 |

90.0 |

2.7 |

131.4 |

0.09 |

3.52 |

0.09 |

4.19 |

|

Americas |

104.1 |

488.8 |

112.0 |

522.6 |

0.30 |

1.43 |

0.30 |

1.38 |

|

Arab States |

0.4 |

18.3 |

0.4 |

18.4 |

0.04 |

1.85 |

0.03 |

1.67 |

|

Asia Lower |

4.3 |

178.3 |

5.1 |

265.4 |

0.05 |

2.01 |

0.05 |

2.36 |

|

Asia/Pac. Upper |

66.2 |

520.2 |

73.7 |

628.8 |

0.18 |

1.40 |

0.16 |

1.38 |

|

Europe |

162.9 |

306.8 |

172.3 |

326.8 |

0.61 |

1.16 |

0.60 |

1.14 |

|

All regions |

340.3 |

1 602.5 |

366.3 |

1 893.2 |

0.31 |

1.45 |

0.29 |

1.48 |

Note: Current spending in billions US$ is that in 2019 (projected in % GDP to follow the share of 0–4-year-olds in the population by 2030 and 2035). “Asia Lower” stands for lower-middle- and low-income countries in Asia (including Kyrgyzstan); “Asia/Pac. Upper” stands for upper-middle- and high-income countries in Asia and the Pacific (including Kazakhstan); Europe includes Russian Federation, Turkey and Israel. Arab States include Saudi Arabia only.

Source: Author’s calculations.

As expected, the bulk of the total annual spending required would come from spending on expansion, especially by 2030, with a significant effort in Africa in terms of percentage of its GDP. In total across all regions of the world, annual spending on universal childcare services of high quality would be around US$2.2 trillion by 2035, with 82 per cent coming from the expansion of services (US$1.9 trillion), a six-fold increase on current spending. Even in Europe, which includes many countries with relatively well-developed childcare systems, the expansion would account for 65 per cent of total spending requirements, meaning total annual investment should nearly treble (from US$163 billion to US$470 billion in 2030).

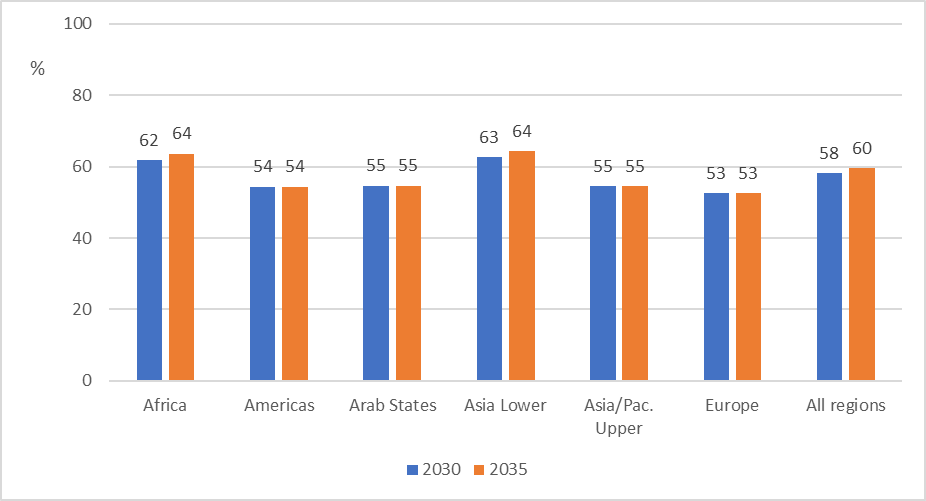

Figure 3 shows that the contribution of the younger age group (0–2 years – ECED) to the total costs of ECCE facilities is remarkably similar across higher-income regions (53–55 per cent) and higher for lower-income regions (62–64 per cent). These figures reflect the effect of a lower enrolment in the 0–2 age group (compared to the 3–5 age group) that is more than compensated for by the lower child/staff ratios for the 0–2 age group, especially in lower-income countries.

Figure 3. Contribution of the 0–2 years age group to total spending on ECCE (%)

Note: “Asia Lower” stands for lower-middle- and low-income countries in Asia (including Kyrgyzstan); “Asia/Pac. Upper” stands for upper-middle- and high-income countries in Asia and the Pacific (including Kazakhstan); Europe includes Russian Federation, Turkey and Israel. Arab States include Saudi Arabia only.

Source: Author’s calculations.

Examining cross-country differences in overall costs in 2030, three main factors explain about 90 per cent of the variation, when costs are expressed as a proportion of GDP 32:

-

the population of children targeted in proportion to the total population (which explains 57 per cent of the variation alone);

-

the ratio of the average wage (AW) to GDP per capita (which explains a further 19 per cent of the variation); and

-

the modelled wages in ECCE as a proportion of the AW (which explains a further 4 per cent of the variation).

On the low-spending end of the spectrum (below 1 per cent of GDP in total), countries/territories such as Singapore, Sri Lanka, Malta, Hong Kong (China) and Brunei Darussalam have low AWs in terms of per cent of GDP per capita. On the high-spending end of the spectrum, many African countries require expenditure of more than 5 per cent of their GDP (as does Kyrgyzstan), which is mainly driven by the high proportion of pre-school children in their population (above 10 per cent in most). By contrast, spending requirements in Nigeria, Rwanda and Ghana are lower despite also having large shares of young children in their populations (10 per cent or more), because these countries have lower ratios of AW to GDP per capita (<1).

Among high-income countries of similar economic and demographic structures, a few cases are worth noting. For example, Sweden has a higher spending requirement than Norway and Denmark, not only because of one extra year of age to cover (its primary school entry age is 7) but also because of a higher incidence of employer social security contributions, which adds to the wage bill. Childcare workers in Sweden are also paid closer to the AW compared to those in the other two countries. Germany and Canada are also projected to spend close to the same levels as Sweden despite a primary school entry age of 6, but this is mostly explained by a much higher ratio of ECCE wages to AW of about 1.4, compared to most other high-income countries where the ratio is around 1 or below.

In the discussion about whether to substitute childcare services for paid childcare leave (for children under the age of 1), it is useful to compare the simulated weekly costs per child of either type of care (in per cent of AW). In most countries, the weekly cost of paid leave per child under 3 years is larger than the cost of childcare, even in countries with higher informal employment where the modelled replacement rate for leave is lower than 67 per cent AW. Given the rise in qualifications and the related pay increase of childcare workers in lower-income countries, the unit cost of childcare increases in 2035, but is higher than the cost of childcare leave only in 10 out of 25 countries in that group. In higher-income countries the cost of childcare is only markedly higher than the cost of childcare leave in Mexico, Brazil and Portugal.

Long-term care

Care needs are examined for three different age groups with limitations in their daily activities:

-

disabled dependent children;

-

working-age population with limitations in daily activities because of long-standing illness or disability; and

-

older persons facing important functional limitations in their day-to-day activities (using an arbitrary age threshold of 65).

Box 2

Key concepts related to long-term care services

Long-term care services include support and assistance to older persons, adults and children with functional limitations to enable them to carry out activities of daily living (personal care), such as bathing and eating, as well as activities that are instrumental to achieving personal care, such as maintaining a clean household, cooking, dealing with administrative tasks or socializing. Long-term care services also typically include basic medical support, such as nursing care. Services are provided by nurses as well as non-health professionals, including domestic workers (“personal assistants or personal care workers”).

Functional limitations can result from a disability or the process of ageing. Disability is a complex, dynamic and multidimensional concept, with both a medical and a social component. It is an umbrella term for impairments, activity limitations and participation restrictions, referring to the various barriers that may result from the interaction between an individual with long-term impairments (physical, mental, intellectual or sensory) and that individual’s contextual factors (environmental and personal).

Long-term care services can be provided in community-based or in institutional residential settings. Community-based care refers to all forms of care that do not require older persons or persons with disabilities to reside permanently in an institutional care setting; they include in-home care, community centres and day centres. Institutional residential care refers to institutionalized care delivered in assisted-living facilities and nursing homes. Respite care provides short-term care in order to relieve unpaid carers. It can occur in people’s homes as well as in community and day centres or residential facilities.

Long-term care services can be provided in-kind or in-cash (or a combination of both). Under the first method, beneficiary older persons receive services from the public sector or private providers fully or partially compensated by the State (through non-contributory or contributory systems, such as taxation or social insurance). In the second scenario (cash-for-care schemes), beneficiaries receive transfers that can either be spent on long-term care services provided by paid care workers (in-home or institutions), or to be used as they see fit, including to compensate for unpaid services provided by family members.

Source: ILO 2018a; ILO 2022.

One of the aims of the study is to move away from a system that by default or by design relies on unpaid carers, so as to enable these individuals to remain attached to the labour market (at least for those of working age). However, this aim of reducing reliance on unpaid care is extended to the population of retired carers as well. Although care by partners and relatives may complement the formal system, relying on existing partners, even retired, can put extreme strains on them, may affect their own well-being and may lead to higher costs down the line (Hoefman, Exel, and Brouwer 2013). This means that eligibility to receive formal care should not rest on the presence of a willing unpaid carer, even within the household. 33

For all age groups, the focus is on person-centred care service provision that enables the people receiving care to live fulfilling and dignified lives with the autonomy to function and participate in society on equal terms to those without impairments. The rationale behind the model simulated is to improve the quality of care as well as its sustainability, affordability and accessibility. It is therefore comprehensive and universal.

As such, the model assumes that every person who needs care will receive collectively funded formal care regardless of income or family circumstances, free at the point of use, albeit with different intensity depending on the level of need. The model also aims to simulate decent working conditions for personal care workers, in line with a human-centred recovery plan from COVID-19 (ILO 2021a).

The costing of universal long-term care (LTC) will thus mainly depend on the following elements:

-

the prevalence of different types and intensity of care needs in each age group;

-

the extent of needs that should be covered (severe, moderate) and their type (personal care, household care);

-

the pay of care workers and qualifications (and provision for training costs);

-

the number and hours of care workers needed to perform different tasks; and

-

overhead costs (see table 7).

4.1. Extent of needs coverage

The first two elements of costings are likely to lead to the widest range of estimates, as it is notoriously difficult to measure “needs” and “adequate service” in practice. For example, household tasks of cleaning and cooking may not only benefit the care recipient but also their household. Moreover, people reporting impairments in household surveys may not all require the same level of “care”; for example, some impairments can be addressed by additional equipment or adaptations (including in the social environment, such as public transport).

The paragraphs below describe the process to determine a plausible density of full-time LTC workers per population by age group, as a proxy for the aggregate level of adequate care provision. 34 Several approaches are possible and these densities are estimated based on levels of needs approximated from different sources and methodologies.