Ride-hailing versus traditional taxi services: The experiences of taxi drivers in Lebanon

Abstract

Lebanon is experiencing a structural transformation of its economy and labour market, but at the same time has been hit by a series of crises in recent years. In the face of rising unemployment, it is often argued that digital platforms can offer new employment and income-generating opportunities. The platform economy’s role in structural change is not yet clear, but digital labour platforms undoubtedly have significant growth potential. An important concern is whether digital platforms can provide not merely jobs but decent jobs that could help to dampen the effects of rampant unemployment in Lebanon. This paper provides insights into the working conditions of platform-based taxi drivers, examining, among other aspects, the question of flexibility and autonomy at work and algorithmic management practices. It engages critically with the trajectory and development of taxi platforms and shows how they depend heavily on venture capital funds, the “non‑uberized” economy, the State and the non-market society in Lebanon. The paper also identifies areas in which regulations are required to harness the potential of digital platforms and other technological innovations to generate decent work opportunities.

Introduction

The series of crises that have hit Lebanon since 2019 have exposed systemic imbalances in the country’s economic and social fabric.1 Lebanon is experiencing a structural transformation of its economy and labour market. The role of the platform economy in this restructuring process is not yet clear, but digital labour platforms undoubtedly have significant growth potential. Such platforms are already now penetrating various sectors of the economy and they will play an increasingly greater role in the coming years, with implications for the future of work. An important concern is whether digital platforms can provide not merely jobs but decent jobs that could help to dampen the effects of rampant unemployment in Lebanon. The taxi sector is one in which platforms have been making inroads for several years now, and it is often argued that they create employment opportunities and provide workers with flexibility and autonomy. At the same time, ride-hailing platforms are also disrupting the traditional taxi sector, as the services they offer are cheap and can be accessed at the click of a button.

Digital technologies enable companies such as Careem and Uber to analyse how users (drivers and passengers) use their platforms, which provides them with significant insights into consumer behaviour and market conditions. In addition, the integration of real-time Global Positioning System (GPS) data and road traffic data allows platforms to achieve greater efficiency by optimizing the routes taken by drivers, which helps to lower the costs for consumers. Together with the wider choice and greater ease of use, this has made ride‑hailing platforms increasingly popular among consumers. Platforms are also attractive to drivers as they offer various incentives and bonuses, leading more and more traditional taxi drivers to switch to platform work.

However, it may be imprudent to rely on the international companies behind these platforms as an engine of recovery in Lebanon, since they tend to exit national markets when the economic and policy environment is not favourable to them. It is therefore important to understand the expansion of platforms, their current impact and their future prospects as a source of employment in the country. The taxi sector in Lebanon is quite different from that in other countries, as it is highly segmented, with different types of services available depending on customers’ needs. In addition, the sector is heavily regulated, entry being contingent on the fulfilment of several legal requirements. Both the Careem and Uber taxi platforms entered the Lebanese market around the same time (in June and July 2014, respectively), targeting mainly the high-end segment of the market. While Uber launched Uber Black, Careem set up not only a “Luxury Business” service but also an “Economy Sedan” service to attract different types of users.

As the taxi market is so segmented, it is possible that platform-enabled services will continue to occupy a small niche in the foreseeable future. Indeed, the traditional Lebanese system of shared taxis, known as servees (from the French pronunciation of “service”), with its carpool-like operation, allows drivers to optimize rides and this may allow such taxis to remain the preferred choice for most people, especially workers and students who commute daily and do not mind sharing vehicles in return for lower fares.

No systematic study has previously been conducted in Lebanon on the penetration of taxi platforms and its implications for drivers in the traditional taxi sector, or on the working conditions for drivers who operate on such platforms. This paper provides insights into the working conditions of platform-based taxi drivers, examining, among other aspects, the question of flexibility and autonomy at work and algorithmic management practices. It engages critically with the trajectory and development of taxi platforms and shows how they depend heavily on venture capital funds, the “non‑uberized” economy, the State and the non-market society in Lebanon. The paper also identifies areas in which regulations are required to harness the potential of digital platforms and other technological innovations to generate decent work opportunities.

An overview of the taxi sector in Lebanon

Public transport in Lebanon is a relatively small sector and there has been a decline in the number of State‑owned public companies following the long civil war (1975–90). Lebanon’s Railway and Public Transport Authority runs a small bus fleet, which has suffered from inadequate maintenance over the years. This neglect, combined with the unreliability of the service and the absence of any fixed schedule, has made publicly owned buses the least popular mode of transport, accounting for about 10 per cent of total public transport trips.

The lack of reliable government-run public transport has created a huge void in this sector and allowed a wide range of privately operated public transport services such as taxis, minibuses and buses to thrive. Privately run buses are quite popular as they are well maintained. Despite traffic congestion, this mode of transport is more suitable for longer trips. Minibuses are generally not well maintained, yet they are also popular owing to their speed and low fares and the fact that they connect high-density urban areas which are not well served by buses. Finally, servees taxis remain the preferred choice for daily commuters such as students and employees on account of their speed and affordability.

Unlike other countries, Lebanon does not have a uniform taxi market but, rather, several different types of taxis in operation. From a legal standpoint, all taxis have the same status, but they operate through different arrangements and have different occupancies and price levels. While each type of taxi caters to a specific niche market, all such vehicles have a distinctive red number plate. The taxis on the streets of Lebanon can be categorized into four types:

-

Servees taxis are the most popular option used by passengers. This arrangement, which is quite specific to Lebanon, is based on a fixed government-set fare. The servees drivers drive around, looking out for potential passengers waiting or walking down the road. Once they have spotted one, they stop in front of that pedestrian who, in turn, indicates his or her destination to the driver. The latter can either accept or refuse in view of the fixed (implied) fare.2 In contrast to a regular taxi ride, where the driver picks up a single passenger or a small group of passengers and drives them to the desired destination directly, servees passengers are constantly picked up on the road until the taxi is full.

-

Traditional taxicab services like those offered everywhere else in the world are also available in Lebanon, though they are not as popular as servees. The passenger hails an empty cab and is driven to his or her destination without being joined by any additional passengers. However, such taxis are more expensive than servees and are therefore used only by those willing to pay a higher fare in return for the comfort of privacy and the convenience of a faster service.

-

Many taxi drivers work entirely for taxi companies. They are in most cases full-time employees of that company and receive passengers exclusively through that company. Many use their own cars and/or taxi licence but it is also common for the taxi companies to have their own fleets of licensed cars.

-

Finally, there are a significant number of private cars operating as taxis. Their drivers are individuals without proper taxi licences (as identified by the distinctive red number plate) but who transport passengers for payment. Such taxis exist for multiple reasons. First, persistent unemployment in the country forces many individuals to use their available assets – in this case, their cars – to try to make a living. Second, the law enforcement authorities are unable to monitor such illegal practices throughout the country. Third, the public transport sector is severely mismanaged, with local authorities failing to ensure that adequate services are provided. As taxi licences are valid for countrywide operation, the licence holders can theoretically drive in any area. However, with licences being in limited supply and unemployment so high, demand for them pushes up their prices. This prompts many drivers to operate in urban areas, where passenger demand is highest, to recoup the costs of their licence or simply to increase their income, thereby depriving more remote regions of reliable taxi services and creating a supply gap that private cars can fill.

1.1 Entering the taxi sector

Entry into the taxi sector is contingent on the number of taxi licences, which is limited by the Government. In 1994, the number of licences was increased threefold from 10,649 to 33,290, but the Government has not issued any new ones since then. While the Government has claimed that the law in question was passed to ease traffic congestion and to tackle the problem of illegal licences, no study has been conducted to verify the measure’s effectiveness.

As the number of taxi licences is limited, they are often traded openly in a parallel market, with a single

licence costing between US$8,000 and US$10,000 – more than 300 times the minimum wage. Ownership of a taxi licence in Lebanon offers a major advantage in that the owner is covered by social security. For decades before the financial crisis of 2019, social security coverage was highly sought after, mainly because of rising healthcare costs. As neither universal healthcare nor retirement benefits are available in Lebanon, many people bought licences despite not actually intending to operate a taxi. Under Lebanese law, taxi licence holders are not allowed to leave their licences unused or to use their licensed vehicles for private transport. However, enforcement of these rules remains lax and violations are widespread. In addition to a taxi licence, individuals wishing to operate a taxi must hold a specific driving licence for that purpose, which is different from an ordinary licence. However, these are not especially difficult to obtain.

1.2 The advent of platform companies

The lack of adequate public transport services allowed ride-hailing companies such as US‑based Uber and Dubai-based Careem3 to enter the Lebanese market easily. However, in contrast to many other countries, the Lebanese authorities require all ride-hailing drivers to be legally registered as taxi drivers and to operate properly licensed taxi cars. This requirement was introduced, among other reasons, to placate the taxi drivers’ unions, which had protested against the entry of the platform companies. Nevertheless, many traditional drivers still demand that ride-hailing should be banned in the country.

The recruitment of drivers for the platform companies was not easy. The latter invested considerable sums in campaigns aimed at encouraging drivers to sign up to their platforms. There were large billboards and online advertisements targeting drivers. In addition, the companies deployed a sizeable army of marketing associates, typically young university students, with the sole purpose of attracting drivers to the platforms. These “brand ambassadors”, as they were dubbed by the companies, were equipped with a mobile internet hotspot. They would stop servees drivers on the road and explain to them the benefits of belonging to a ride-hailing company. Furthermore, they would offer to install the relevant app on drivers’ mobile phones and subsequently create an account for them on the platform. The ride-hailing companies also had a referral programme under which drivers already working on the platform were given US$100 if they managed to persuade another driver to sign up. This monetary incentive was paid once referred drivers completed their first ride for the platform.

Creating an account was the first step and after that the driver was required to submit a number of legal documents to the platform company. These included a driver’s licence, a clean criminal record, car registration papers, a taxi driving permit (idhin muzāwala) issued by the union, liability insurance, and an authorization (wakālat qiyāda), if the car or the licence was rented. There were also specifications to be met by the driver’s car, namely that it must not be older than ten years and must be in a good condition. The original documents had to be delivered in hard copy to the company, whereupon the car’s condition would be verified by company staff.

Once approved – almost a certainty unless the documents submitted were counterfeit or the car was in a poor condition – the driver would be invited to a training session. According to the drivers interviewed, this one-hour session tended to focus on how to use the app. After undergoing this training, a driver could log on to the platform and wait to be assigned rides.

As Uber and Careem claimed to have introduced a new type of service into the public transport market, they encountered widespread opposition from drivers’ unions and private taxi companies. The arguments made by their opponents centred on the legal basis for classifying workers – a common issue raised at taxi drivers’ protests around the world. According to the Commercial Register, the activities of Uber Lebanon include “the sale of a mediation service allowing users to secure, through properly licensed individuals, a car and a driver, including but not limited to taxi cars and properly licensed events cars, on demand through mobile phones and the internet”.

The above description is quite different from the remit of taxi companies. The latter are normally licensed to deal with “all sorts of taxi cars across Lebanese territory, and [to engage in] any activity originating from that commercial activity”. Moreover, taxi companies must abide by strict regulations such as owning at least ten taxi licences and having parking space for at least ten cars and an office with an area of 35 square metres or above. Taxi companies are also required to register their employees in the National Social Security Fund (since the licences are owned by the company) and to pay employer’s social security contributions, among others. Taxi companies therefore argue that they are being forced to compete on an uneven playing field (Yehia 2019).

Data and methods

The data for this paper is drawn from a survey conducted by the ILO among platform-based and traditional taxi drivers in June–August 2019 and May–June 2021. The sample in 2019 comprised 200 traditional and 200 platform-based taxi drivers, most of whom (167 drivers) were registered with Uber while the remainder (33 drivers) were registered with Careem. A smaller number of drivers were surveyed in 2021 (45 traditional and 54 platform-based taxi drivers), the focus then being on assessing the impact of the COVID-19 pandemic and the concurrent economic crises.

The questionnaires sought to gather information on the socio-demographic background of respondents; their work history, including information about other jobs; and their working conditions, including earnings, working time, work-related expenditure, social security coverage, autonomy and control, perceptions of work and workplace solidarity. The questionnaires contained detailed quantitative as well as open-ended qualitative questions (in Arabic) aimed at capturing workers’ experiences. The interviews were conducted in both 2019 and 2021 through computer-assisted personal interviewing with inbuilt validation rules, using mobile devices (mobile phones, tablets).

As it is difficult to obtain official statistics on the number of platform-based taxi drivers in Lebanon and their basic characteristics, we could not construct a sampling base from which to draw a random sample. In any case, the main objective of this research study was to understand their working conditions and their experiences with taxi platforms. The survey was conducted in three cities: Beirut, Tripoli and Jounieh (a city which attracts many tourists). A convenient sampling approach was adopted, and the interviews were conducted in different neighbourhoods, on different days, at different times of the day and with workers who were registered with Uber or Careem (the only two such platforms operating in Lebanon at that time) to ensure some heterogeneity. The taxi drivers were located by enumerators mainly on the streets and in places such as hotels, tourist sites, hospitals, universities, shopping malls, platform company support offices and taxi stands. In addition, the snowball technique, where respondents are asked to identify other potential subjects, was used to increase the sample size. The target population consisted of workers aged 18 years or older who had been working in the sector for at least three months.

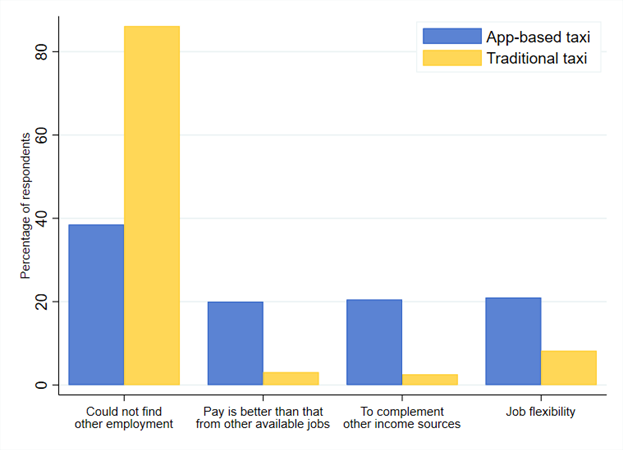

In general, taxi drivers in Lebanon are not highly educated: only a small proportion of the platform-based drivers (4 per cent) have a university degree and the share is even lower among traditional drivers (2 per cent). In Lebanon, driving skills are an important asset for workers, especially those with a low level of educational attainment. An overwhelming majority of traditional drivers (86 per cent) and a majority of platform-based drivers (39 per cent) in the sample reported that they had started working as taxi drivers above all because of the lack of alternative employment opportunities. The other main reasons reported by platform-based drivers for working in the taxi sector were job flexibility (21 per cent), the opportunity to complement other income sources (21 per cent) and better pay compared with other available jobs (20 per cent) (see figure 1).

Figure 1. Principal reason for working in the taxi sector in Lebanon, app-based versus traditional drivers, 2019 (percentage)

Source: ILO survey of taxi drivers in Lebanon, 2019.

Among the respondents, 79 per cent of traditional drivers and 78 per cent of platform-based drivers owned the car which they operated. A higher proportion of Uber drivers (80 per cent) than Careem drivers (64 per cent) owned their taxi. In addition, while 71 per cent of the traditional drivers had purchased the car specifically to work in the taxi business, this share was much lower among platform-based drivers (34 per cent). This is an interesting finding which indicates that many platform-based drivers are first-time taxi drivers: that is, they initially bought their car for another purpose and then went on to obtain a taxi licence (as required by the authorities) so that they could drive the car as a platform-enabled taxi.

A comparison of traditional and platform-based taxi drivers’ working conditions

The earnings of taxi drivers vary depending on the type of service. For the purposes of this paper, the analysis was limited to the differences between just two types: platform-based taxis and traditional taxis. Working as a taxi driver is the main source of income for about 93 per cent of traditional drivers, and for 76 per cent of platform-based drivers. These proportions are very similar to what is observed in many other developing countries (Rani, Gobel and Dhir 2022), but they are unlike those in developed countries, where taxi driving tends to be a source of supplementary income (Berger et al. 2019; Hall and Krueger 2018).

3.1 Earnings

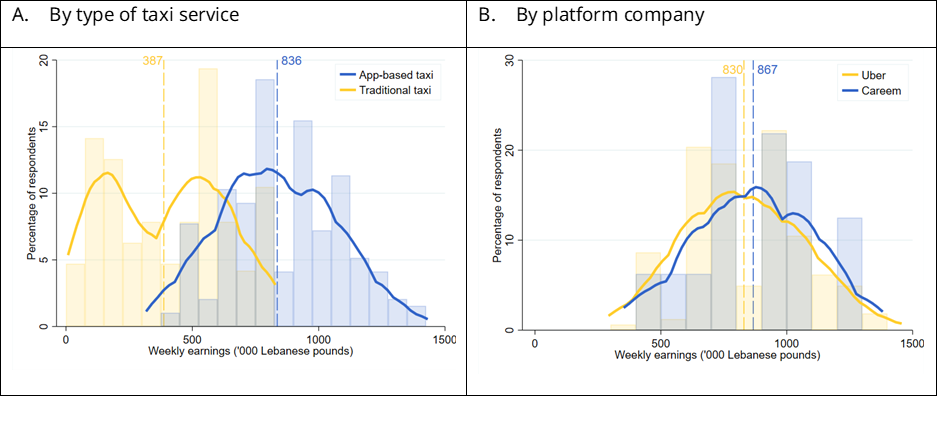

The hourly earnings of taxi drivers take waiting time into account, as it is difficult to separate this from their work as such. There are significant variations in earnings between traditional and platform-based drivers. The average weekly earnings of a traditional taxi driver in 2019 were 387,000 Lebanese pounds, which was less than half the earnings of platform-based drivers (836,000 pounds) (figure 2, panel A). The earnings of platform-based drivers who were registered with Careem were slightly higher, at 867,000 pounds, than those of Uber drivers (figure 2, panel B). The earnings of platform-based drivers were around 287 per cent of the national average wage for male workers in Lebanon, compared with 132 per cent in the case of traditional drivers.4 A statistical analysis controlling for all the basic characteristics shows that platform-based drivers in Lebanon earn about 80 per cent more than traditional drivers.

Figure 2. Distribution of weekly earnings of taxi drivers in Lebanon, by type of service (panel A) and by platform company (panel B), 2019 (Lebanese pounds)

Note: The broken vertical lines show the averages for each group.

Note: The broken vertical lines show the averages for each group.

Source: ILO survey of taxi drivers in Lebanon, 2019.

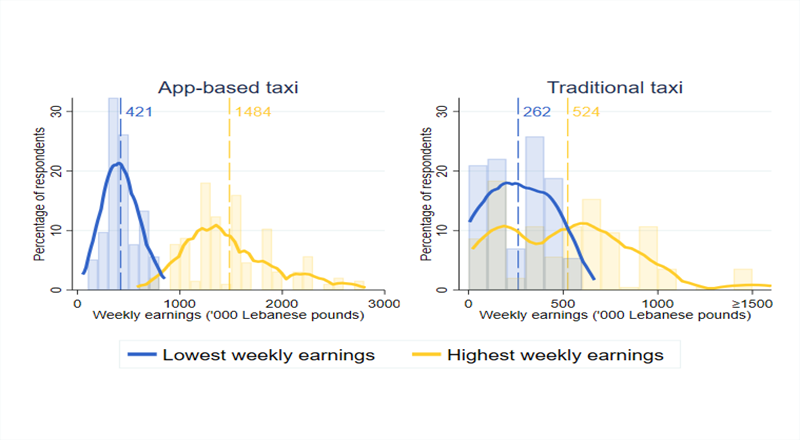

The earnings of taxi drivers in both groups also varied over time. Some of the platform-based drivers reported that the maximum weekly income per driver could reach about 1.5 million pounds, almost double their average income. In contrast, the maximum weekly earnings for traditional drivers stood at 524,000 pounds on average (see figure 3), which is less than the average weekly earnings of the platform-based drivers and about 80 per cent more than the national average wage of male workers. Despite these relatively high earnings, only a small proportion of taxi drivers manage to lay aside money from their monthly income. Indeed, the majority (83 per cent of traditional drivers and 66 per cent of platform-based drivers) reported that they were unable to build up any savings.

Figure 3. Distribution of maximum and minimum weekly earnings of taxi drivers in Lebanon, app-based versus traditional drivers, 2019 (Lebanese pounds)

Note: The broken vertical lines show the averages for each group.

Source: ILO survey of taxi drivers in Lebanon, 2019.

There are several factors behind the earnings differential between traditional and platform‑based taxi drivers, and these findings should be interpreted with caution. First, the high earnings of platform-based drivers are partly due to bonuses and incentives that they receive from the platform for several reasons, such as working during peak hours (62 per cent of respondents), meeting or exceeding a certain volume of rides (62 per cent) and working during unsocial hours (41 per cent). While the strategies for performance-based pay adopted by Uber and Careem were quite similar, a higher proportion of drivers registered with Careem reported that their bonuses and incentives were linked to meeting or exceeding a certain volume of rides (81 per cent) compared with Uber drivers (58 per cent) (table 1). Such strategies help platforms to retain their drivers: an overwhelming majority of platform‑based drivers (84 per cent) reported that bonuses and incentives were either “important” or “very important” for their incomes.

Table 1. Criteria for taxi drivers in Lebanon to receive bonuses or incentives on Uber and Careem, 2019 (percentage of respondents)

|

Signing up as new drivers |

Working during unsocial hours |

Meeting or exceeding an hourly threshold of rides |

Meeting or exceeding a certain volume of rides |

Working during peak hours with high demand |

|

|

Uber |

3 |

41 |

8 |

58 |

65 |

|

Careem |

0 |

44 |

3 |

81 |

59 |

|

TOTAL |

2 |

41 |

9 |

62 |

62 |

Source: ILO survey of taxi drivers in Lebanon, 2019.

Second, tips from customers constitute an important source of income, especially for platform‑based drivers, 96 per cent of whom reported receiving such tips, compared with just 16 per cent of traditional drivers. For both groups of drivers, these tips made up about 6 per cent of their income.

Third, the entry of taxi platforms into the Lebanese market has disrupted the traditional taxi sector and led to a decline in the earnings of drivers from that sector. Approximately 71 per cent of traditional drivers reported that their daily earnings had decreased owing to lower demand for their services. This is largely because platforms have been able to offer rides at a lower cost than traditional taxis with a view to attracting customers – a strategy made possible by the venture capital funds through which these platforms are often financed. About 40 per cent of the platform-based drivers have reported a decline in the fares charged for rides since they started with the company, which has an impact not only on their own earnings but also on those of their traditional counterparts, whose fares are set by local authorities.

3.2 Income volatility on taxi platforms

While the income levels of taxi drivers on platforms are higher than those of drivers operating traditional taxis, the former experience considerable income volatility, as observed earlier in the analysis of minimum and maximum weekly earnings. Some of the reasons for this volatility are discussed below.

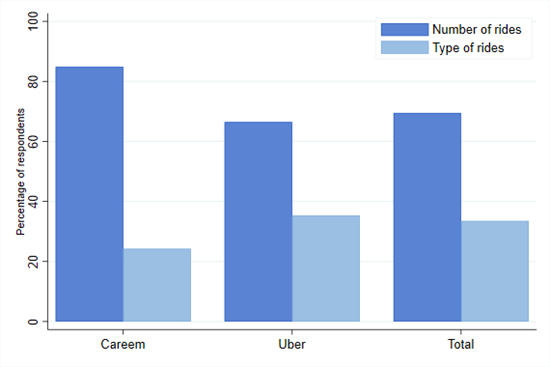

First, the income earned by drivers is directly related to the demand for their services on the platform. On any given day or week, drivers have no control over the number of rides that they will provide, since this depends largely on the algorithms used by a platform to assign rides based on drivers’ ratings and other factors. If a driver’s average rating is below a certain threshold, it becomes very difficult to get new rides, and sometimes drivers can even be deactivated from the platform without any justification being provided. The ratings have an impact not only on the number of rides that drivers are assigned but also on the type of rides, for both Uber and Careem drivers. Thus, about 70 per cent of the platform-based drivers surveyed believe that ratings affect the amount of work that they receive (figure 4).

Figure 4. Perceived impact of ratings on number and type of rides among platform‑based taxi drivers in Lebanon, 2019 (percentage of respondents)

Source: ILO survey of taxi drivers in Lebanon, 2019.

Second, unlike traditional drivers, most of whom (70 per cent) keep all the income that they earn, platform-based drivers pay part of their income from each ride to the platform as a commission fee, with the commission rate varying between 15 and 25 per cent for each ride. There was not much difference in the commission fees paid by Uber and Careem drivers.

Third, since the taxi platforms set the fares for a ride there is a huge variation in fares depending on the area and the time of day, with drivers often facing a sudden drop in the fare from one ride to the next. Moreover, platforms use “surge pricing” during peak hours to attract drivers to neighbourhoods where there is high demand. The incomes of taxi drivers are also affected by external factors. For instance, during the currency devaluation and inflation in early 2021, some of the platforms took time to adjust their rates. This led to major insecurity among taxi drivers as they were receiving less money for performing either the same amount of work or more work. Such reduction in income can disincentivize drivers, who are completely at the mercy of the market as there is no mechanism within the platforms or in the wider regulatory framework governing the taxi sector for tackling these issues. Taxi drivers on platforms are often not unionized and have very few tools at their disposal to cope with the situation.

Fourth, although the average income of platform-based drivers is higher, about 52 per cent of the respondents from that group did not consider their earnings to be fair and sufficient. This could be because platforms deduct a significant proportion of their earnings as commission fees (between 15 and 25 per cent).

Finally, the operational and maintenance costs of the vehicles are a significant item of expenditure that is often borne by the drivers. These include fuel costs, insurance, repair and maintenance fees, fines and parking fees, mobile phone charges and car wash costs. The survey findings indicate that the biggest cost is that of fuel charges, which, on average, consumed 42 per cent of the income of traditional drivers and 24 per cent of that of platform‑based drivers. In addition, the latter have to spend part of their income on mobile phone bills because of the nature of their work – a work-related expenditure that is not incurred by traditional drivers. Platform-based drivers also bear higher insurance costs (about 460,000 pounds per year) than traditional drivers (260,000 pounds per year).

Another significant cost incurred by taxi drivers is the rent paid for operating permits (which entitle them to use red number plates). As there is a limited supply of permits but massive demand, a huge parallel market has arisen for these permits (see section 1.1 and 3.6) and their cost is often beyond the means of most drivers. About 78 per cent of the taxi drivers operating on platforms owned their car, of whom some 28 per cent were renting their permit and spending 84,000 pounds per week on this. Approximately 91 per cent of the drivers who did not own their car rented the vehicle from someone else and spent, on average, 310,000 pounds per week on rental of the car as well as the permit. The proportion of traditional taxi drivers renting permits was slightly lower: 24 per cent of those who owned their car and 52 per cent of those who rented it. The rental costs of these permits were included in the vehicle rent and amounted to 190,000 pounds per week.

3.3 Employment relationship

Platforms classify taxi drivers as independent contractors, with Careem additionally referring to them as “captains”. The surveys included questions on whether platform-based drivers had read the platform’s terms and conditions and understood these. Most platform-based drivers had not seen a copy of their work contract. About 28 per cent of traditional drivers employed by a taxi company reported having seen a copy of their contract or the terms and conditions related to their job, while this was the case for only 19 per cent of platform-based drivers.5 Among those who had seen a copy, the terms and conditions were clear for 51 per cent; however, 32 per cent reported that they had not read the document. For most of the traditional drivers (79 per cent), seeing a copy of their contract was important or very important, while only 19 per cent of platform-based drivers felt that way. Indeed, a majority (67 per cent) of platform-based drivers considered that seeing their contract was unimportant.

3.4 Working hours

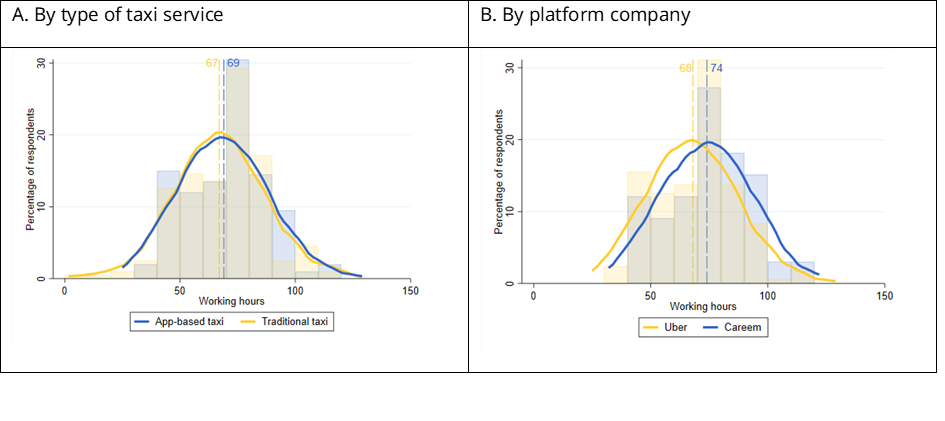

Irrespective of whether they are platform-based or operate traditionally, taxi drivers believe their job to be relatively stressful, especially because of traffic congestion. On average, drivers rated the stress level of their job as 8 on a scale of 1 to 10 (10 being “overwhelmingly stressful”), with no significant differences between the two groups. The high stress levels experienced by taxi drivers are not surprising, as most of them work between 60 and 80 hours per week. On average, platform-based drivers operate about 69 hours per week, which is slightly higher than the average for traditional drivers (67 hours per week). Both traditional and platform-based drivers typically operate six or seven days a week (see figure 5). About 65 per cent of platform-based drivers and 56 per cent of traditional drivers operate every day of the week. On Sundays, about 76 per cent of platform-based drivers and 56 per cent of traditional drivers are in operation, in both Beirut and Tripoli. Traditional drivers work much more frequently in the morning and afternoon (over 90 per cent) than during the night (10 per cent). More than half of the platform-based drivers remain operational throughout the entire day except for the morning, while 45 per cent work in the morning.

Figure 5. Distribution of weekly working hours in the taxi sector in Lebanon, by type of service (panel A) and by platform company (panel B), 2019

Note: The broken vertical lines show the averages for each group.

Note: The broken vertical lines show the averages for each group.

Source: ILO survey of taxi drivers in Lebanon, 2019.

3.5 Autonomy and flexibility

Platforms have tried to market themselves and attract taxi drivers through the flexibility and autonomy that they offer, implying that drivers can effectively be “their own boss”. That being said, traditional taxi drivers are able to set their own working schedules and decide when to take their lunch breaks, and which passengers to accept depending on the distance and also the destination. Some of this autonomy and flexibility is lost on taxi platforms, as drivers are not provided by the platform with information in advance about the customer’s destination or the distance to be travelled and have little time in which to decide whether to accept the ride or not.

Another more straightforward difference between the traditional and platform segments of the taxi sector has to do with the ability of drivers to influence the price of a ride. If platform‑based drivers really were “their own boss”, one would expect them to have a significant degree of influence on the price charged. However, the survey findings reveal that platform‑based drivers have no such influence at all: the fares are set by an algorithm, which takes several factors into consideration, and drivers do not have a choice once they have accepted the ride.

The fares set by the platform are not based on a simple computation of market equilibrium. Indeed, the algorithms are often referred to as a “black box”, since there is a lack of transparency over the factors that underlie fare calculations. Although the algorithms themselves are not open for inspection, it is known that platforms take non-market factors into account, and that there is often an element of human intervention. Relevant platform strategies in that regard include lowering fares to retain users or to penetrate new markets, increasing fares for specific regions to ensure that drivers are evenly distributed geographically, and increasing fares at certain times of the day and at weekends to encourage drivers to log on to the app during those periods. The fact that platforms operating in Lebanon are unprofitable further reinforces the view that fares are heavily subsidized through venture capital funds to allow the platforms to gain a foothold in the Lebanese market.

While drivers are given a choice whether to accept rides or not, in practice they are quite constrained. They have to make a binary decision (“yes” or “no”), with no possibility of negotiating either with the customer or with the platform. Furthermore, the use of acceptance rates as a performance indicator has implications for platform workers. When a driver cancels a ride, that decision is logged and aggregated. Refusing or cancelling a ride request may result in corrective action: 36 per cent of the platform-based drivers who participated in the survey reported facing such repercussions. These could take the form of a lowered rating (in 25 per cent of cases); accounts being blocked or suspended (21 per cent); fines or deductions from earnings (14 per cent); loss of income or no payments (10 per cent); ineligibility for bonuses (8 per cent); and a reduction in the number of rides (5 per cent). This “take-it-or-leave-it” approach hardly gives drivers a free choice, especially when they know that their decision will have a direct effect on their income and livelihoods. About 70 per cent of platform‑based drivers reported that the acceptance rate affected the number of rides that they subsequently received.

Moreover, for taxi drivers to be truly autonomous, they would need to have access to all available information. However, in practice, platforms do not provide information about a passenger’s destination until the driver has accepted the ride. Access to all relevant information when making a decision is essential to enjoy freedom and autonomy, especially as a self-employed worker. In fact, no entrepreneurs can be contractually forced to serve a client if they believe that it will not be profitable. The implicit elements of coercion in taxi platforms must be considered when assessing whether platform-based arrangements should be regulated as service provision contracts or as a form of disguised self-employment. The basic premise of freely negotiated contracts is the absolute freedom to choose, which does not seem to apply on taxi platforms.

3.6 Social protection

Health insurance is available to a large majority of taxi drivers in Lebanon, which is quite different from the situation in several other developing countries (ILO 2021). A higher proportion of drivers operating on platforms (87 per cent) have health insurance compared with those working in the traditional taxi sector (73 per cent) (see table 2). Among platform‑based drivers, about 35 per cent have another job as their primary job, which provides them with health insurance. For 74 per cent of platform-based drivers their insurance is covered by the National Social Security Fund (NSSF), while 13 per cent are covered by private insurance.

Table 2. Proportion of platform-based and traditional taxi drivers in Lebanon covered by social protection benefits, 2019 (percentage)

|

Health insurance |

Employment injury benefits |

Unemployment insurance |

Disability insurance |

Pension |

|

|

Platform taxi |

87 |

0 |

0 |

6 |

31 |

|

Traditional taxi |

73 |

0 |

0 |

0 |

3 |

Source: ILO survey of taxi drivers in Lebanon, 2019.

Although the NSSF legally covers and provides social security for all taxi drivers, the reality is much more complex. The social security benefits that accompany ownership of a taxi licence are normally granted to the driver. However, many licence owners choose to rent out their licence while retaining the social security coverage for themselves. The coverage is often sold as an “add-on” to the licence itself, meaning that drivers renting a licence are asked to pay additional amounts if they want the licence owner to also allow them to benefit from NSSF coverage. While this is illegal under the NSSF-related legislation, it is a widespread phenomenon. Investigations to verify whether the drivers of taxis match the registered licence holders are meant to be conducted by the NSSF, but these are few and far between.

The ILO survey found that about 28 per cent of traditional drivers and 41 per cent of platform‑based drivers in the sample drove using rented licences. The possibility of owners illegally benefiting from social security coverage was foreseen by the legislators, hence the stipulations of the decree granting NSSF coverage to workers that define beneficiaries as those driving for a living. However, various loopholes allow the illegal leasing of licences without social security coverage. In addition, the lack of enforcement procedures to penalize drivers or licence owners involved in such transactions leaves the drivers at the mercy of market forces. If the demand for licences exceeds the supply – as has been the case in Lebanon for decades – many drivers have no choice but to rent licences while forgoing the accompanying social security coverage so as to reduce their costs.

This situation also creates an adverse selection risk for the NSSF. Since social security coverage is traded separately on the parallel market for licences, only those with heightened health risks or pre-existing medical conditions will opt to pay the additional amounts necessary to benefit from such coverage, which in turn translates into higher expenditures for the NSSF.

While 31 per cent of platform-based drivers have a pension plan and/or retirement benefits, only a very small proportion of traditional drivers (3 per cent) have such plans or benefits. For platform-based drivers, the pension plan is provided through their earlier job under NSSF end‑of‑service indemnity, or in some cases by the private insurance that they have either from being self-employed or from another job that they are currently holding or previously held, and not through their platform-based work. Moreover, only 6 per cent of platform-based drivers and none of the traditional drivers contribute, through self-enrolment, to a private disability insurance scheme.

3.7 Unionization and collective action

The public transport sector boasts a unionization rate of 100 per cent, which is surprising given the labour movement’s rather modest performance in Lebanon. In fact, union membership is a prerequisite for certain official procedures and taxi drivers are almost always expected to show their union card when they are stopped by police at traffic stops. As a result, almost all legally registered taxi drivers are de facto members of a union. Nevertheless, for most drivers, interaction with the union rarely goes beyond the periodic membership renewal procedures. Unions in this sector have yet to demonstrate that they can help to bring about improvements in the working conditions of their members. The multiplicity of unions remains a significant obstacle to the formation of a robust and effective union movement, since the divided unions have failed to project a clear and unifying message that workers can rally around. One example is the recent debate about the increase in taxi fares. The law grants the Ministry of Public Works and Transport the right to set these fares. However, owing to the pervasive inflation that has gripped the economy, and especially the devaluation of the Lebanese pound, some unions have asked their member drivers to adopt a new fare while others have refused, creating confusion among drivers and passengers alike (Ali 2021).

Despite the aforementioned fragmentation, taxi unions are among the most active trade unions in the country. Protest actions by public transport drivers often include road blockages and are therefore a powerful means of winning public attention. However, such actions have rarely been effective in achieving specific gains for workers. Unions’ poor performance in that respect has led to frustration and scepticism among drivers about the effectiveness of collective action. Almost none of the unionized drivers interviewed had joined a union in the hope of being able to change anything in their working conditions, and 88 per cent did not believe that their union could help them to improve their working conditions.

The impact of platforms on the traditional taxi sector

The poor functioning of the public transport system and the existence of different types of private taxi services have allowed taxi platforms to exploit this gap and enter the Lebanese market. Pricing under existing taxi arrangements has been quite opaque, as the cars are not equipped with taximeters to calculate the fare, which is often left entirely to the driver’s discretion. The locals are less affected by this opaqueness as there are “standard” fares, while foreign tourists and visitors from other areas of the country who are not familiar with the public transport system in the main cities are more likely to be overcharged. The lack of trust in pricing means that ride-hailing platforms are preferred by tourists and other passengers unfamiliar with the local environment. The convenience of taxi platforms providing users with an estimated fare and time to reach their destination, along with the ability to track the ride, has played an important role in platforms’ success in establishing themselves in this market.

Servees drivers, who account for the majority of taxi drivers in the country, were hardly affected by the advent of ride-hailing platforms, as these targeted a different clientele such as tourists, who rarely use servees in the first place. Most of the regular passengers of servees drivers, notably students and employees with a limited budget, were not ready to pay the higher fares of ride-hailing platforms. Regular commuters were less likely to be impacted by unfair pricing as they were generally familiar with the average prices of their commutes. They were therefore less incentivized to switch to ride-hailing.

The impact of the ride-hailing platforms was felt mostly by drivers who operate as taxicabs, that is, driving usually a single passenger from one location to another, and who generally target customers willing to pay higher fares. They found themselves in direct competition with platform-based drivers and lost a significant number of tourist bookings. Taxi drivers would often offer to drive tourists around the country for a daily fare of about US$150. Such an arrangement was a significant source of income for taxi drivers, supplementing the fares that they received from their normal shifts. As tourists began to use ride-hailing platforms instead of hailing cabs on the street, traditional taxi drivers were forced to either switch to driving through platforms or risk losing access to that more lucrative clientele.

Owing to the regulation that restricts taxi work to the owners (or lessees) of taxi licences, platforms have led to an increase in the price of licences on the parallel market as there is greater demand from a new generation of drivers. The net effect of this increase in prices on drivers is not clear. Owners of licences have certainly benefited from the additional demand. On the other hand, those renting licences have mostly seen their costs increase even if they do not work as platform-based drivers.

The impact of the COVID-19 pandemic and the economic crises

A second survey of a smaller sample of platform-based and traditional taxi drivers was conducted by the ILO in May–June 2021 to assess the impacts of the COVID-19 pandemic and the concurrent economic crises. About 72 per cent of respondents said that they were continuing to work as taxi drivers, while 21 per cent reported having permanently quit their jobs; the remaining 7 per cent said that they were not currently working but that they did intend to resume their work as taxi drivers eventually. Those drivers who permanently quit their taxi job did so for reasons not related to the pandemic. They had either found a better alternative or were no longer satisfied with the income they were earning as taxi drivers, especially after the currency devaluation and the economic crises in the country.

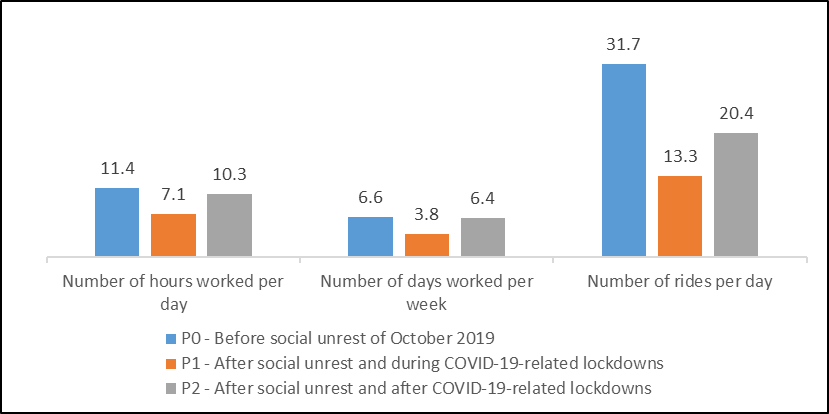

The survey findings indicate that the closures and curfews imposed to try to curb the spread of the coronavirus had a much bigger impact on taxi drivers than the civil unrest of October 2019. The pandemic was cited as the main reason for a slowdown in their activity by 87 per cent of respondents. Specifically, taxi drivers were asked to compare their daily working hours, number of days worked per week and number of rides per day during three different periods: P0 (before the social unrest of October 2019); P1 (after the social unrest and during COVID‑19-related lockdowns); and P2 (after the social unrest and after lockdowns). These indicators of activity decreased following the social unrest, but they decreased even more during lockdowns (see figure 6). This is probably due to the restrictions on movement imposed by the Government, which automatically reduced demand for taxi services. For example, taxi drivers’ working hours decreased from 11.4 hours per day in P0 to 7.1 hours in P1; they then readjusted in P2 to 10.3 hours, a level that is still lower than that of P0. Moreover, 79 per cent of respondents reported that the number of requests for rides in a typical day had decreased since the start of the pandemic because there were fewer potential clients and people could not afford to use taxi services to the same extent as before.

Figure 6. Selected indicators of activity of taxi drivers in Lebanon, 2019–21

Source: ILO survey of taxi drivers in Lebanon, 2021.

The average number of rides per day dropped from 31.7 before the social unrest of October 2019 to 13.3 during the COVID-19-related lockdowns in 2020. Although drivers were, on average, taking 20.4 rides per day after the lockdowns, this was still lower than the level before October 2019.

5.1 Changes in income and expenditure

Taxi drivers’ income was also dented by the pandemic but it was subsequently readjusted as the result of a fare rise. Before the social unrest of October 2019, the average weekly income of traditional drivers had stood at around 726,000 Lebanese pounds and that of platform‑based drivers at 590,000 pounds. These averages decreased by almost half during the lockdown periods (333,000 pounds and 225,000 pounds, respectively), but afterwards they increased to 2,061,000 pounds for traditional drivers and 465,000 pounds for platform‑based drivers.6 Indeed, drivers reported that their income had fallen during the pandemic because of the decrease in activity (31 per cent of respondents) or owing to currency depreciation (32 per cent), but a significant proportion (31 per cent) said that their income had increased because of the higher fares. Only 6 per cent of drivers reported that their income had not changed. In addition, 88 per cent said that they had not experienced any changes in bonuses or incentives since the start of the pandemic. As for gratuities, the majority stated that these had decreased in their total value (in US dollar equivalent terms) owing to the currency depreciation.

As a result of the decline in demand and earnings, the financial situation of taxi drivers’ households has worsened since the start of the pandemic, as reported by 80 per cent of the drivers surveyed. A sizeable proportion of these households (64 per cent) reported receiving support from the Government to meet their needs. The coping strategies adopted by these households included cutting down on unnecessary expenditure (91 per cent), deferring payments of bills (36 per cent), selling possessions (24 per cent), falling back on savings (20 per cent) and taking out loans from friends or relatives (19 per cent). After deducting all work-related expenses, the average take-home share of income is 51.4 per cent for traditional drivers and 33.3 per cent for platform-based drivers. Moreover, although 76 per cent of drivers owned the licence that enabled them to operate a taxi, 35 per cent were still paying rental charges and 24 per cent said that the payment terms had changed and that rental charges had increased since the start of the pandemic.

5.2 Differential effect of the economic crises

The effect of the several concurrent economic crises was not homogenous across the two groups of taxi drivers. The COVID-19 pandemic seems to have hit platform-based drivers much harder than traditional ones. Thus, platform-based drivers saw the average number of rides that they were assigned per day fall from 20.4 before the social unrest of October 2019 to 4.0 during the lockdowns. This subsequently picked up again but had only recovered to 12.2 rides per day at the time of the survey in May–June 2021.

When asked whether they had stopped working since the start of the pandemic, 80 per cent of platform-based drivers said that they had (for periods ranging from a few days to a few months), compared with just 41 per cent of traditional drivers. Most platform-based drivers (76 per cent) explained that lockdown restrictions had been the main reason for the decline in their activity. Indeed, while ride-hailing apps were completely shut off during the lockdown, some traditional taxi drivers managed to evade the restrictions and continued to operate. None of the drivers reported having another job to fall back on as an additional source of income.

This differential impact of the economic crises has prompted many platform-based drivers to abandon the platforms and work as traditional drivers instead. Of the drivers surveyed in 2019 who were then working on platforms, about 48 per cent had switched to traditional taxi driving by the time of the second survey in 2021. As for the drivers who reported operating traditional taxis in 2019, only 2 per cent had become platform-based drivers two years later.

Sustainability of platform-mediated work and its subsidization

Approaching taxi platforms as a stand-alone market and treating its internal mechanisms as if they were self-contained can be misleading. Platform work relies for its expansion on pre‑existing institutions and arrangements, which one would not expect to see in a hypothetical, entirely “uberized” economy of the future. In effect, the lack of protection and the volatility in working conditions and income faced by drivers are only sustainable because platforms are heavily subsidized by venture capital funds, the “non-uberized” economy, the State and the non-market society.

Full-time workers (35 per cent of the taxi drivers) who engage in platform-enabled activities in their free time are a typical example of the non-uberized economy subsidizing uberized activities. These employees benefit from the security afforded by a permanent job, which includes social security coverage, a fixed and steady source of income, and other allowances (for, say, education and transport). This may lead them to overestimate the profitability of their platform-mediated additional activity, or “gigs”. In other words, had it not been for the wide array of allowances and benefits from their full-time position in the non-uberized economy, their supplementary work as platform-based taxi drivers would not be sustainable.

The State is also essentially subsidizing the ride-hailing platforms, both directly and indirectly. Direct forms include the social security coverage offered to taxi licence owners. This depends on the driver being the licence owner or renting the licence from an owner who is not interested in such coverage, in which case the driver needs to be able to pay the additional fees, as described in section 3.6. Moreover, the State offers an indirect subsidy by virtue of its position as the guarantor of public welfare. As individuals working in platform activities lose access to the benefits available to full-time employees in non-uberized sectors, and as they are exposed to market volatility, they naturally have to rely on existing forms of public welfare assistance as a last resort. After all, platform workers require the same public services and are vulnerable to the same social, economic and medical risks as any other worker. However, unlike existing full-time employment arrangements, these needs are not reflected in the model contracts and revenue packages for platform-enabled work. Platforms may thus be described as “free-riders” on public welfare systems, which bear all the costs that under labour law are incorporated either into direct sums paid to full-time employees or into mandatory in-kind remunerations (such as health insurance, family allowances and sick leave). This is on top of the de facto subsidy resulting from the fact that the Government’s share of the National Social Security Fund (NSSF) contributions of taxi drivers has not been paid in years, meaning that the actual social security costs of these drivers were borne by the other insured, overwhelmingly “traditional” workers who work in the offline economy.

When the welfare system fails to meet their needs (for example, if there is an increase in waiting times for social security reimbursements), drivers turn to a third source of subsidies: their own social network. Such subsidies are provided by the relatives, friends and acquaintances of drivers, which allows them to obtain necessary goods and services more quickly at discounted prices or under informally negotiated instalment plans.

Treating ride-hailing as a coherent and smoothly functioning sector would therefore imply ignoring the subsidies provided by the non-uberized economy and existing social institutions. This can lead to a false assumption of sustainability, as would soon become clear if that new form of work were to expand further and completely replace existing arrangements, specifically non‑uberized activities and non-market social interactions.

In other words, the volatility and uncertainty of the platform economy are only sustainable when the latter is embedded in a wider economy and supported by its social institutions, laws and social ethics. The gradual expansion of the platform economy thus entails a structural contradiction. As the platform economy penetrates more and more sectors, it simultaneously undermines the subsidies it requires to survive, or at the very least the subsidies that allow platform workers to enjoy decent living standards and acceptable working conditions.

This should not be seen as inevitable. Strong traditions of mutual assistance and the reciprocal exchange of services and goods have in the past helped to bridge the gap between the needs of individuals and what the market has to offer, especially at times of transformation. However, when the social safety net was weakened by multiple economic, demographic and social factors associated with economic modernization, regulations were necessary to ensure that wages and working conditions were able to support decent living standards. A similar approach is required when addressing the gradual transformation of the “gig” economy into a sector in its own right, to ensure that the unsustainability of such activities does not translate into a downward spiral of precarity for the individuals involved.

6.1 Social protection

Although taxi licence owners benefit from social protection by the NSSF, the parallel market for licences undermines that system as many drivers renting a licence may have to forgo such coverage if they cannot afford the additional amounts demanded by the licence owner. Since platform-based drivers are more likely to rent rather than own the licences that they use to operate and are generally younger, they are less likely to choose to pay for social security coverage. This leaves them at significant risk, especially given the stressful nature of such work – an aspect that they emphasized during the interviews.

Platform-based drivers do not benefit from NSSF coverage, and many do not have another job that would provide them with social security entitlements. While some platforms do provide insurance for accidents that occur when fulfilling an order, this practice is far from universal. Since taxi drivers are not contractually considered employees of the platform, and since NSSF coverage is largely employment-related, they do not have any other means to access social security benefits separately if they wanted to.

The fact that platform-based taxi drivers can only benefit from social protection as a “spill-over” from separate eligibilities, rather than by virtue of their platform-enabled work, is highly problematic. On the one hand, the case of platform-based taxi drivers with rented licences demonstrates how lax enforcement of the law has turned the right to social protection into a tradeable asset whose price is determined by market forces. This effectively means that as working conditions of the workers deteriorate, the price of social protection coverage increases, rendering it even more inaccessible to those who need it the most. Arguably, this is already taking place as NSSF reimbursements are no longer in line with market rates, meaning that only those who can afford to pay out of their own pocket can access healthcare. On the other hand, the complete lack of regulations enshrining the right of platform-based taxi drivers to social protection leaves such workers in a very vulnerable position, which is all the more unfair in view of the essential services that they provided to society during the COVID‑19-related lockdowns.

6.2 Rights at work and the question of control

Activities in the platform economy in Lebanon take place in a relative legal vacuum. Any regulations affecting that sector are usually limited to the areas of overlap with other sectors. In other words, the regulations pertaining to the platform economy were originally put in place to regulate other economic sectors or areas of activity. For example, the requirement for platform-based drivers to have distinctive number plates, with all its legal ramifications, is more a trickle-down effect from the regulations governing the taxi sector than one specifically designed for ride-hailing. The contracts between drivers and platforms are arbitrated in the same manner as any other contract. There are no specific regulations aimed at organizing the platform economy as a new economic paradigm with its own challenges, power relations and legal loopholes. The application of seemingly obsolete or at the very least incomplete laws to a highly dynamic new form of work has its pitfalls.

Nevertheless, this legal vacuum does not imply a complete absence of rules. Many of the issues normally dealt with at the regulatory level are treated (for better or worse) in the “service contracts” that define the relationship between platforms and their drivers. However, that relationship is far from equal, with the platform retaining a significant level of control over the driver. Indeed, several class action lawsuits by platform workers have pointed to the level of control that the platforms have over their work as evidence that they are employees and eligible for the relevant benefits. In effect, driver conduct is significantly controlled by the platforms, but that control is exercised indirectly.

Passenger ratings are among the most effective means of control used by ride-hailing platforms. At first glance, such ratings may seem like genuinely unbiased feedback from passengers but, in reality, they serve to indirectly enforce the platform’s rules. Ratings are based on customers’ expectations, which are heavily influenced by the platform. Thus, in their marketing of ride-hailing to consumers, platforms seek to portray this as a luxury service revolving around comfort and ease of use. For example, images of smiling taxi drivers holding doors open for happy passengers are often used in marketing campaigns, together with promises of timely arrivals and quick, efficient rides. These positive attributes are perceived by passengers as the benchmark against which a platform’s services should be rated. Drivers who do not meet the expectations normally receive lower ratings and are therefore at higher risk of suspension.

Promising a certain level of quality is widely used in the marketing of goods and services elsewhere, and there is nothing devious about it as such. However, setting high customer expectations and then penalizing drivers who do not meet those is tantamount to establishing a de facto code of conduct. The only difference here is that compliance with this code of conduct is monitored by a third party and enforced by an algorithm put in place by the platform – an algorithm that can be modified as the company sees fit to advance its interests.

Indeed, this may lead to even stricter enforcement than one would expect in a normal employer–employee relationship. Customers’ perceptions of politeness, comfort and even speed can vary widely. What one passenger perceives as pleasant and friendly behaviour may well seem rude and disturbing to another. However, all customers’ ratings are weighted equally when determining a driver’s average rating, and, by extension, they all have the same potential to trigger the driver’s suspension from the platform. As a result, instead of following a clear code of conduct, drivers find themselves constantly having to adjust their behaviour patterns in the hope of satisfying the expectations of new customers, whose perceptions they have no way of knowing in advance. Since one less-than-perfect rating could trigger a suspension by causing a driver’s average rating to fall below a threshold that is not known to them either, the whole process results in a forced overzealousness that is likely to be accompanied by financial and psychological stress.

In a normal employer–employee relationship, conduct and performance are monitored by one party, the employer, against a clear set of criteria. Even if corrective action is taken by an employer, employees are able to protest and to clarify the issue if necessary. This is not possible for platform-based drivers, whose aggregate rating is an automatically generated average of the ratings from multiple customers whom they served in the past, each of whom may or may not have had specific complaints about the service provided.

The platform thus exercises a significant level of control over how drivers go about their supposedly entrepreneurial activities. Through a combination of algorithmic design and targeted marketing, platforms have developed powerful enforcement rules. Platforms assign the monitoring of drivers and evaluation of their performance to the customers. Nevertheless, the rules for penalizing drivers are set by the platform, and as a result, even unfair ratings by demanding passengers can damage their ratings and reputation.

6.3 Unionization and collective action

Despite the spirit of camaraderie and the common grievances that they share, platform-based drivers have not been able to mount a concerted collective action to lobby for their concerns. Efforts to do so have been hampered by the lack of sector-wide relationships of trust between the various drivers, most of whom have never met in person. The use of referrals to organize, that is, asking drivers to refer colleagues and introducing these to the objectives and methods of a planned collective action, had not succeeded in generating a “trust network” among drivers. This is largely because drivers are constantly afraid that the platform companies are trying to infiltrate their circles with a view to punishing the organizers of and participants in such campaigns.

A more specific obstacle to collective action has to do with the design of ride-hailing platforms. In the event of a shortage of drivers in a given area, the “surge pricing” algorithm normally increases fares to encourage drivers to service that area. However, this also means that if several drivers collectively decide to stop using the platform for a day as a sign of protest, those drivers who do not honour the collective decision have their fares multiplied. Moreover, because many of the core functions are automated, the impact of driver strikes very much depends on the scale of organization. As essential as they are to the service offered by such platforms, drivers are in fact the most interchangeable element of the operation, since there is a large pool of them. Therefore, only a strike involving numerous drivers can cause a real disruption to the service.

The platform algorithms essentially act like a pressure valve that inhibits and undermines any collective action. The ability of platforms to indirectly deter agreement and collective action among drivers is problematic. This is especially important, bearing in mind, that the current unprofitability of platforms will almost certainly translate into an increase in commissions in the future. It will then be even more imperative for drivers to organize. Whether they decide to do so as “entrepreneurs” or “workers” is irrelevant. As the market share of platform-enabled services grows, and as these platforms merge to consolidate their control, it is essential to ensure that mechanisms for the democratic negotiation and renegotiation of the terms and conditions of work are in place to prevent the emergence of a monopolistic situation.

Conclusions and policy recommendations

Ride-hailing platforms have the potential to provide decent employment opportunities in Lebanon. However, they have created new challenges that need to be addressed. In particular, the working conditions of taxi drivers are determined by the terms of their service agreements with the platforms, which are unilaterally set by the latter. To remedy this situation, regulations would need to be introduced by the State to safeguard basic rights and decent working conditions for platform workers. Some policy recommendations that could help in tackling the challenges of platform-enabled taxi work are set out in the following sections.

Stronger enforcement of taxi regulations

Although the provision of social security coverage for taxi drivers is commendable given that there is no universal social protection in Lebanon, lax enforcement of the regulations governing benefits have decoupled such coverage from its employment basis. Social security coverage has thus become a commodity traded on the secondary market for taxi licences, rather than a right for those working as taxi drivers, as originally conceived. In other words, the need (or lack thereof) for such coverage is now one of the factors determining the price or rental rate of a taxi licence rather than the work of the taxi driver in question. The price of this “social security add-on” is effectively determined by its value to the drivers who need it the most, which creates an adverse selection risk for the National Social Security Fund (NSSF) while simultaneously negating the raison d’être of social protection as a right for all taxi workers.

A stricter enforcement of the requirement that only those working as taxi drivers should enjoy social security coverage would benefit all taxi drivers. First, it would automatically extend social security coverage to them and improve their working conditions, especially for those operating through rented licences, who must often pay the licence owner an additional fee for such coverage. Second, it would disincentivize the purchase of taxi licences merely to obtain social security coverage. That would cause licence prices to fall, opening up the sector to all those wishing to work as drivers, but for whom the high cost of licences had been prohibitive. In that regard, regulators could partner with the platforms and use their more up-to-date and accurate database of drivers to ensure that these drivers are provided with social security coverage, while developing new oversight mechanisms to do the same for traditional taxi drivers.

Such a measure would have to be complemented by a new model for funding social protection coverage. Currently, taxi drivers’ social security contributions under Decree No. 4886 of 1982 are calculated on the assumption that drivers are earning the minimum wage, and they are paid by the drivers themselves. That arrangement was anchored in the service that self‑employed drivers provided to society. If it were to remain unchanged, the platforms would continue to benefit unfairly from social subsidies, as explained in section 6.1. Instead, a new arrangement should be introduced so that risks are distributed equitably, tying contributions to a driver’s earnings but also ensuring that platforms which benefit from such coverage also bear part of the costs. The details of such an arrangement would have to be elaborated through dialogue between the drivers (both traditional and platform-based), the NSSF, relevant ministries and the platforms themselves.

Unionization and freedom of association

While unionization rates among taxi drivers are impressive, the existing unions have not only been consistently excluded from governmental decision-making processes but they have also failed to properly integrate platform-based drivers. Indeed, during the early stages of the expansion of ride-hailing platforms in Lebanon, unions were overtly hostile to platform work. A compromise was ultimately reached, whereby all platform-based taxi drivers were required to be in the possession of legitimate taxi licences. However, that was not followed by any specific efforts on the part of unions to understand the challenges associated with this new work arrangement or to adapt accordingly. Meanwhile, as described in section 6.3, platforms have an intrinsic anti-union atmosphere that undermines any independent effort by platform‑based drivers to organize and engage in collective action. Working conditions in the sector are set by the platform itself, which retains that power through internal performance indicators, an asymmetric access to market information and a firm grip on the niche clientele who use ride-hailing services.

As platform taxi work evolves, it is crucial that drivers be given a say in how their rides are allocated, priced and organized by promoting freedom of association among platform-based drivers. Any new trade unions that are set up must be equipped with the technical resources required to address the new challenges of platform work.

Existing unions have an important role to play in such efforts, regardless of whether the new unions are formed as separate entities or are absorbed within existing ones. The analysis presented in this paper has highlighted the symbiotic interlinkages between traditional and platform-based work in the taxi sector. These interlinkages justify and should underpin future campaigns to expand the role of unions and encourage unionization among platform-based drivers with a view to improving their working conditions.

Addressing information asymmetry

The entry of platforms into the taxi sector was accompanied by the digitalization of several aspects of such work, including fare calculation, route selection and customer satisfaction management. This is a sharp break with the traditional arrangement, where taxi drivers possess all relevant information and are able to adjust their work accordingly. The data, generated through devices owned by drivers and passengers, allows the platforms to gather market intelligence in real time while denying that information to the originators.

If platform-based drivers are indeed self-employed entrepreneurs, they should be able to make their theoretically independent decisions by analysing all the available information. However, as platforms are not transparent and there is an asymmetry of information, which skews the balance of power between drivers and platforms, giving the latter significant leverage that they can use to maximize their profits at the expense of drivers and passengers alike. The value of information in this context cannot be overstated. It allows the platform, among other things, to improve its algorithms (for example, using data from previous rides to predict the duration or cost of a new trip), ensure compliance with platform regulations (for example, real‑time GPS data can warn the platform whenever a driver exceeds the speed limit) and match passengers with the nearest drivers.

Not only are taxi drivers contributing to the capital of the platform company (insofar as the robustness and functionality of its algorithms are an asset), but they are also using their own capital to do so (their smartphone or their own car). In addition, platforms are able to collect massive amounts of data that the company can use internally for machine-learning algorithms and for algorithmic management. These algorithms are used to allocate work and to monitor and discipline workers with the support of GPS tracking. While the platforms benefit from the “datafication labour” performed by the drivers, they often do not have many rights over their data. Efforts should therefore be undertaken to safeguard drivers’ access to the digital data that they create, or at the very least to develop a mechanism to remunerate them for that data.

Acknowledging and regulating new forms of control

Taxi platforms market themselves as champions of freedom and flexibility by classifying taxi drivers as self-employed so that they can earn a higher income. In reality, though, the relationship between platforms and workers is much more complex. As discussed in sections 3.5 and 6.2, platforms exercise a significant level of control over who provides the service, how it is provided and how it is priced. Although this does not entirely coincide with the traditional employment relationship, an arrangement involving such levels of control cannot be deemed as self-employment either. The market forces will only play to the detriment of the drivers, given the monopoly held by the platforms and the lack of protection for the drivers engaged in such an arrangement. A novel regulatory approach is therefore necessary – one that maintains the autonomous aspects of taxi work which all drivers seem to cherish while providing them with the basic security and rights that are not guaranteed by the current legal framework or by the platforms’ terms of service.

The need for such an approach is becoming increasingly urgent as more and more workers take up “gigs” as their main source of revenue. As explained in section 6, platforms currently benefit from a wide range of informal subsidies provided by the State and the “non-uberized” economy, in which many drivers and/or members of their households earn a living. If platform‑enabled work is to expand further and become a fully functioning sector of economic activity, more should be done to ensure that it is resilient and able to provide platform workers with decent working conditions, decent incomes and social protection.

Whether or not the shape taken by the new regulations coincides with that of the regulations governing traditional employment is not so important. What is crucial, however, is that regulators, workers and platforms should engage effectively with one another to develop these regulations and establish institutions that allow all three parties to play an active role in directing the sector’s future growth.