Annexes

.Annex 1 Glossary

This glossary focuses on the basic concepts, definitions and methodology guiding the analytical work of the ILO on social security or social protection.1 It does not set out to assert any universal definitions; its purpose is simply to clarify how terms and concepts are used in this report and in the ILO more broadly.

Cash transfer programme: A non-contributory scheme or programme providing cash benefits to individuals or households, usually financed through taxation, other government revenue or external grants or loans. Cash transfer programmes2 may or may not include a means test.

Cash transfer programmes that provide cash to families subject to the condition that they fulfil specific behavioural requirements are referred to as conditional cash transfer programmes. For example, beneficiaries may be required to ensure that their children attend school regularly, or to use basic preventive nutrition and healthcare services.

Cash transfer(s): A generalized catch-all term used mainly to describe social assistance benefits. However, social protection systems have, since their very inception two centuries ago, disbursed cash transfers. Irrespective of whether they are contributory or non-contributory, social protection schemes provide cash benefits (cash transfers). For instance, unemployment insurance, pensions and employment injury schemes all provide cash benefits. Eight of the nine functions of social protection provide cash benefits.

Contributory scheme: A scheme in which contributions made by protected persons (actual or potential beneficiaries) directly determine entitlement to benefits (acquired rights). The most common form of contributory social security scheme is a statutory social insurance scheme, usually covering workers in formal wage employment and, in some countries, the self-employed. Other common types of contributory schemes, providing – in the absence of social insurance – a certain level of protection include national provident funds, which usually pay a lump sum to beneficiaries when particular contingencies occur (typically old age, invalidity or death). In the case of social insurance schemes for those in wage or salaried employment, contributions are usually paid by both employees and employers (though, in general, employment injury schemes are fully financed by employers). Contributory schemes can be wholly financed through contributions but are often partly financed from taxation or other sources; this may be done through a subsidy to cover the deficit, a general subsidy replacing contributions altogether, or through subsidies directed specifically at certain groups of contributors or beneficiaries. Such groups include persons who do not contribute as they (a) are caring for children or studying, (b) are in military service or unemployed, (c) have an income too low to make full contributions, or (d) receive benefits below a certain threshold due to low contributions in the past).

Employment guarantee scheme: A public employment programme that provides a guaranteed number of days of work per year to poor households, generally providing wages at a relatively low level (typically at the minimum wage level if this is adequately defined).

Means-tested scheme: A scheme which provides benefits upon proof of need and which targets certain categories of individuals or households whose means are below a certain threshold. These schemes are also often referred to as “social assistance schemes” (see also below). A means test is used to assess whether the individual’s or household’s own resources (income and/or assets) are below a defined threshold, in order to determine whether the applicants are eligible for a benefit and, if so, the level at which that benefit will be provided. In some countries, proxy means tests are used; through which, eligibility is determined without actually assessing income or assets, on the basis of other household characteristics (proxies such as household composition, housing characteristics, productive assets or level of education of household members) that are deemed more easily observable. Means-tested schemes may also include entitlement conditions and obligations, such as work requirements, participation in health check-ups or (for children) school attendance. Some means-tested schemes also include other interventions that are delivered on top of the actual income transfer itself.

Non-contributory scheme: A scheme that does not normally require a direct contribution from beneficiaries or their employers as a condition of entitlement to receive relevant benefits. Such schemes are financed through taxes or other state revenues, or, in certain cases, through external grants or loans. The term covers a broad range of schemes, including universal schemes for all residents (such as national health services), non– means-tested categorical schemes for certain broad groups of the population (such as children below a certain age, or older people above a certain age) and means-tested schemes (such as social assistance schemes).

Public employment programme: A government programme offering employment opportunities to certain categories of people who are unable to find other employment. Public employment programmes, which are also known in some countries as public works programmes, include employment guarantee schemes (see above), “cash-for-work” and “food-for-work” programmes.

Social assistance scheme/programme: A scheme that provides benefits to vulnerable groups of the population, especially households living in poverty. Most social assistance schemes are means-tested.

Social insurance scheme: A contributory social protection scheme that guarantees protection through an insurance mechanism, based on: (a) the payment of contributions before the occurrence of the insured contingency; (b) the sharing or “pooling” of risk; and (c) the notion of a guarantee. The contributions paid by (or for) insured people are pooled together, and the resulting fund is used to cover the expenses incurred exclusively by those individuals affected by the occurrence of the relevant (and clearly defined) contingency or contingencies. In contrast to commercial insurance, risk-pooling in social insurance is based on the principle of solidarity, with contributions typically related to a person’s capacity to pay (for example, proportional to earnings) as opposed to premiums that reflect individual risks.

Many contributory social security schemes are presented and described as “insurance” schemes (usually “social insurance schemes”), despite comprising mixed characteristics, with some non-contributory elements in terms of entitlement to benefits. This allows for a more equitable distribution of benefits, particularly for people with low incomes and short or broken work careers, among others. These non-contributory elements take various forms, and are financed either by other contributors (redistribution within the scheme) or by the State.

Social protection: Social protection, or social security, is a human right and is defined as the set of policies and programmes designed to reduce and prevent poverty, vulnerability and social exclusion throughout the life cycle. Social protection includes nine main areas: child and family benefits; maternity protection; unemployment support; employment injury benefits; sickness benefits; health protection (medical care); old-age benefits; invalidity and disability benefits; and survivors’ benefits. Social protection systems address all these policy areas through a mix of contributory schemes (social insurance) and non-contributory tax-financed benefits (including social assistance).

As a human right, social protection (or social security) is enshrined as such in the Universal Declaration of Human Rights (1948), the International Covenant on Economic, Social and Cultural Rights (1966), and other major United Nations human rights instruments. States have a legal obligation to protect and promote human rights, including the right to social protection, (or social security) and to ensure that people can realize their rights without discrimination. The overall responsibility of the State includes ensuring the due provision of benefits according to clear and transparent eligibility criteria and entitlements, and the proper administration of the institutions and services. Where benefits and services are not provided directly by public institutions, the effective enforcement of the legislative framework is particularly important for the provision of benefits and services (UN 2008).

“Social protection” is a current term used to refer to “social security”, and the two terms are generally used interchangeably. It must be noted, however, that the term “social protection” is sometimes used to cover a broader range of services than “social security”, including protection provided between members of the family or members of a local community. On other occasions, “social protection” is also used with a narrower meaning, understood as comprising only measures addressed to the poorest, most vulnerable or excluded members of society. The ILO and other United Nations institutions use both in discourse with their constituents and in the provision of relevant advice to them.

Social protection floor: ILO Recommendation No. 202 stipulates that Member States should establish and maintain national social protection floors as a nationally defined set of basic social security guarantees which secure protection aimed at preventing or alleviating poverty, vulnerability and social exclusion (ILO 2012). These guarantees should ensure at a minimum that, over the life cycle, everyone in need has effective access to at least essential healthcare and basic income security. These together ensure effective access to essential goods and services defined as necessary at the national level. More specifically, national social protection floors should comprise at least the following four social security guarantees, as defined at the national level:

-

access to essential healthcare, including maternity care;

-

basic income security for children;

-

basic income security for persons of working age who are unable to earn sufficient income, in particular in cases of sickness, unemployment, maternity and disability; and

-

basic income security for older persons.3

Such guarantees should be provided to all residents and all children, as defined in national laws and regulations, and subject to existing international obligations.

Recommendation No. 202 also states that basic social security guarantees should be established by law. National laws and regulations should specify the range, qualifying conditions and levels of the benefits giving effect to these guarantees, and provide for effective and accessible complaint and appeal procedures.

Social protection floors correspond in many ways to the notion of “core obligations”, namely the obligation to ensure the realization of, at the very least, minimum essential levels of rights embodied in human rights treaties (UN 2012; 2014).

Social protection programme or scheme (or social security programme or scheme): A distinct framework of rules to provide social protection benefits to entitled beneficiaries. Such rules specify the geographical and personal scope of the programme (the target group), entitlement conditions, the type of benefits provided, the amounts of such benefits (cash transfers), periodicity and other benefit characteristics, as well as the financing (through contributions, general taxation and/or other sources), governance and administration of the programme.

While “programme” may refer to a wide range of programmes, the term “scheme” is usually used in a more specific sense referring to a programme that is anchored in national legislation and characterized by at least a certain degree of formality.

A programme or scheme can be supported by one or more social security institutions governing the provision of benefits and their financing. It should, in general, be possible to draw up a separate account of receipts and expenditure for each social protection programme. It is often the case that a social protection programme provides protection against a single risk or need, and covers a single specific group of beneficiaries. Typically, however, one institution administers more than one benefit programme.

Social security: The fundamental right to social security is set out in the Universal Declaration of Human Rights (1948) and other international legal instruments. The notion of social security adopted here covers all measures providing benefits, whether in cash or in kind, to secure protection from, among other things:

-

lack of work-related income (or insufficient income) caused by sickness, disability, maternity, employment injury, unemployment, old age or death of a family member;

-

lack of (affordable) access to healthcare;

-

insufficient family support, particularly for children and adult dependants; and

-

general poverty and social exclusion.

Social security thus has two main (functional) dimensions, namely “income security” and “availability of medical care”, reflected in the Declaration of Philadelphia (1944), which forms part of the ILO’s Constitution, in the following terms: “social security measures to provide a basic income to all in need of such protection and comprehensive medical care”.4 Recommendation No. 202 stipulates that, at least, access to essential healthcare and basic income security over the life cycle should be guaranteed as part of nationally defined social protection floors, and that higher levels of protection should be progressively achieved by national social security systems in line with Convention No. 102 and other ILO instruments.

Access to social security is essentially a public responsibility, and is typically provided through public institutions financed from either contributions or taxes, or both. However, the delivery of social security can be and often is mandated to private entities. Moreover, many privately run institutions exist (of an insurance, self-help, community-based or mutual character), which can partially assume certain roles usually played by social security (such as the operation of occupational pension schemes) to complement and perhaps largely take the place of elements of public social security schemes. Entitlements to social security are conditional either on the payment of social security contributions for prescribed periods (contributory schemes, most often structured as social insurance arrangements) or on a requirement, sometimes described as “residency plus”, under which benefits are provided to all residents of the country who also meet certain other criteria (non-contributory schemes). Such criteria may make benefit entitlements conditional on age, health, labour market participation, income or other determinants of social or economic status and/or even conformity with certain behavioural requirements.

Two main features distinguish social security from other social arrangements. First, benefits are provided to beneficiaries without any simultaneous reciprocal obligation (thus, it does not, for example, represent remuneration for work or other services delivered). Second, it is not based on an individual agreement between the protected person and the provider (as is the case, for example, in a life insurance contract); the agreement applies to a wider group of people and so is collective in nature.

Depending on the category of applicable conditions, a distinction is also made between non–means-tested schemes (where the conditions of benefit entitlement are not related to the total level of income or wealth of the beneficiary and her or his family) and means-tested schemes (where entitlement is granted only to those with income or wealth below a prescribed threshold). A special category of “conditional” schemes includes those which, in addition to other conditions, require beneficiaries (and/or their relatives or families) to participate in prescribed public programmes (for example, specified health or educational programmes).

Social security system or social protection system: The totality of social security or social protection schemes and programmes in a country, taking into account that the latter term is often used in a broader sense than the former.

All the social security schemes and institutions in a country are inevitably interlinked and complementary in their objectives, functions and financing. Thus, they form a national social security system. For reasons of effectiveness and efficiency, it is essential that there is close coordination within the system, and that – especially for coordination and planning purposes – the receipts and expenditure accounts of all the schemes are compiled into one social security budget for the country so that its future expenditure and financing of the schemes comprising the social security system are planned in an integrated way.

Social transfer: All social security benefits comprise transfers either in cash or in kind: that is, they represent a transfer of income, goods or services (for example, healthcare services). This transfer may be from the active to the old, the healthy to the sick, or the affluent to the poor, among others. The recipients of such transfers may be in a position to receive them from a specific social security scheme because (a) they have contributed to such a scheme (contributory scheme), (b) they are residents (universal schemes for all residents), (c) they fulfil specific age criteria (categorical schemes) or meet specific resource conditions (social assistance schemes), or (d) they fulfil several of these conditions at the same time. In addition, it is a requirement in some schemes (employment guarantee schemes, public employment programmes) that beneficiaries accomplish specific tasks or adopt specific behaviours (conditional cash transfer programmes). In any given country, several schemes of different types generally coexist and may provide benefits for similar contingencies to different population groups.

Targeted scheme or programme: See social assistance scheme.

Universal scheme/categorical scheme: Strictly speaking, universal schemes provide benefits under the single condition of residence. However, the term is also often used to describe categorical schemes, which provide benefits to certain broad categories of the population without a means test or a proxy means test. The most common forms of such schemes are those that transfer income to older people above a certain age, to all persons with disabilities, or to children below a certain age. Some categorical schemes also target households with specific structures (one-parent households, for example) or occupational groups (such as rural workers). Most categorical schemes are financed by public resources.

Universal social protection: It refers to social protection systems that ensure everyone has access to comprehensive, adequate and sustainable protection over the life cycle, in line with ILO standards. Achieving universal social protection entails actions and measures to realize the human right to social security by progressively building and maintaining nationally appropriate social protection systems. Rights-based social protection systems, encompassing social protection floors and higher levels of protection, guarantee that the rights and obligations of all parties concerned – workers, employers, governments, state institutions – are anchored in law and duly observed to ensure human well-being and a dignified life. The State has primary responsibility for establishing the legal and administrative architecture and sustainable financing of social security, and is the final guarantor of its proper administration and good governance. Universal social protection is crucial for the prevention and reduction of poverty, inequalities and social exclusion, effectively maintaining workers’ incomes and living standards. In the context of covariate shocks and crises, it can respond effectively, enabling access to healthcare and stabilizing aggregate demand by supporting income security and business continuity. A universal social protection system bolsters the social contract: as an investment in human capabilities, decent work and inclusive economies, it ensures the willingness of everyone to pay taxes and make social contributions, thereby sustaining the system and fostering social cohesion.

.Annex 2 Measuring social protection coverage and expenditure

Social protection coverage

Measurement of effective coverage for SDG indicator 1.3.1

This report provides a comprehensive data set for the monitoring of SDG indicator 1.3.1, based on the data compiled through the Social Security Inquiry together with other sources. The data set was submitted to the United Nations Statistics Division in the framework of SDG monitoring; in particular, in the context of SDG 1 (“End poverty in all its forms everywhere”), the ILO is responsible for producing estimates on SDG indicator 1.3.1: “Proportion of population covered by social protection floors/systems, by sex, distinguishing children, unemployed persons, older persons, persons with disabilities, pregnant women, newborns, work injury victims, and the poor and the vulnerable.”

The indicator reflects the proportion of persons effectively covered by social protection systems, including social protection floors (for the definition of “effective coverage” and how it is measured, see below). It covers the main components of social protection – child, family and maternity benefits; support for people without jobs, people with disabilities, victims of work injuries and older people5 – with the aim of gauging progress towards SDG target 1.3, and towards the goal of providing at least a basic level of support in all the main contingencies of the life cycle, as defined in Recommendation No. 202. Health coverage, although it is one of the four basic guarantees of the social protection floor, is monitored not under SDG indicator 1.3.1 but under SDG indicators 3.8.1 and 3.8.2 (see the definition of “effective coverage” and criteria for its measurement in the next section of this annex). Calculations include separate indicators to distinguish effective coverage of social protection cash benefits for children, unemployed people, older people and people with disabilities, pregnant women and mothers with newborns, those who have suffered injury at work, the poor and the vulnerable. For each case, coverage is expressed as a share of the respective population group. Effective coverage for workers in the event of sickness, although it is reflected in Recommendation No. 202, is not included within SDG indicator 1.3.1.

Indicators are calculated as follows:6

-

Share of the population covered by at least one social protection cash benefit: ratio of the population receiving cash benefits7 under at least one of the contingencies or social protection functions (contributory or non-contributory benefit), or actively contributing to at least one social security scheme to the total population.

-

Share of children covered by social protection benefits: ratio of children or households receiving child or family cash benefits to the total number of children/households with children.

-

Share of women giving birth covered by maternity benefits: ratio of women receiving cash maternity benefits to women giving birth in the same year (estimated based on age-specific fertility rates published in the United Nations’ World Population Prospects or on the number of live births corrected for the share of twin and triplet births).

-

Share of persons with disabilities receiving benefits: ratio of persons receiving disability cash benefits to persons with severe disabilities. The latter is calculated as the product of prevalence of disability ratios (published for each country group by the WHO) and each country’s population.

-

Share of unemployed receiving benefits: ratio of recipients of unemployment cash benefits to the number of unemployed persons.

-

Share of workers covered in case of employment injury: ratio of workers protected by injury insurance to total employment or the labour force.

-

Share of older persons receiving a pension: ratio of persons above statutory retirement age receiving an old-age pension (including contributory and non-contributory) to persons above statutory retirement age.

-

Share of vulnerable persons receiving benefits: ratio of social assistance cash benefits recipients to the total number of vulnerable persons. The latter are calculated by subtracting from total population all people of working age who are contributing to a social insurance scheme or receiving contributory benefits, and all persons above retirement age receiving contributory benefits.

Aggregate coverage indicators

Two aggregate measures of coverage are used in this report: the first aggregate indicator reflects legal coverage,8 the second effective coverage (for more detail, see below).

-

The share of the population enjoying comprehensive social security protection is estimated based on the number of people of working age who enjoy comprehensive legal social security coverage – that is, who are covered by law in respect of eight areas (sickness, unemployment, old age, employment injury, child/family benefit, maternity, invalidity, survivors) specified in Convention No. 102.9

-

The share of the population covered by at least one social protection cash benefit (SDG indicator 1.3.1(a), see above) reflects the effective coverage of the population in at least one area10 – that is, the share of the total population receiving contributory or non-contributory benefits in at least one area or actively contributing to at least one social security scheme.

Measuring social protection coverage: Concepts and criteria

General considerations

Measuring social protection coverage is a complex task. Several dimensions need to be considered in order to arrive at a comprehensive assessment.

In practice, few countries have available the full range of statistical data necessary for such a comprehensive assessment of social security coverage; nevertheless, partial information is available for a large number of countries. Many countries have acknowledged the need to undertake better regular monitoring of social security coverage and are stepping up their efforts to improve data collection and analysis; the SDG agenda, and especially targets 1.3 and 3.8, have been instrumental in encouraging this work.

Social security coverage is a multidimensional concept with at least three dimensions:

-

Scope. This is measured by the range (number) and type of social security areas (branches) to which the population of the country has access. Population groups with differing status in the labour market may enjoy different scopes of coverage, and this factor must be taken into account in assessing overall scope.

-

Extent. This usually refers to the percentage of people covered within the whole population or the target group (as defined by, for example, gender, age, income level or labour market status) by social security measures in each specific area.

-

Level. This refers to the adequacy of coverage in a specific branch of social security. It may be measured by the level of cash benefits provided, where measurements of benefit levels can be either absolute or relative to selected benchmark values such as previous incomes, average incomes, the poverty line and so on. For health benefits, it is measured as the range of health services covered and the level of financial protection (support value) provided in relation to those services. Measures of quality are usually relative, and may be objective or subjective – for example, the satisfaction of beneficiaries as compared with their expectations would be a subjective measure.

In measuring coverage, a distinction is made between legal coverage and effective coverage in each of the three dimensions above, so as to reflect different dimensions of coverage. Table A2.1 summarizes these various dimensions.

Table A2.1 Multiple dimensions of coverage: Examples of questions and indicators

|

Dimension of coverage |

Legal coverage |

Effective coverage |

|

Scope |

Which social security areas are anchored in the national legislation? For a given group of the population: for which social security area(s) is this group covered according to the national legislation? |

In which areas is social security provision actually implemented? For a given group of the population: for which social security areas is this group effectively covered (benefits actually being available)? |

|

Extent |

For a given social security area (branch): which categories of the population are covered according to the national legislation? What percentage of the population or labour force is covered according to the national legislation? |

For a given social security area (branch): which categories of the population enjoy actual access to benefits in case of need (currently or in the future)? The “beneficiary coverage ratio”: for a given social security area, what percentage of the population affected by the contingency receives benefits or services (for example, percentage of older persons receiving an old-age pension; percentage of unemployed receiving unemployment benefits)? The “contributor coverage ratio”: for a given social security area, what percentage of the population contributes to the scheme, or is otherwise insured by the scheme, and can thus expect to receive benefits when needed (for example, percentage of working-age population or of the labour force contributing to a pension scheme)? By extension, the “protected person coverage ratio” would include people who, in the future – assuming that legislation is unchanged – would be entitled to a health benefit (as a service user, beneficiary, contributor or dependant, according to the type of national system) or a non-contributory cash benefit, through either a universal scheme or a means-tested scheme, provided they meet the eligibility criteria. |

|

Level |

For a given social security area: what is the level of protection provided according to the national legislation? For cash benefits: what is the prescribed amount or replacement rate according to the national legislation? For healthcare benefits: what is the prescribed health package and level of co-payment, if any? |

For a given social security area: what is the level of protection actually provided (for example, for cash benefits, average level of benefit as a proportion of median income, minimum wage or poverty line; for health benefits, effective use of services and level of financial protection (affordability))? |

Source: Based on ILO (2010).

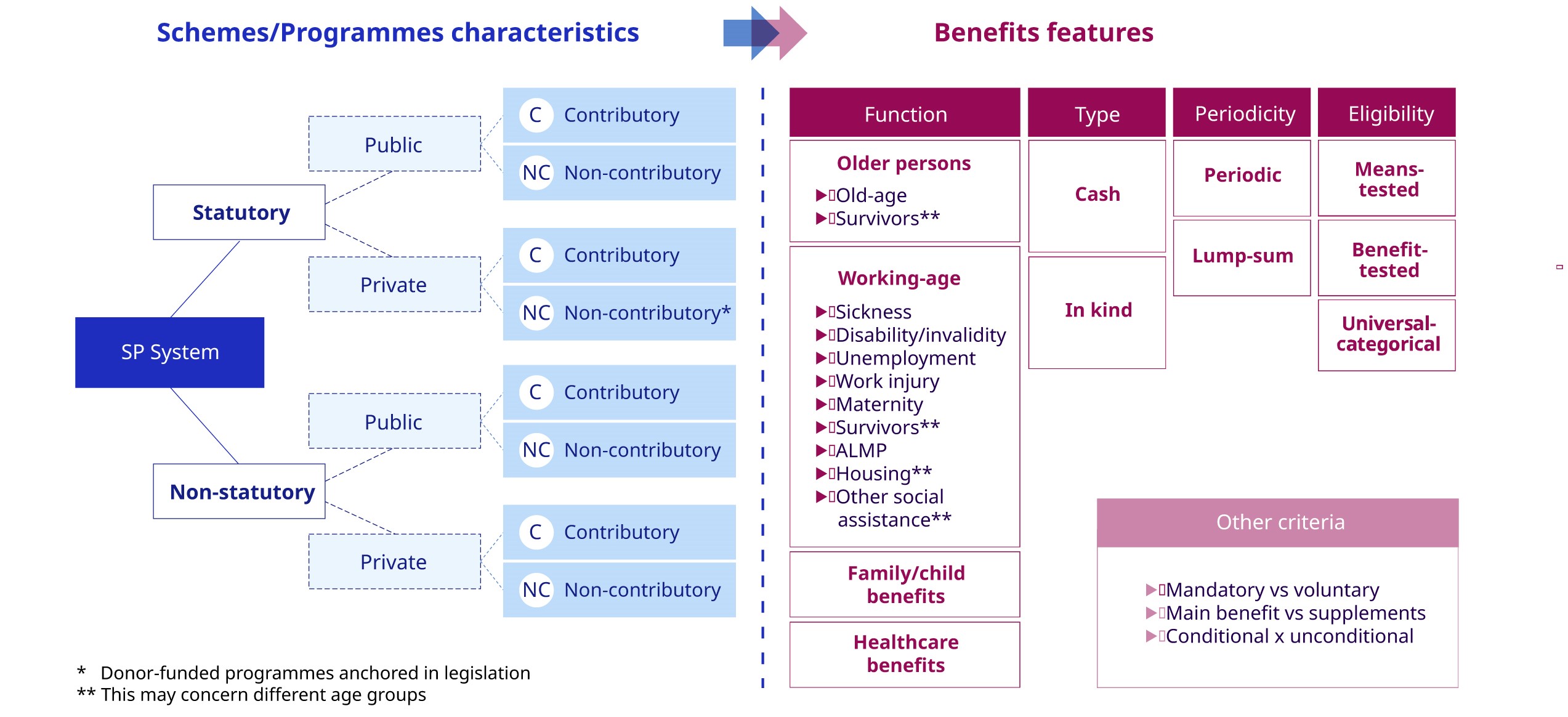

Figure A2.1. Overview of social protection schemes and benefits characteristics and features

* Donor-funded programmes anchored in legislation

** This may concern different age groups

SP = social protection, ALMP = active labour market policies.

The diagnostic overview is used at the stage of data analysis to properly categorize the collected social protection data under schemes and benefits in a country (see figure A2.1).

Legal coverage

Estimates of the scope of legal coverage usually measure the number of social security areas (branches) by which – according to existing national legislation – a population or specific groups within it is or are covered. The list of the nine branches covered by ILO Convention No. 102 is used as guidance.

Estimates of the extent of legal coverage use both information on the groups covered by statutory schemes for a given social security area (branch) in national legislation and available statistical information quantifying the number of people concerned at the national level. A population group can be identified as legally covered in a specific social security area (for example, old age, unemployment protection, maternity protection) if the existing legislation sets out that this group is mandatorily covered by social insurance, or that the group will be entitled to specified non-contributory benefits

under certain circumstances – for instance, to an old-age state pension on reaching the age of 65, or to income support if income falls below a specified threshold. A legal coverage ratio for a given branch of social security is the ratio between the estimated number of people legally covered and – as appropriate – the labour force or working-age population in the relevant age range. For example, since Convention No. 102 allows a ratifying country to provide coverage through social insurance, through universal or means-tested benefits, or a combination of these, it also formulates alternatives to minimum requirements for the extent of coverage, as follows:

-

prescribed classes of employees, constituting not less than 50 per cent of all employees; or

-

prescribed classes of the economically active population, constituting not less than 20 per cent of all residents; or

-

all residents whose means during the contingency do not exceed prescribed limits.

For healthcare, the legal coverage estimates the number of people belonging to the population groups identified under the law11 as covered by the social health protection scheme(s). This takes into account all public or publicly led schemes that provide a healthcare benefit package to a given population without hardship (that is, effectively committing to a level of financial protection against the costs of healthcare in law or regulation) as a primary cover, both contributory and non-contributory. The provisions for employer liability were also mapped and an estimate is available.

The level of legal coverage for specific branches of social security is usually measured for cash benefits by benefit ratios or replacement ratios calculated for specified categories of beneficiaries, using benefit formulas or benefit amounts specified in the legislation. For example, Convention No. 102 sets minimum replacement rates for cash benefits in seven of the nine specified branches (see tables in Annex 3). It stipulates that such minimum rates should apply to a defined “standard” beneficiary meeting qualifying conditions, and be guaranteed at least to those with earnings up to a certain prescribed selected level. For healthcare benefits, the extent of the prescribed benefit package is necessarily a qualitative indicator against the main components of a comprehensive package as defined in ILO standards, including promotive, preventive, curative and rehabilitative care. The extent of healthcare provision that can be accessed also needs to be stipulated in legislation. The level of co-payment is measured as a percentage of the costs of care left to the patient to cover out of pocket. Currently, data on legal provisions for benefit packages and financial protection are not collected systematically and in a uniform fashion across regions, and therefore could not be reported in this edition of the World Social Protection Report.

Effective coverage

Measurements of effective coverage should reflect how the legal provisions are implemented in reality.12 Effective coverage is usually different from (and usually lower than) legal coverage because of non-compliance, problems with enforcement of legal provisions, or other deviations of actual policies from the text of the legislation. In order to arrive at a full coverage assessment, measures of legal and effective coverage need to be used in parallel.

Measurements of the scope of effective coverage in a country reveal the number of social security areas (branches) for which there is relevant legislation that is actually enforced – that is, whether in all such areas the majority of the population legally covered are also effectively covered (as measured by the extent of effective coverage; see below).

When measuring the extent of effective coverage, a distinction has to be made between measurement in terms of protected persons and in terms of actual beneficiaries. Protected persons are those who have benefits guaranteed but are not necessarily currently receiving them – for example, people who contribute to a pension scheme are protected, but not yet receiving a pension. Similarly, people affiliated to a healthcare scheme are effectively protected, although they receive the benefit only when they have a specific health need (for example, immunization, injury or illness).

In respect of protected persons, the contributor coverage ratio reflects, in the case of contributory schemes, the number of those protected should they be affected by the contingency covered, now or in the future: that is, the share of the employed population (or alternatively the population of working age or in the labour force) who contribute directly or indirectly to social insurance in a given social security area and are thus likely to receive benefits when needed. An example is the share of employed people contributing to a pension scheme. The protected person coverage ratio includes all people entitled to benefits (both contributory and non-contributory), assuming no change to legislation. For health benefits, even in contributory schemes, the protection granted usually extends to the dependants of the contributor; hence, for healthcare benefits, the protected persons coverage ratio represents the share of the population protected by a scheme, regardless of whether they are contributing or not. The share of the population protected by social health protection (figure 4.43) reflects this methodology.13

In respect of actual beneficiaries, the beneficiary coverage ratio describes the share of the population affected by a certain contingency (such as older people or the unemployed) who actually benefit from the appropriate social protection benefits (in these examples, old-age pensions or unemployment benefits). This ratio reflects the number of those actually receiving benefits, for example the number of recipients of any pension benefits among all residents over the statutory pensionable age, or the number of beneficiaries of some kind of income support among all those unemployed, or all below the poverty line. For healthcare benefits and sickness cash benefits, measurement of actual benefit provision in relation to the occurrence of such contingencies is challenging, and there is no consensus on the optimal methodology to capture these dimensions of coverage.

Measurements of the level of effective coverage aim to identify the levels of benefits (usually related to certain benchmark amounts or benefit packages) actually received by beneficiaries, such as unemployment benefits or pensions paid, compared to average earnings or the minimum wage or the poverty line. In the case of contributory pension schemes, the effective level of benefit may also relate to future (potential) benefit levels. In the case of healthcare, SDG indicator 3.8.1 is an index by which to measure effective access to a range of health services and infrastructure in times of need by a given national population (WHO and World Bank 2017).14 When it comes to the level of financial protection afforded when effectively accessing health services, there is an international consensus on the use of out-of-pocket payments made by households on healthcare and its impact on poverty as a proxy indicator for the lack of financial protection, as reflected in SDG indicator 3.8.2 (WHO and World Bank 2017).

When assessing coverage and gaps in coverage, three types of schemes need to be distinguished, namely: (a) contributory social insurance or other types of contributory schemes; (b) universal schemes covering all residents (or all residents in a given category);15 and (c) means-tested schemes potentially covering all those who pass the required test of income and/or assets. In the case of social insurance, it makes sense to look at

the number of those who are actual members of, and contributors to, such schemes, and who thus potentially enjoy coverage in the event of any of the contingencies covered by their social insurance – sometimes with their dependants. These people fall into a category of persons “protected” in the event of a given contingency. The concept of protected persons may also apply where people are covered by universal or categorical programmes if all residents, or all residents in a given category (for example, a certain age range), are entitled to certain benefits or to free access to social services by law and in practice in the event of the given contingency. It is, however, rather difficult to specify who is in fact effectively protected in the case of benefits granted on the basis of a means test or proxy means test, or in the form of conditional cash transfers.

The above measures of extent and level of coverage are specifically applied to certain areas (branches) of social security (and sometimes even only to specific schemes or types of scheme); they do not attempt to provide a generic measure of social security coverage. Ensuring the specificity of coverage indicators by area is essential to establish a meaningful analysis and ensure its relevance for policy development. In the case of healthcare benefits, the level of benefit coverage needs to encompass both the extent of services used in practice and the financial protection awarded against the costs of healthcare. SDG indicators 3.8.1 (service coverage) and 3.8.2 (catastrophic expenditure on health) are used as proxies to monitor the level of effective coverage along those two dimensions.

Social protection expenditure

Data on social protection expenditure are collected according to different standards around the world, including the International Monetary Fund’s Government Finance Statistics (GFS) 2014 standard and other national standards. Figures on social protection expenditure are presented both including and excluding general government expenditure on health, with a view to disaggregating cash and care benefits. The source for general government expenditure is the WHO’s Global Health Expenditure Database.16,17

Data on expenditure for this report were obtained from various sources (see table A2.2).

Table A2.2 Comparison of different definitions used to measure social protection expenditure

|

Source |

Definition |

Functions/areas covered |

|

International Monetary Fund (IMF) https://www.imf.org/external/pubs/ft/gfs/manual/pdf/ch6ann.pdf |

Expenditure on social protection Government outlays on social protection include expenditures on services and transfers provided to individuals and households, and expenditures on services provided on a collective basis. Expenditures on individual services and transfers are allocated to groups 7101 (sickness and disability) to 7107 (social exclusion); expenditures on collective services are assigned to groups 7108 (research and development Social Protection) and 7109 (Social Protection not elsewhere classified). Collective social protection services are concerned with matters such as formulation and administration of government policy; formulation and enforcement of legislation and standards for providing social protection; and applied research and experimental development into social protection affairs and services. |

Sickness, disability, old age, survivors, family and children, unemployment, housing, social exclusion (social assistance), research on social protection, general administrative expenditure on social protection. |

|

Organisation for Economic Co-operation and Development (OECD) |

Expenditure on social protection Social expenditure comprises cash benefits, direct in-kind provision of goods and services, and tax breaks with social purposes. Benefits may be targeted at low-income households, the elderly, disabled, sick, unemployed or young people. To be considered “social”, programmes have to involve either redistribution of resources across households or compulsory participation. Social benefits are classified as public when general government (that is, central, state and local governments, including social security funds) controls the relevant financial flows. All social benefits not provided by general government are considered private. Private transfers between households are not considered as “social” and not included here. |

Old age, survivors’, incapacity-related and family benefits; active labour market policies; unemployment and housing benefits; and benefits in other social policy areas. |

|

United Nations Economic Commission for Latin America and the Caribbean (UNECLAC) http://estadisticas.cepal.org/cepalstat/WEB_CEPALSTAT/MetodosClasificaciones.asp?idioma=i |

Expenditure on social protection UNECLAC uses the EUROSTAT/OECD definition. See “Classification of final expenditure on GDP” at https://www.oecd-ilibrary.org/economics/eurostat-oecd-methodological-manual-on-purchasing-power-parities_9789264011335-en. |

Older people, disabled people, people suffering from occupational injuries and diseases, survivors, unemployed, destitute, family and children, homeless, low-income earners, indigenous people, immigrants, refugees, alcohol and substance abusers, etc. |

|

Government Spending Watch (GSW) http://www.governmentspendingwatch.org/research-analysis/social-protection

|

Expenditure on social protection All government spending which boosts economic development for the poor and promotes inclusive and employment-intensive growth that can help meet this goal. Government Spending Watch data focus on the direct government interventions that have been most effective in reducing poverty and providing employment, known as “social protection” spending. |

Social safety nets, social funds, social welfare assistance/services, labour market interventions and social Insurance programmes (including pensions). Excludes all social services provided by government that could be classified as education or health, nutrition, or water, sanitation and hygiene. |

|

Asian Development Bank (ADB) https://www.adb.org/sites/default/files/publication/632971/ki2020.pdf |

Expenditure on social protection Government expenditure on social protection includes expenditure on services and transfers provided to individuals and households, and expenditure on services provided on a collective basis. Expenditure on social protection is allocated to sickness and disability, old age, survivors, family and children, unemployment, housing, social exclusion not elsewhere classified, and social protection research and development. |

Sickness, disability, old age, survivors, unemployment, etc. |

|

World Health Organization (WHO) |

Expenditure on health General government expenditure on health comprises the sum of health outlays paid for in cash or supplied in kind by government entities, such as ministries of health, other ministries, parastatal organizations or social security agencies (without double counting government transfers to social security and extrabudgetary funds). It includes all expenditure made by these entities, regardless of the source, so any donor funding passing through them is included. It also includes transfer payments to households to offset medical care costs, extrabudgetary funds to finance health services and goods, and both current and capital expenditure. |

Health |

|

National |

Expenditure on social protection When the source is national expenditure on social protection it is taken from the Social Security Inquiry or other national sources. In this context, in-kind benefits are often excluded. |

Sickness, disability, old age, survivors, unemployment, etc. |

Global and regional estimates

Regional results for effective and legal coverage indicators are obtained as averages of figures from countries in each region weighted by the population group concerned. For effective coverage, estimates are based on administrative data produced by the countries and collected via the ILO Social Security Inquiry. For SDG regions with insufficient country coverage, imputations were used. Regional and global estimates were produced in cooperation with the ILO Department of Statistics (see methodological details below).

Regional results for expenditure indicators are obtained as averages of figures from countries in each region weighted by the total GDP of the corresponding country. The GDP data used were current GDP in US dollars according to the IMF.

Regional and income groupings

The regional and income groupings used are listed in tables A2.3 and A2.4. Maps are built using the United Nations template.18

Table A2.3 Regional groupings

|

Region |

Subregion (broad) |

Countries and territories |

|

Africa |

Northern Africa |

Algeria, Egypt, Libya, Morocco, Sudan, Tunisia, Western Sahara |

|

|

Sub-Saharan Africa |

Angola, Benin, Botswana, Burkina Faso, Burundi, Cabo Verde, Cameroon, Central African Republic, Chad, Comoros, Congo, Côte d'Ivoire, Democratic Republic of the Congo, Djibouti, Equatorial Guinea, Eritrea, Eswatini, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Mayotte, Mozambique, Namibia, Niger, Nigeria, Réunion, Rwanda, Saint Helena, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, South Sudan, Sudan, Tanzania (United Republic of), Togo, Uganda, Zambia, Zimbabwe |

|

Americas |

Latin America and the Caribbean |

Anguilla, Antigua and Barbuda, Argentina, Aruba, Bahamas, Barbados, Belize, Bolivia (Plurinational State of), Brazil, British Virgin Islands, Cayman Islands, Chile, Colombia, Costa Rica, Cuba, Curaçao, Dominica, Dominican Republic, Ecuador, El Salvador, Falkland Islands (Malvinas), French Guiana, Grenada, Guadeloupe, Guatemala, Guyana, Haiti, Honduras, Jamaica, Martinique, Mexico, Montserrat, Netherlands Antilles, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, Saint Kitts and Nevis, Saint Lucia, Saint Martin (France), Saint Vincent and the Grenadines, Sint Maarten (Kingdom of the Netherlands), Suriname, Trinidad and Tobago, Turks and Caicos Islands, United States Virgin Islands, Uruguay, Venezuela (Bolivarian Republic of) |

|

|

Northern America |

Bermuda, Canada, Greenland, Saint Pierre and Miquelon, United States |

|

Arab States |

Arab States |

Bahrain, Iraq, Jordan, Kuwait, Lebanon, Occupied Palestinian Territory, Oman, Qatar, Saudi Arabia, Syrian Arab Republic, United Arab Emirates, Yemen |

|

Asia and the Pacific |

Eastern Asia |

China, Hong Kong (China), Japan, Korea (Democratic People's Republic of), Macao (China), Mongolia, Republic of Korea, Taiwan (China) |

|

|

South-Eastern Asia and the Pacific |

American Samoa, Australia, Brunei Darussalam, Cambodia, Cook Islands, Fiji, French Polynesia, Guam, Indonesia, Kiribati, Lao People's Democratic Republic, Malaysia, Marshall Islands, Micronesia (Federated States of), Myanmar, Nauru, New Caledonia, New Zealand, Niue, Norfolk Island, Northern Mariana Islands, Palau Islands, Papua New Guinea, Philippines, Samoa, Singapore, Solomon Islands, Thailand, Timor-Leste, Tokelau, Tonga, Tuvalu, Vanuatu, Viet Nam, Wallis and Futuna Islands |

|

|

Southern Asia |

Afghanistan, Bangladesh, Bhutan, India, Iran (Islamic Republic of), Maldives, Nepal, Pakistan, Sri Lanka |

|

Europe and Central Asia |

Northern, Southern and Western Europe |

Albania, Andorra, Austria, Belgium, Bosnia and Herzegovina, Channel Islands, Croatia, Denmark, Estonia, Faeroe Islands, Finland, France, Germany, Gibraltar, Greece, Guernsey, Iceland, Ireland, Isle of Man, Italy, Jersey, Kosovo,19 Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Montenegro, Netherlands, North Macedonia, Norway, Portugal, San Marino, Serbia, Slovenia, Spain, Sweden, Switzerland, United Kingdom |

|

|

Eastern Europe |

Belarus, Bulgaria, Czechia, Hungary, Poland, Republic of Moldova, Romania, Russian Federation, Slovakia, Ukraine |

|

|

Central and Western Asia |

Armenia, Azerbaijan, Cyprus, Georgia, Israel, Kazakhstan, Kyrgyzstan, Tajikistan, Türkiye, Turkmenistan, Uzbekistan |

Note: Figures do not always include all the countries and territories in a region because of missing information or unreliable data.

Table A2.4 Income groupings

|

Income group |

Countries and territories |

|

High-income |

Andorra, American Samoa, Antigua and Barbuda, Aruba, Australia, Austria, Bahamas, Bahrain, Barbados, Belgium, Bermuda, British Virgin Islands, Brunei Darussalam, Canada, Cayman Islands, Channel Islands, Chile, Croatia, Curaçao, Cyprus, Czechia, Denmark, Estonia, Falkland Islands (Malvinas), Faroe Islands, Finland, France, French Guiana, French Polynesia, Germany, Gibraltar, Greece, Greenland, Guam, Guernsey, Guyana, Hong Kong (China), Hungary, Iceland, Ireland, Isle of Man, Israel, Italy, Japan, Jersey, Kuwait, Latvia, Liechtenstein, Lithuania, Luxembourg, Macao (China), Malta, Martinique, Monaco, Nauru, Netherlands, Netherlands Antilles, New Caledonia, New Zealand, Niue, Norfolk Island, Northern Mariana Islands, Norway, Oman, Panama, Poland, Portugal, Puerto Rico, Qatar, Republic of Korea, Réunion, Romania, Saint Kitts and Nevis, St Martin (French part), Saint Pierre and Miquelon, San Marino, Saudi Arabia, Seychelles, Singapore, Sint Maarten (Dutch part), Slovakia, Slovenia, Spain, Sweden, Switzerland, Taiwan (China), Trinidad and Tobago, Turks and Caicos Islands, United Arab Emirates, United Kingdom, United States, United States Virgin Islands, Uruguay, Wallis and Futuna |

|

Upper-middle-income |

Albania, Anguilla, Argentina, Armenia, Azerbaijan, Belarus, Belize, Bosnia and Herzegovina, Botswana, Brazil, Bulgaria, China, Colombia, Cook Islands, Costa Rica, Cuba, Dominica, Dominican Republic, Ecuador, El Salvador, Equatorial Guinea, Fiji, Gabon, Georgia, Grenada, Guadeloupe, Guatemala, Indonesia, Iraq, Jamaica, Kazakhstan, Kosovo,20 Libya, Malaysia, Maldives, Marshall Islands, Mauritius, Mexico, Montenegro, Montserrat, Namibia, North Macedonia, Occupied Palestinian Territory, Palau, Paraguay, Peru, Republic of Moldova, Russian Federation, Saint Lucia, Saint Vincent and the Grenadines, Serbia, South Africa, Suriname, Thailand, Tonga, Türkiye, Turkmenistan, Tuvalu, Venezuela (Bolivarian Republic of) |

|

Lower-middle-income |

Algeria, Angola, Bangladesh, Benin, Bhutan, Bolivia (Plurinational State of), Cabo Verde, Cambodia, Cameroon, Comoros, Congo, Côte d’Ivoire, Djibouti, Egypt, Eswatini, Ghana, Guinea, Haiti, Honduras, India, Iran (Islamic Republic of), Jordan, Kenya, Kiribati, Kyrgyzstan, Lao People’s Democratic Republic, Lebanon, Lesotho, Mauritania, Mayotte, Micronesia (Federated States of), Mongolia, Morocco, Myanmar, Nepal, Nicaragua, Nigeria, Pakistan, Papua New Guinea, Philippines, Saint Helena, Samoa, Sao Tome and Principe, Senegal, Solomon Islands, Sri Lanka, Tajikistan, Tanzania (United Republic of), Timor-Leste, Tunisia, Ukraine, Uzbekistan, Vanuatu, Viet Nam, Western Sahara, Zambia, Zimbabwe |

|

Low-income |

Afghanistan, Burkina Faso, Burundi, Central African Republic, Chad, Democratic Republic of the Congo, Eritrea, Ethiopia, Gambia, Guinea-Bissau, Korea (Democratic People’s Republic of), Liberia, Madagascar, Malawi, Mali, Mozambique, Niger, Rwanda, Sierra Leone, Somalia, South Sudan, Sudan, Syrian Arab Republic, Togo, Uganda, Yemen |

Note: Figures do not always include all the countries in a region because of missing information or unreliable data. World Bank income level classification accessed on 31 January 2024.

Estimating global and regional aggregates of social protection indicators: Methodological description

The global and regional estimates presented in this report are based on econometric models designed to impute missing data when nationally reported data are unavailable. The output of the models is a complete time series modelled estimates for eight social protection coverage rates disaggregated by sex for 189 countries and territories from 2009 to 2023. The country-level estimates (reported and imputed) are then aggregated to produce global and regional estimates of the social protection indicators.

Data coverage

Input data used in the model were collected through the ILO Social Security Inquiry. The number of countries with at least one year of data reported included in the global and regional estimations is as follows: overall coverage by social protection (at least one year data point available between 2009 and 2023), 181 countries; older persons, 183 countries; persons with severe disabilities, 165 countries; mothers with newborns, 161 countries; children, 169 countries; unemployed, 177 countries; vulnerable population, 171 countries; employment injury, 169 countries. Detailed information on the share of the global and regional populations for which data were reported to the ILO through the Social Security Inquiry is provided in table A2.8 for each indicator.

Description of the econometric model

For each social protection coverage rate, there are two main econometric models for which regional and global aggregates are generated. For countries for which at least one data point exists, the imputations are created using a country fixed effect model. In contrast, in countries with no available data, imputations are created through a fixed effect using the interaction of three variables: gender, year and regions (older persons, disability, and unemployment coverage); gender, year and income groups (total and maternity coverage); or gender, year and a dummy for developing economies (vulnerable, children, and injuries coverage). The two distinct models are chosen from an array of models based on the cross-validation methodology, which selects the models with the highest accuracy in predicting the coverage rates in pseudo out-of-sample simulations. The models use as explanatory variables: log GDP per capita; the share of government spending as a percentage of GDP; the share of population under the age of 15; labour force participation, self-employment, and informality rates; and subregional and income group dummies. As the old-age coverage indicator has greater data coverage than the other indicators, it is the first indicator estimated and its modelled estimates are later included as an explanatory variable for the overall social protection coverage rate. In turn, the overall coverage modelled estimate is then used as an explanatory variable for the rest of the indicators (except for coverage for older persons). After the predictions of the fixed effect models described above, a moving average smoothing function is applied, followed by a linear interpolation and extrapolation to shift estimated coverage rates to match the observed data.

Moreover, since the model predictions are disaggregated by sex, female and male estimates are rebalanced to ensure that the implied total sex rate obtained from summing the demographic breakdowns match the total rate as the one collected from the ILO Social Security Inquiry.

Table A2.5 Regional groupings used in the regressions

|

Africa |

|

Americas |

|

Arab States |

|

Asia and the Pacific |

|

Europe and Central Asia |

Note: Regional groupings in the regression are based on the ILO classification of geographical regions.

Table A2.6 Income groups used in the regressions

|

Low-income |

|

Lower-middle-income |

|

Upper-middle-income |

|

High-income |

Method of producing global and regional aggregates

The regional and global aggregates are obtained by weighted averages of the underlying country-level estimates (reported or imputed). The weights used for each coverage rate, which are equivalent to the denominators for each rate, are listed in table A2.7.

Table A2.7 Denominator for each indicator

|

Indicator |

Denominator |

Source of denominator |

|

Overall coverage |

Total population |

UN, World Population Prospects, 2022 revision |

|

Older persons |

Population aged 65 and above |

UN, World Population Prospects, 2022 revision |

|

Persons with severe disabilities |

Total population |

UN, World Population Prospects, 2022 revision |

|

Mothers with newborns |

Female population aged 15–49 |

UN, World Population Prospects, 2022 revision |

|

Children |

Population aged 0–14 |

UN, World Population Prospects, 2022 revision |

|

Unemployed |

Total unemployed |

ILO modelled estimates, November 2023 edition |

|

Vulnerable population |

Total population |

UN, World Population Prospects, 2022 revision |

|

Employment injury |

Total employed |

UN, World Population Prospects, 2022 revision |

Table A2.8 contains figures on data coverage by ILO regional classifications for each indicator based on data reported through the aggregation of denominators or weights listed in table A2.7.

Table A2.8 Data coverage underlying global and regional aggregates (share of regional population in 2023 for which at least one data point is available between 2009 and 2023)

|

Region |

Aggregate estimate |

Persons with severe disabilities |

Vulnerable persons |

Older persons |

Mothers with newborns |

Children |

Unemployed |

Employment injury |

|

World |

0.99 |

0.96 |

0.98 |

1.00 |

0.91 |

0.95 |

0.99 |

0.98 |

|

Africa |

0.99 |

0.86 |

0.93 |

1.00 |

0.85 |

0.89 |

0.98 |

0.95 |

|

Americas |

1.00 |

0.98 |

0.97 |

1.00 |

0.62 |

0.96 |

0.99 |

0.98 |

|

Arab States |

0.87 |

0.85 |

0.87 |

1.00 |

0.86 |

0.65 |

0.86 |

1.00 |

|

Asia and the Pacific |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

|

Europe and Central Asia |

1.00 |

1.00 |

0.99 |

1.00 |

1.00 |

0.99 |

1.00 |

0.96 |

|

Broad subregion |

|

|

|

|

|

|

|

|

|

Northern Africa |

1.00 |

1.00 |

0.85 |

1.00 |

0.97 |

1.00 |

1.00 |

0.97 |

|

Sub-Saharan Africa |

0.99 |

0.83 |

0.95 |

1.00 |

0.82 |

0.87 |

0.97 |

0.95 |

|

Latin America and the Caribbean |

1.00 |

0.97 |

0.96 |

1.00 |

0.88 |

0.95 |

0.99 |

0.96 |

|

Northern America |

1.00 |

1.00 |

1.00 |

1.00 |

0.10 |

1.00 |

1.00 |

1.00 |

|

Arab States |

0.87 |

0.85 |

0.87 |

1.00 |

0.86 |

0.65 |

0.86 |

1.00 |

|

South-Eastern Asia and the Pacific |

1.00 |

1.00 |

1.00 |

1.00 |

0.98 |

0.98 |

1.00 |

1.00 |

|

Southern Asia |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

|

Northern, Southern and Western Europe |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

0.99 |

|

Eastern Europe |

1.00 |

1.00 |

0.97 |

1.00 |

1.00 |

0.97 |

1.00 |

0.89 |

|

Central and Western Asia |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

0.98 |

1.00 |

Sources of data

This report is based on the ILO World Social Protection Database,21 which provides in-depth country-level statistics on various dimensions of social security or social protection systems, including key indicators for policymakers, officials of international organizations and researchers, including the United Nations monitoring of the SDGs.

Most of the data in the ILO World Social Protection Database are collected through the ILO Social Security Inquiry, the ILO’s periodic collection of administrative data from national ministries of labour, social security, welfare, social development, finance and other areas. The Social Security Inquiry questionnaires and manual are available online.

For measuring legal coverage, the main source is the ISSA Social Security Programs Throughout the World, used in combination with labour force and working-age population data from ILOSTAT.

Other data sources include the following:

-

For indicators of effective coverage: existing global social protection statistics, including those of Eurostat, the World Bank ASPIRE database, UNICEF, UN Women and ISSA.

-

For indicators of legal coverage: HelpAge International, and the Mutual Information System on Social Protection (MISSOC).

-

For health coverage: WHO Global Health Observatory Data Repository; UN, World Population Prospects, 2022 revision; World Bank, World Development Indicators and Global Consumption Database.

-

For indicators on expenditure: the GDP data used are current GDP in US dollars according to the World Bank; data on expenditure from the International Monetary Fund (IMF), Eurostat, OECD, UN Economic Commission for Latin America and the Caribbean (UNECLAC), Asian Development Bank (ADB), Government Spending Watch (GSW), WHO Global Health Expenditure Database and national sources such as ministries of finance and/or economics.

-

For population and labour market indicators: ILOSTAT; UN, World Population Prospects, 2022 revision. Definitions used for these indicators are available in the resolution concerning statistics of work, employment and labour underutilization, 19th International Conference of Labour Statisticians (ICLS), October 2013.22 The ILO World Social Protection Database also draws on national official reports and other sources (which usually are largely based on administrative data) and on survey data from a range of sources including national household income and expenditure surveys, labour force surveys, and demographic and health surveys, to the extent that these include variables on social protection.

Where new data from the above-mentioned sources were not available, data from previous editions of the World Social Protection Report were used.

.Annex 3. Minimum requirements in international social security standards

International social security standards have come to be recognized globally as key references for the design of rights-based, sound and sustainable social protection schemes and systems. They also give meaning and definition to the content of the right to social security as laid down in international human rights instruments (notably the Universal Declaration of Human Rights, 1948, and the International Covenant on Economic, Social and Cultural Rights, 1966), thereby constituting essential tools for the realization of this right and the effective implementation of a rights-based approach to social protection. International social security standards are primarily tools for governments which, in consultation with employers and workers, are seeking to draft and implement social security law, establish administrative and financial governance frameworks, and develop social protection policies. More specifically, these standards serve as key references for:

-

the elaboration of national social protection policies, including social security extension strategies;

-

the development and maintenance of comprehensive national social protection systems and the progressive achievement of universal social protection;

-

the design and parametric adjustment of (contributory or tax-financed) social security schemes;

-

the establishment and implementation of effective recourse, enforcement and compliance mechanisms;

-

the good governance of social security and improvement of administrative and financial structures;

-

the realization of international and regional obligations, and the operationalization of national social protection strategies and action plans; and

-

working towards the achievement of the SDGs, particularly Goals 1, 3, 5, 8, 10 and 16.

The ILO’s normative social security framework consists of nine up-to-date Conventions and nine Recommendations.23 The most prominent of these are the Social Security (Minimum Standards) Convention, 1952 (No. 102), and the Social Protection Floors Recommendation, 2012 (No. 202). Other Conventions and Recommendations set higher standards in respect of the different social security branches, or spell out the social security rights of migrant workers. ILO standards establish qualitative and quantitative benchmarks which together determine the minimum standards of social security protection to be provided by social security schemes in certain life contingencies, with regard to:

-

the definition of the contingency (what risk or life circumstance must be covered?);

-

the individuals protected (who must be covered?);

-

the type and level of benefits (what should be provided?);

-

any entitlement conditions, including any qualifying period (what should a person do to get the right to a benefit?); and

-

the duration of benefit and any waiting period (how long must the benefit be paid/provided for, and when must it commence?).

In addition, they set out common rules of collective organization, financing and management of social security, as well as principles for the good governance of national systems. These include:

-

the general responsibility of the State for the due provision of benefits and proper administration of social security systems;

-

solidarity, collective financing and risk pooling;

-

participatory management of social security schemes;

-

guarantee of defined benefits;

-

adjustment of pensions in payment to maintain the purchasing power of beneficiaries; and

-

the right to complain and appeal.

Tables A3.1 to A3.9 provide a summary overview of some of the key requirements set out in ILO standards.

Table A3.1 Main requirements: ILO social security standards on health protection

|

|

Convention No. 102: Minimum standards |

Convention No. 130a and Recommendation No. 134b: Advanced standards |

Recommendation No. 202: Basic protection |

|

What should be covered? |

Any ill-health condition, whatever its cause; pregnancy, childbirth and their consequences. |

The need for medical care of a curative and preventive nature. |

Any condition requiring healthcare, including maternity. |

|

Who should be covered? |

At least: 50% of all employees, and wives and children; or categories of the economically active population (forming not less than 20% of all residents, and wives and children); or 50% of all residents. |

C.130: All employees, including apprentices, and their wives and children; or categories of the active population forming not less than 75% of the whole active population, and their wives and children; or prescribed class(es) of residents forming not less than 75% of all residents. (Persons already receiving certain social security benefits shall also continue to be protected under prescribed conditions.) R.134: In addition: persons in casual employment and their families, members of employers’ families living in their house and working for them, all economically active persons and their families, all residents. |

At least all residents and children, subject to the country’s existing international obligations. |

|

What should the benefit be? |

In case of ill health: general practitioner care, specialist care at hospitals, essential medications and supplies; hospitalization if necessary. In case of pregnancy, childbirth and their consequences: prenatal, childbirth and postnatal care by medical practitioners and qualified midwives; hospitalization if necessary. |

C.130: The medical care required by the person’s condition, with a view to maintaining, restoring or improving health and ability to work and attend to personal needs, including at least: general practitioner care, specialist care at hospitals, allied care and benefits, essential medical supplies, hospitalization if necessary, dental care and medical rehabilitation. R.134: Also the supply of medical aids (for example, eyeglasses) and services for convalescence. |

Goods and services constituting at least essential healthcare, including maternity care, meeting accessibility, availability, acceptability and quality criteria; free prenatal and postnatal medical care for the most vulnerable; higher levels of protection should be provided to as many people as possible, as soon as possible. |

|

What should the benefit duration be? |

As long as ill health, or pregnancy and childbirth and their consequences, persist. May be limited to 26 weeks in each case of sickness. Benefit should not be suspended while beneficiary receives sickness benefits or is treated for a disease recognized as requiring prolonged care. |

C.130: Throughout the contingency. May be limited to 26 weeks where a beneficiary ceases to belong to the categories of persons protected, unless he/she is already receiving medical care for a disease requiring prolonged care, or as long as he/she is paid a cash sickness benefit. R.134: Throughout the contingency. |

As long as required by the health status. |

|

What conditions can be prescribed for entitlement to a benefit? |

Qualifying period may be prescribed as necessary to preclude abuse. |

C.130: Qualifying period shall be such as not to deprive of the right to benefits persons who normally belong to the category. R.134: Right to benefit should not be subject to qualifying period. |

Persons in need of healthcare should not face hardship and an increased risk of poverty due to financial consequences of accessing essential healthcare. Should be defined at the national level and prescribed by law, applying principles of non-discrimination, responsiveness to special needs and social inclusion, and ensuring the rights and dignity of people. |

a Medical Care and Sickness Benefits Convention, 1969 (No. 130).

b Medical Care and Sickness Benefits Recommendation, 1969 (No. 134).

Table A3.2 Main requirements: ILO social security standards on sickness benefits

|

|

Convention No. 102: Minimum standards |

Convention No. 130a and Recommendation No. 134b: Advanced standards |

Recommendation No. 202: Basic protection |

|

What should be covered? |

Incapacity to work resulting from illness that results in the suspension of income. |

C.130: Incapacity to work resulting from sickness and involving suspension of earnings. R.134: Also covers periods of absence from work resulting in loss of earnings due to convalescence, curative or preventive medical care, rehabilitation or quarantine, or due to caring for dependants. |

At least basic income security for those who are unable to earn a sufficient income due to sickness. |

|

Who should be covered? |

At least: 50% of all employees; or categories of the economically active population (forming not less than 20% of all residents); or all residents with means under a prescribed threshold. |

C.130: All employees, including apprentices; or categories of economically active population (forming not less than 75% of whole economically active population); or all residents with means under prescribed threshold. R.134: Extension to persons in casual employment, members of employers’ families living in their house and working for them, all economically active persons, all residents. |

At least all residents of working age, subject to the country’s existing international obligations. |

|

What should the benefit be? |

Periodic payments: at least 45% of reference wage. |

C.130: Periodic payments: at least 60% of reference wage; in case of death of the beneficiary, benefit for funeral expenses. R.134: Benefit should be 66.66% of reference wage. |

Benefits in cash or in kind at a level that ensures at least basic income security, so as to secure effective access to necessary goods and services; prevents or alleviates poverty, vulnerability and social exclusion; and enables life in dignity. Levels should be regularly reviewed. |

|

What should the benefit duration be? |

As long as the person remains unable to engage in gainful employment due to illness; possible waiting period of a maximum of three days before benefit is paid; benefit duration may be limited to 26 weeks in each case of sickness. |

C.130: As long as the person remains unable to engage in gainful employment due to illness; possible waiting period of a maximum of three days before benefit is paid; benefit duration may be limited to 52 weeks in each case of sickness. R.134: Benefit should be paid for full duration of sickness or other contingencies covered. |

As long as the incapacity to earn a sufficient income due to sickness remains. |

|

What conditions can be prescribed for entitlement to a benefit? |

Qualifying period may be prescribed as necessary to prevent abuse. |

C.130: Qualifying period may be prescribed as necessary to prevent abuse. |

Should be defined at the national level, and prescribed by law, applying principles of non-discrimination, responsiveness to special needs and social inclusion, and ensuring the rights and dignity of people. |

Table A3.3 Main requirements: ILO social security standards on unemployment protection

|

|

Convention No. 102: Minimum standards |

Convention No. 168a and Recommendation No. 176b: Advanced standards |

Recommendation No. 202: Basic protection |

|

What should be covered? |

Suspension of earnings due to inability to find suitable employment for capable and available person. |